ECONOMIC CALENDAR

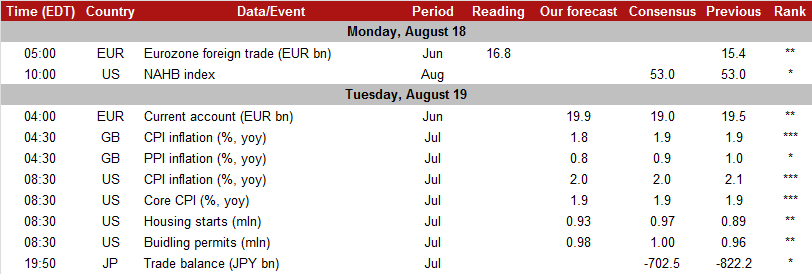

EUR/USD

- Germany's central bank is the opinion that the euro zone economy is expected grow more slowly than initially expected during the rest of this year. The Bundesbank said: “The geopolitical tensions in Eastern Europe owing to the Ukraine conflict as well as in other parts of the world are now appearing to weigh more heavily on corporate sentiment.”

- The international trade balance of the euro zone grew in June to EUR 16.8 bn from EUR 15.7 bn in June last year. The surplus was up from the EUR 15.4 bn recorded in May. The data do not yet reflect the effect of sanctions and counter-sanctions imposed by the European Union and Russia.

- Policymakers will discuss their thinking around the labor markets of major economies at the August 21-23 meeting in Jackson Hole. Investors are eyeing clues about the path for monetary policy in the months ahead. The spotlight will be on Fed chair, Janet Yellen, who will speak on Friday. Other speakers include Bank of Japan Governor Haruhiko Kuroda, Central Bank of Brazil Governor Alexandre Antonio Tombini and Bank of England Deputy Governor Ben Broadbent.

- Another important events this week are US inflation figures for July scheduled for Tuesday and European flash PMIs on August 21.

- Data from the Commodity Futures Trading Commission released on Friday showed that speculators reduced bullish bets on the USD in the latest week after net longs had hit a more than one-year high in the previous week. The value of the dollar's net long position slipped to USD 27 bn in the week ended August 12, from USD 29.41 bn previously. Net longs declined for the first time in four weeks.

- Current trading idea of GrowthAces.com for the EUR/USD is to go long near 1.3360. We do not expect anything hawkish from Janet Yellen and in our opinion technical situation of the EUR/USD candlestick chart (triple hammers) supports the EUR/USD recovery.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Significant technical analysis’ levels:

Resistance: 1.3416 (high Aug 13), 1.3433 (high Aug 8), 1.3345 (high Aug 1)

Support: 1.3359 (low Aug 15), 1.3348 (low Aug 14), 1.3342 (low Aug 13)

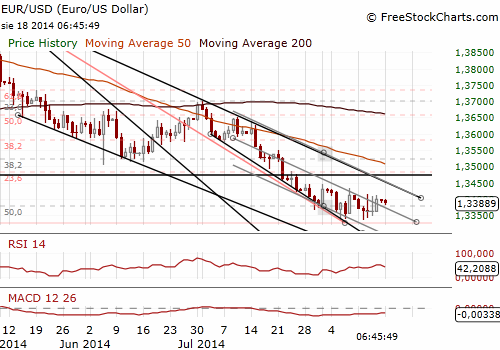

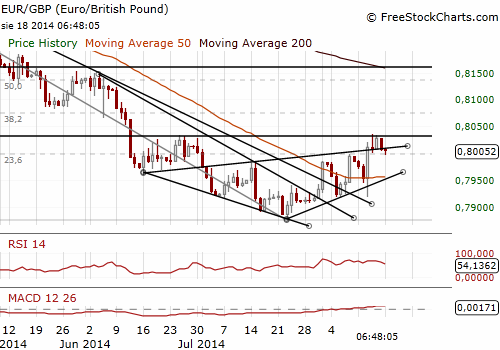

EUR/GBP

- The GBP rose after BoE Governor Mark Carney said in a newspaper interview that UK rates may have to increase even before the growth of real wages recovers. Recent comments from the central bank suggested the opposite and prompted markets to push back bets on a first hike.

- Carney’s comments offset data from Rightmove that showed British house prices were cooling in August. Prices of property coming onto the market fell by 2.9% mom, leading to a slowing in the annual rate of price growth to 5.3% in August from 6.5% a month earlier.

- The EUR/GBP reached our stop-loss level at 0.7995 but we have taken a small profit on our long position at 0.7950. In our opinion the reaction after Carney’s comments had short-term nature. At GrowthAces.com we remain bullish on the EUR/GBP and are still looking to go long on the EUR/GBP. However, we will wait for lower levels, near 0.7980.

- CPI inflation data are scheduled for Tuesday. Our forecast is in line with market consensus. The Bank of England will publish minutes from its last monetary policy meetings on Wednesday. The minutes may reveal the first dissenting vote to hike rates since July 2011. MPC member Martin Weale is expected to have dissented in favour of a rate hike this month.

Significant technical analysis’ levels:

Resistance: 0.8037 (high Aug 15), 0.8063 (high Jun 12), 0.8075 (38.2% of 0.8400-0.7874)

Support: 0.7994 (session low Aug 18), 0.7981 (low Aug 13), 0.7977 (10-dma)

GrowthAces.com trading positions:

USD/CAD: long at 1.0905, target 1.1070, stop-loss 1.0840

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.