Talking Points:

- Euro, Japanese yen Looking to Greek Debt Negotiations for Direction Cues

- Aussie and New Zealand dollars Slide on Risk Aversion, Soft Chinese Economic Data

Greece is in the spotlight once again in European trading hours. Officials from Athens are due to meet with representatives of the so-called “institutions” – the EU, ECB and IMF – in an attempt to avoid a cash crunch. The government faces €4.3 billion in T-Bill redemptions and a maturing loan of €1.2 billion to the IMF just this month. Without a deal to unlock a €7.2 billion aid tranche, Greece may run out of money in a matter of weeks. That portends default and could pave the way for an exit from the Eurozone.

Both sides are ultimately interested in an accord. The newly-minted Greek administration of Alexis Tsipras surely realizes its grip on power depends on its ability to deliver relief from years of Depression-like economic woes, which will be hard to do in a messy “Grexit” scenario. Meanwhile, Eurozone officials almost certainly want to avoid setting a precedent for a country to leave the currency bloc that may encourage further splintering down the road.

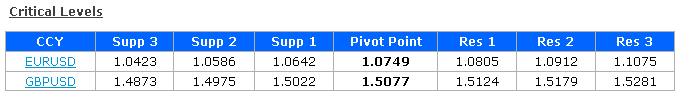

With this in mind, another eleventh-hour deal seems likely. Such a result may offer a temporary lift to the Euro and boost risk broader risk appetite around the financial markets, which might put pressure on the safety-linked Japanese Yen. Follow-through might be limited however considering investors’ priced-in baseline outlook seems to lean in favor of resolution, not dissolution. Needless to say, continued deadlock may carry the opposite results, though this too could see restrained volatility unless all hope is truly seen as lost. Indeed, the markets seem content to offer the negotiating parties the benefit of doubt even as endless meetings yield no results as long as things remain in motion.

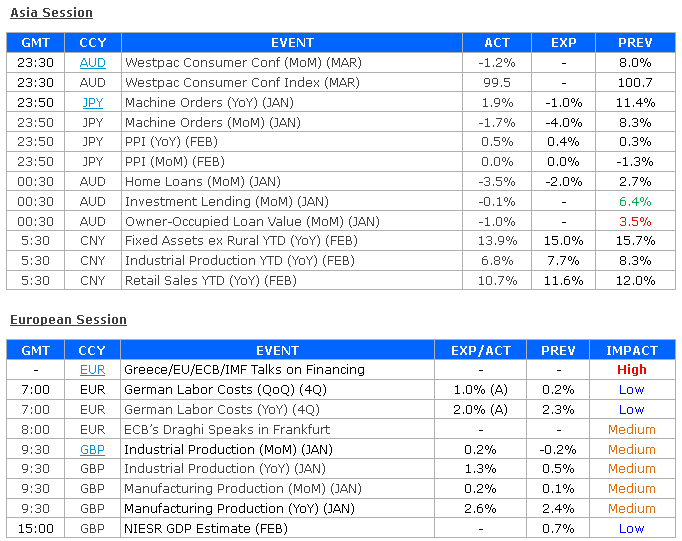

The Australian and New Zealand Dollars underperformed in otherwise quiet overnight trade as Asian stocks followed Wall Street lower, sapping demand for the sentiment-linked currencies. Disappointing Chinese economic data compounded selling pressure, with measures of growth in retail sales and industrial production undershooting economists’ estimates and sliding to multi-year lows. The MSCI Pacific FX Hedge regional benchmark equity index fell 0.4 percent.