For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.0882, after strong US economic data.

In the US, number of people claiming unemployment benefits for the first time dropped to 282.0K in the week ended 21 March, compared to a level of 291.0K in the previous week. Markets were expecting it to ease to a level of 290.0K. Additionally, the nation’s Markit preliminary services PMI surged to a 6-month high of 58.6 in March, from prior month’s reading of 57.1.

Separately, the St. Louis Fed President, James Bullard stated that the present low levels of inflation in the US was temporary and the risks associated with keeping interests at zero levels for too long might be substantial. He further opined that the Fed should raise interest rates soon as he felt that it was an ideal time now to normalize the monetary policy. However, the Atlanta Fed President, Dennis Lockhart stated that interest rates in the US would increase in the middle of 2015 or even later, as the nation’s economic growth in the first quarter looks “very soft”.

Elsewhere, in Germany, the GfK consumer confidence data advanced to a level of 10.0, posting its highest level since October 2001 for the month of April, higher than market expected rise to a reading of 9.8 and compared to previous month’s level of 9.7, thus suggesting improvement in Europe’s biggest economy.

Yesterday, the ECB Chief, Mario Draghi, stated that the recently launched QE programme was having desired effects on the Euro-zone’s economic growth but insisted that recovery in the region was ‘cyclical’ and the single-currency bloc would still require structural reforms to address its long term problems.

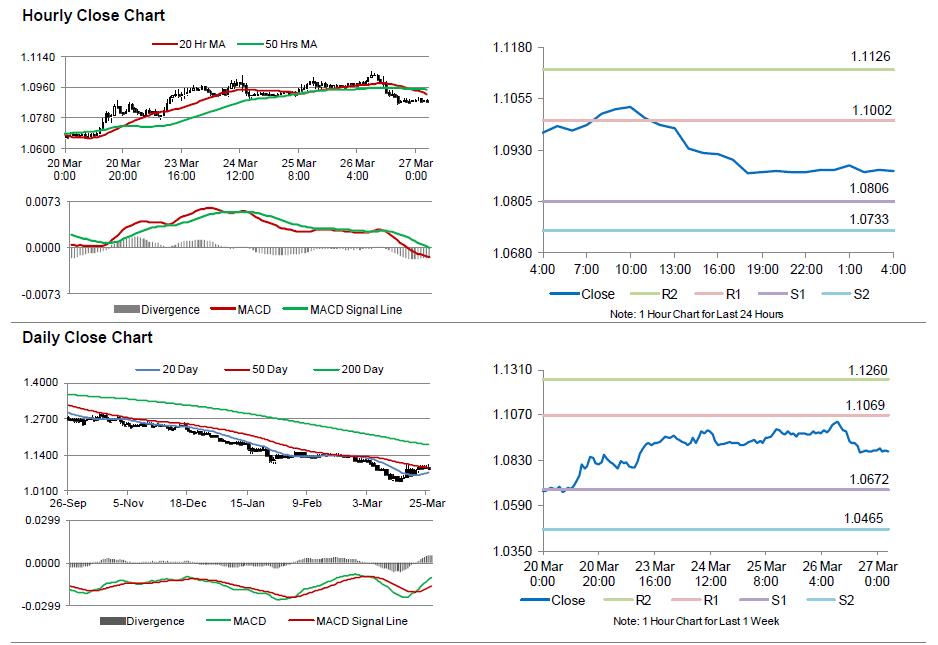

In the Asian session, at GMT0400, the pair is trading at 1.0878, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0806, and a fall through could take it to the next support level of 1.0733. The pair is expected to find its first resistance at 1.1002, and a rise through could take it to the next resistance level of 1.1126.

Trading trends in the pair today are expected to be determined by the US 4Q annualized GDP data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.