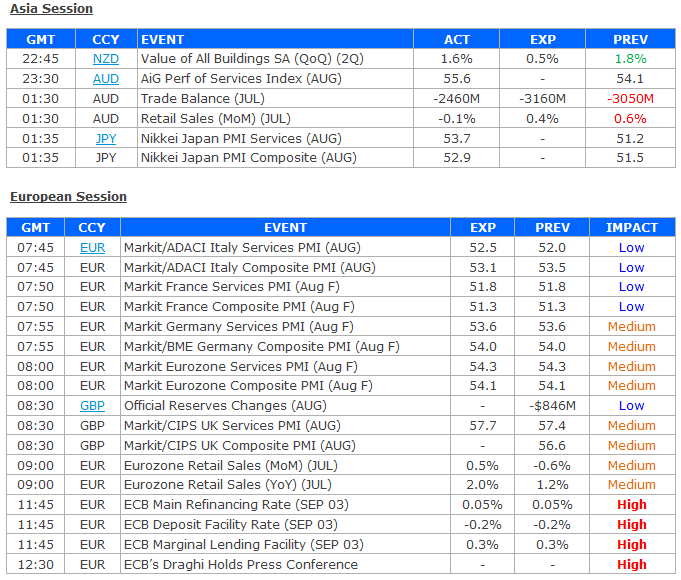

Talking Points:

- Euro, Market-Wide Sentiment in the Balance on ECB Policy Announcement

- Australian Dollar Down on Soft Retail Sales Data, Yen Sold as Risk Recovers

The monetary policy announcement from the European Central Bank has entered the spotlight. With the Greece fiasco now on the backburner, traders will focus on the possibility that policymakers are mulling an expansion of stimulus efforts.

Crude Oil prices have dropped to a new year-to-date low while the Euro has staged an aggressive recovery amid carry trade liquidation since the last ECB sit-down in mid-July. This will bear down on inflation in the months ahead, complicating the central bank’s return to price growth at the target rate of 2 percent.

On the other hand, ECB Vice President Vitor Constancio said the transmission mechanism between growth and prices is working at the weekend’s Jackson Hole Symposium, stressing the importance of boosting output to delivering on the ECB’s inflation mandate. Keeping in mind the pickup in Eurozone economic activity in 2015, this suggests the central bank may feel no hurry to do more for now.

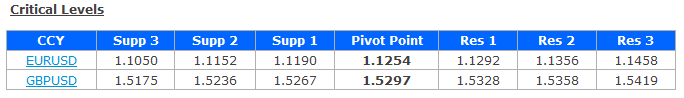

Risk appetite may firm if the ECB hints at expanding accommodation, boosting the sentiment-linked commodity dollars while weighing on the Euro and Yen. This can take the form of a notable downside revision to policymakers’ inflation outlook or leading commentary from President Mario Draghi at his post-announcement press conference.

Alternatively, opting for the status quo could inspire risk aversion, weighing on high-yielding FX while offering support to funding currencies. Follow-through may prove limited in either case however as the following day’s US jobs report looms large, discouraging commitment to a firm directional bias.

The Australian Dollar faced selling pressure overnight after a report showed that retail sales unexpectedly fell in July. Receipts fell 0.1 percent from the prior month, marking the first contraction since May 2014. Economists were expecting a 0.4 percent increase.

The Aussie dropped alongside front-end bond yields, suggesting the disappointing print encouraged RBA rate cut speculation. Priced-in expectations now show traders expect at least one 25 basis point cut in the cash rate over the coming 12 months, with the probability of a reduction at next month’s meeting pegged at 59 percent.

The Japanese Yen likewise faced selling pressure as most Asian stock exchanges firmed, sapping demand for the anti-risk currency.