GROWTHACES.COM Trading Positions

USD/JPY: long at 117.50, target 119.80, stop-loss 116.60

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9630

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.7980

We encourage you to visit our website and subscribe to our newsletter to receive trading positions summary for major pairs and crosses.

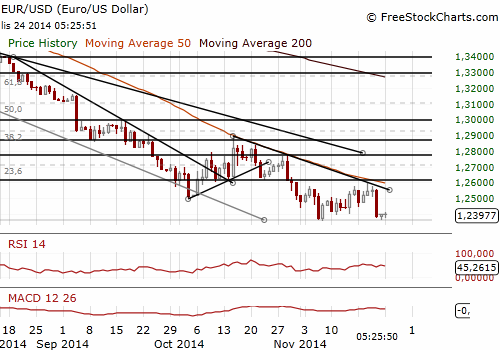

EUR/USD: The Medium-Term Target Is 1.2050

(sell at 1.2480)

- German business sentiment rebounded in November, breaking a streak of six straight declines. The Ifo's business climate index rose to 104.7 from 103.2 in the previous month. The median forecast amounted to 103.0.

- The index of current business conditions rose to 110 from 108.4 in the previous month. Ifo expectations index rose to 99.7 from 98.3 in October. The rise in Ifo index, especially its current component, is a big surprise after the sharp fall in the German composite PMI in the same month.

- The rise in the Ifo together with the strong improvement in ZEW investor sentiment in November, suggests that the German economic activity is rising in the fourth quarter after the stagnation around the middle of the year. However, the recovery is moderate.

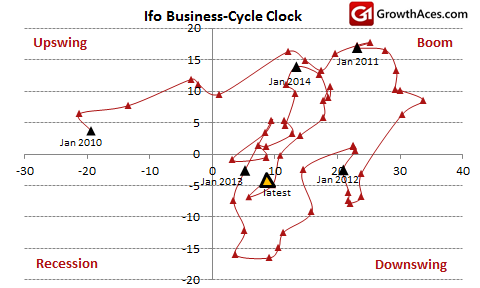

- Let’s take a look at Ifo Business-Cycle Clock. It shows that the economy is in the downswing phase, but the November reading suggests improving activity.

- The EUR/USD fell strongly after Draghi’s speech on Friday. The market priced in full blown quantitative easing in the first half of 2015. Our short position on the EUR/USD (entered at 1.2550) reached its target at 1.2400.

- The EUR/USD opened the Asian session at 1.2380 and recovered slightly after better-than-expected German Ifo reading. In our opinion downside risks remain evident. We lowered our sell order from 1.2520 to 1.2480. In the opinion of GrowthAces.com the medium-term target for the EUR/USD is 1.2050.

Significant technical analysis' levels:

Resistance: 1.2477 (10-dma), 1.2511 (21-dma), 1.2569 (high Nov 21)

Support: 1.2358 (low Nov 7), 1.2342 (low Aug 21, 2012), 1.2296 (low Aug 20, 2012)

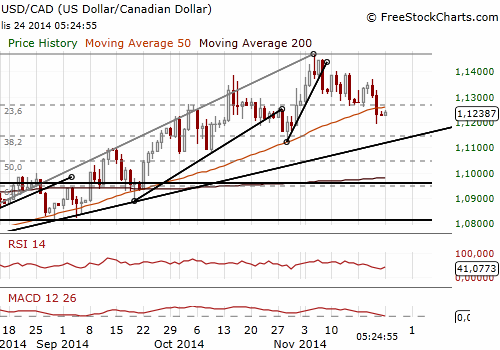

USD/CAD: The Loonie Rallied On CPI Data

(bid order at 1.1160)

- Canada's inflation rate rose in October to an unexpectedly high 2.4% yoy from 2.0% yoy in September, with higher shelter and food prices accounting for most of the change. The reading was higher than the median forecast of 2.1% yoy. Core inflation rate was 2.3% yoy, up from 2.1% yoy in the previous month. The median forecast amounted to 2.1% yoy.

- Cost of shelter went up 2.8% yoy, pushed higher by a 20.1% yoy jump in natural gas prices. Food prices rose 2.8% yoy.

- In the opinion of the Bank of Canada higher inflation is likely temporary. The central bank is expected to keep rates on hold for an extended period of time.

- The USD/CAD fell below the support at 1.1253 (the 61.8% of 1.1122-1.1466) after the inflation data. The CAD rallied to a three-week high against the USD and the USD/CAD hit a day’s low at 1.1191. The currency was also buoyed by a rise in crude prices. Our long position at 1.1260 reached the stop-loss level at 1.1220. The daily momentum indicators are neutral now. We are looking to get long again. We placed the bid order at 1.1160.

- Investors are focused now on Canadian retail sales data for September on Tuesday. It will be the final key piece of economic data before GDP figures for the third quarter on Friday.

Significant technical analysis' levels:

Resistance: 1.1253 (61.8% 1.1122-1.1466), 1.1326 (high Nov 21), 1.1369 (high Nov 20)

Support: 1.1191 (low Nov 21), 1.1181 (low Oct 31), 1.1122 (low Oct 29)