GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/CHF: long at 1.0670, target 1.0990, stop-loss 1.0570

GBP/JPY: long at 182.20, target 184.50, stop-loss 182.20

Pending Orders

USD/JPY: buy at 119.80, if filled – target 121.80, stop-loss 118.80

USD/CAD: buy at 1.2480, if filled - target 1.2780, stop-loss 1.2330

EUR/GBP: sell at 0.7235, if filled - target 0.7110, stop-loss 0.7290

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading strategies.

Source: Growth Aces Forex Trading Strategies

EUR/USD: Strong Bearish Sentiment

(our EUR long closed with losses, we stay sideways considering getting short at higher levels)

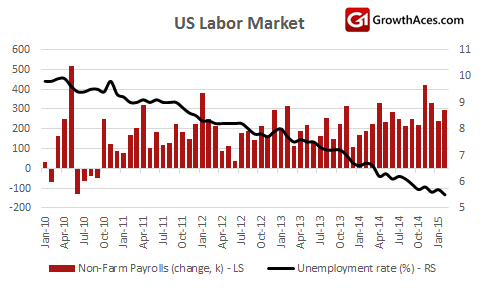

- U.S. Nonfarm payrolls rose 295k in February vs. median forecast for 240k rise and after downwardly revised 239k gain in January. Jobless rate fell to 5.5% from 5.7% in January. The broad job gains came despite disruptive winter weather that took hold across large parts of the country in mid-February. February marked the 12th straight month that employment gains have been above 200k, the longest such run since 1994.

- Wages data are even more important to many than the headline figure and very important to the Fed. Average hourly earnings rose by three cents last month, leaving the yoy gain at 2% compared to a 2.2% in January.

- U.S. trade deficit fell to USD 41.8 billion in January from USD 45.6 billion in December. The shrinking trade gap reflected a drop in exports, which fell USD 5.6 billion to USD 189.4 billion. Imports fell USD 9.4 billion to USD 231.1 billion. Much of the dip in imports likely came from lower oil prices. At the same time, the strong USD is weighing down exports.

- Fed policy meeting is scheduled for March 17-18. Investors expect the central bank could signal its openness to a June rate hike by dropping a pledge to be "patient" in considering such a move. Fed funds futures contracts on Friday suggested traders were pricing in just a 22% probability of a June rate hike. The first contract with a greater-than-50% probability of a hike is September 2015, at 66%.

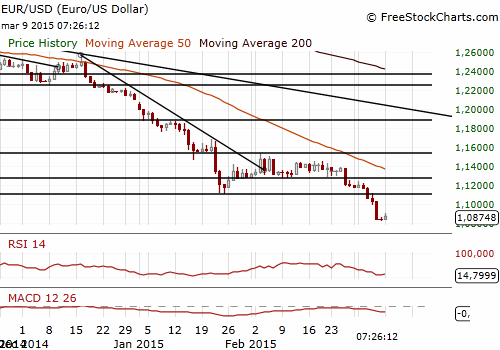

- The EUR/USD fell strongly after the non-farm payrolls and our long position reached its stop-loss level. The EUR/USD opened the Asia session at 1.0831

- Recent days brought us some big losses. We are still the opinion that strong USD tightens monetary conditions in the USA and will make the Fed delay its interest rates hikes, which will negative for the USD in the medium term. We also believe that a significant fall in the EUR/USD will give a boost to the Euro zone economy. However, sentiment towards the EUR/USD is decidedly bearish, as the yield spread between US Treasuries and German bonds is expected to continue to widen in favor of the USD. Investors expect the ECB will struggle to find enough Euro zone bonds to satisfy their QE objectives and the EUR/USD will continue to trend lower.

- Euro zone Sentix research group's index tracking morale among investors and analysts in the euro zone climbed to 18.6, its highest level since August 2007, from 12.4 the previous month. The survey of 1,025 investors was conducted between March 5 and March 7.

- As announced the ECB has started its QE programme today with reported buying of German, French and Belgium bonds.

- We expect some corrective moves on the EUR/USD in the coming days on profit taking. We stay sideways, but given strong bearish sentiment on the EUR/USD we will consider getting short at the levels above 1.1000. The next target for the EUR/USD bears is September 2003 low at 1.0762. Breaking below this level will open the way to the parity.

Significant technical analysis' levels:

Resistance: 1.0906 (hourly high March 6), 1.1033 (high, Mar 6), 1.1113 (high Mar 5)

Support: 1.0809 (low Sep 4, 2003), 1.0762 (monthly low Sep 2003), 1.0072 (76.4% of 0.8228-1.6040)

USD/JPY: Japan’s Q4 GDP Growth Revised Downward

(buy at 119.80)

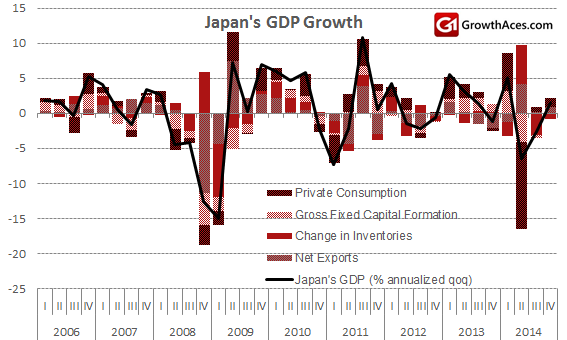

- Revised government data showed that Japanese GDP rose 0.4% qoq and an annualised 1.5% in the fourth quarter, less than the preliminary reading of a 0.6% qoq increase and an annualised 2.2% growth as capital expenditure weakened. Capital expenditure fell 0.1% qoq, versus a preliminary 0.1% qoq increase.

- Japan's service sector sentiment index rose to 50.1 in February from 45.6 in January, up for a third straight month. The outlook index, indicating the level of confidence in future conditions, advanced to 53.2 in February from 50.0 the previous month. The Cabinet Office said the economy is in a moderate recovery trend although there is some weakness. That compared with its previous view that the economy was showing weakness in its recovery.

- Bank of Japan Deputy Governor Hiroshi Nakaso reiterated that the central bank is still halfway through to the 2% price target. Regarding the government bond market, Hiroshi Nakaso said he does not see any sharp fall in liquidity in the market and does not think the BoJ will have a difficulty in buying JGBs from the market.

- Japan recorded a current account surplus for the seventh straight month in January, with the balance standing at JPY 61.4 billion, led by increased exports amid a weaker yen as well as smaller oil imports. Exports grew 15.3% yoy from a year earlier to JPY 6.33 trillion, while imports decreased 8.9% yoy to JPY 7.20 trillion, pushing down the goods trade deficit by JPY 1.54 trillion to JPY 864.2 billion.

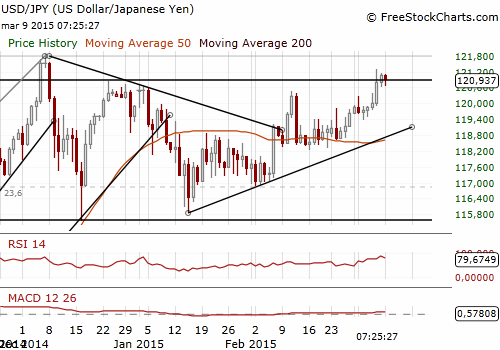

- The USD/JPY rose strongly after Friday’s U.S. non-farm payrolls. The Fed's readiness to raise rates gave a clear advantage to USD/JPY bulls. The USD/JPY broke above the level of 121.00 but we can see some longs locking in profits now. Japanese macroeconomic data and Nakaso comments had little effect on the USD/JPY rate.

- We keep our medium-term bullish USD/JPY outlook and will be looking to get long on dips. We have placed our buy offer at 119.80. We see scope for gains towards 121.86, 2014 peak.

Significant technical analysis' levels:

Resistance: 121.29 (high Mar 6), 121.86 (high Dec 8), 122.00 (psychological level)

Support: 119.90 (low Mar 6), 119.47 (low Mar 4), 119.13 (low Feb 27)