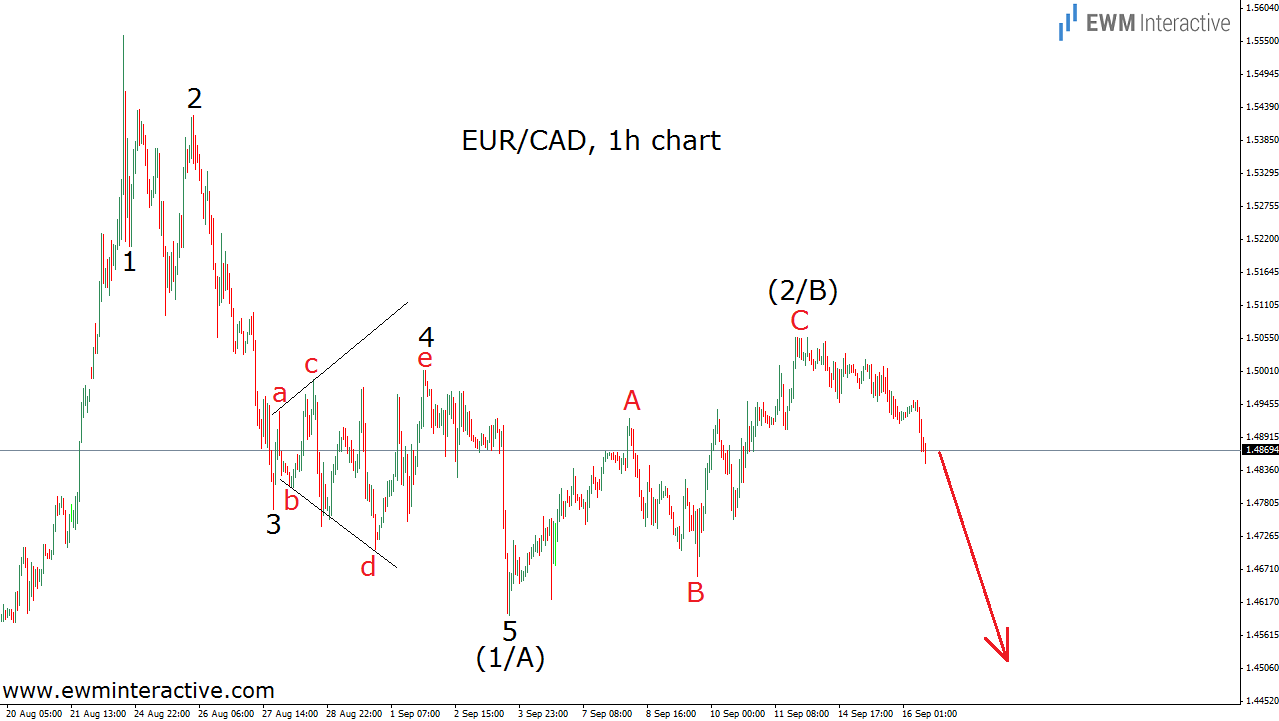

Less than a month ago, on September 16th, we published “The EUR/CAD Saga Continues”, saying that “the exchange rate is likely to plunge below the 1.46 mark again.” We thought so, because of what we saw on the hourly chart of EUR/CAD. According to the Elliott Wave Principle, a five-wave impulse to the south, followed by a three-wave recovery means we should expect more weakness ahead. All of this was clearly visible on the chart below.

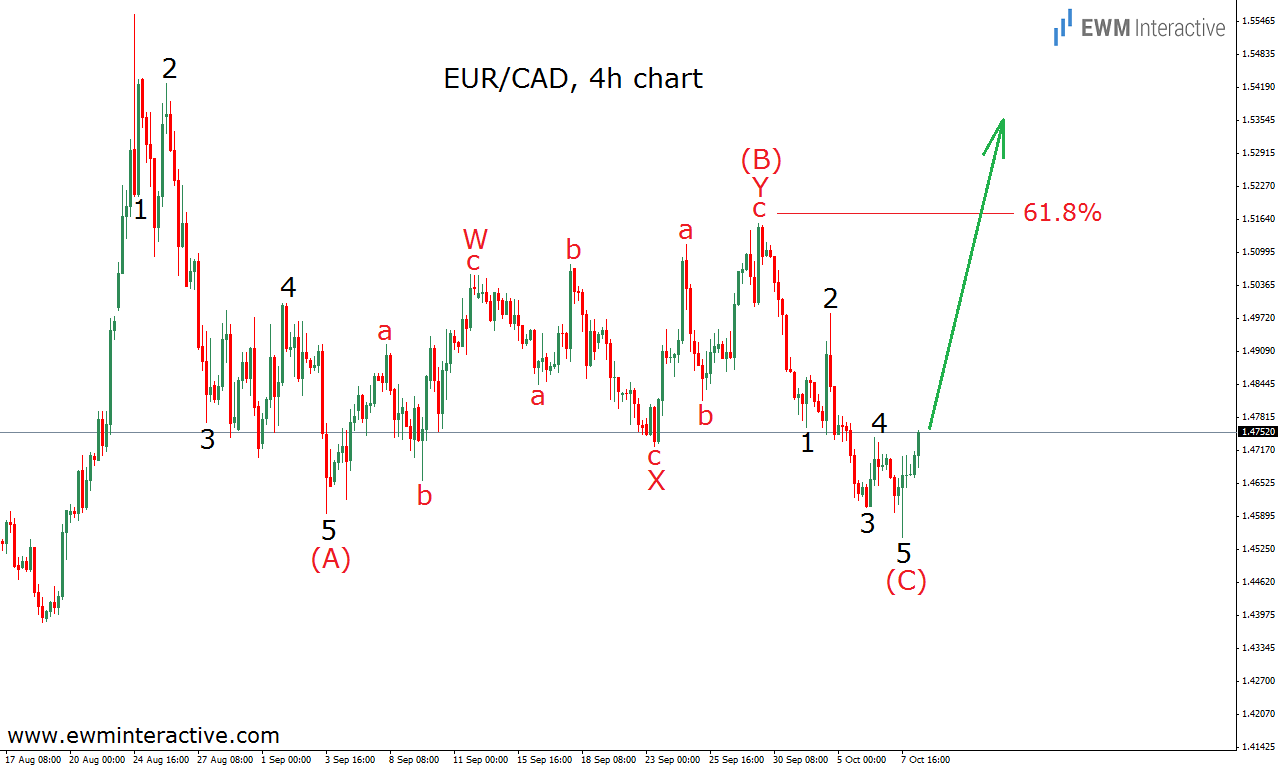

The anticipated sell-off did not happen immediately. EUR/CAD decided to extend the correction in time. Instead of a simple A-B-C zig-zag, as the one shown above, it evolved into a W-X-Y double zig-zag. However, the pair did not go anywhere near the invalidation level at 1.5560, so there was no reason to worry. Instead, on September 29th, EUR/CAD rose to 1.5157, where the 61.8% Fibonacci resistance did what it was supposed to, and gave the start of the decline we have been waiting for. Yesterday, on October 7th, EUR/CAD fell as low as 1.4548. Another great example of how the Wave principle could lead to positive results, if one is patient and disciplined enough to follow its rules.

From now on, there are two most probable scenarios for EUR/CAD. The first one is given on the chart below.

If this is the correct count, the whole development between the top of 1.5560 and the bottom at 1.4548 is an (A)-(B)-(C) correction. This would mean that EUR/CAD should start rising again, because once a correction is over, the larger trend resumes. The alternate count is a little more complicated. Take a look at it on the next chart.

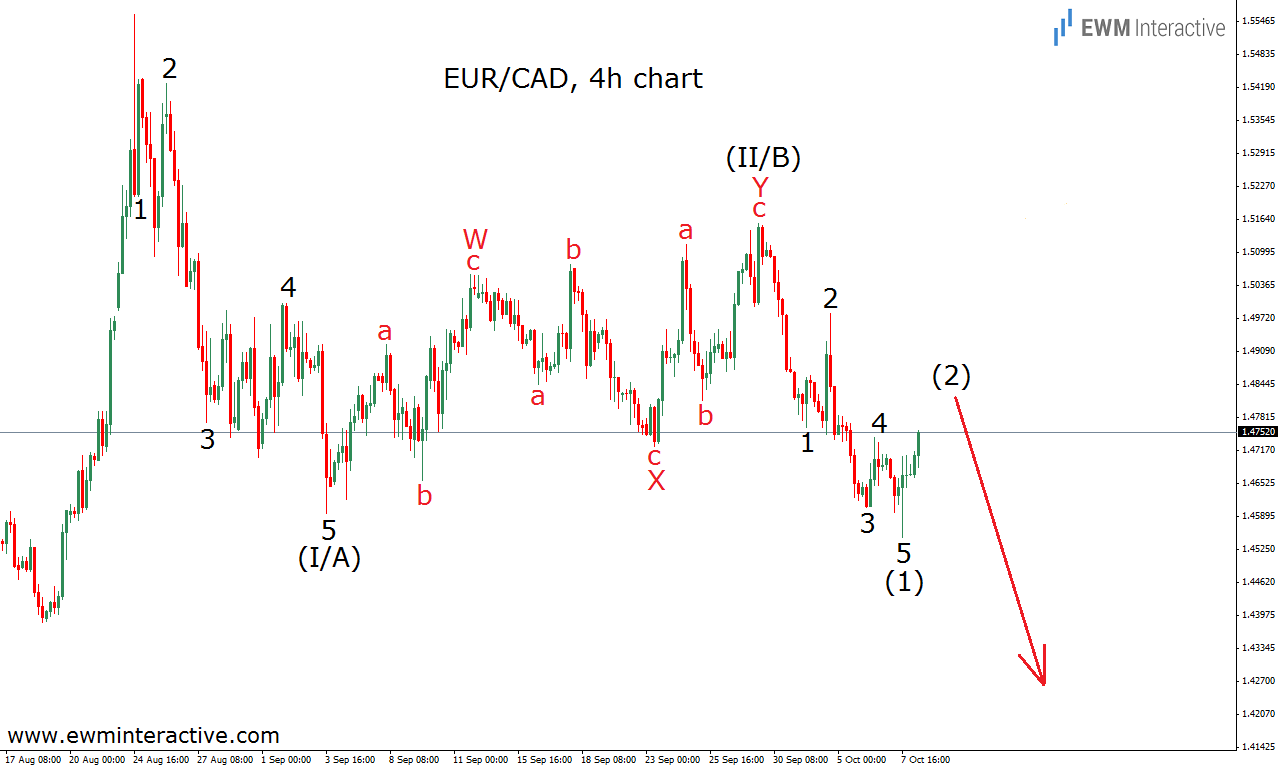

The above-shown wave count suggests, wave (3/C) to the south is still in progress. If this assumption is the right one, EUR/CAD still has a lot of falling to do. This bearish idea would be confirmed, if the rate breaks below 1.4548. The invalidation level lies at 1.5157. Right now, both scenarios are equally probable, so do not pick your favorite. Just observe the confirmation and invalidation levels and be ready to act accordingly.