GROWTHACES.COM Forex Trading Strategies:

Taken Positions:

EUR/USD trading strategy: long at 1.1590, target 1.1900, stop-loss 1.1440

GBP/USD trading strategy: long at 1.5110, target 1.5390, stop-loss 1.4980

EUR/GBP trading strategy: long at 0.7670, target 0.7820, stop-loss 0.7600

Pending Orders:

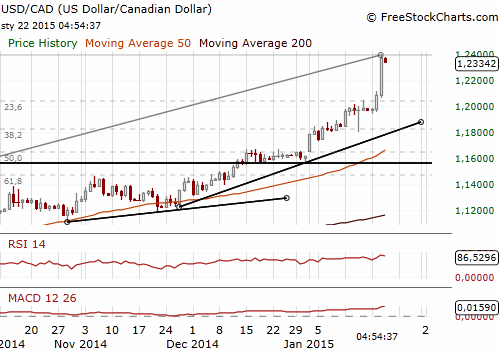

USD/CAD trading strategy: buy at 1.2240, target 1.2720, stop-loss 1.2140

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading strategies summary.

EUR/USD: QE Scenarios - Size Matters

(stay long, target raised to 1.1900)

- Today the European Central Bank will announce its quantitative easing programme. Details of the QE announcement will surely matter. There are some important parameters of the QE such as size, risk sharing and time horizon. The consensus expects a program of about EUR 750 bn of sovereign bond purchases and such a size of the QE has been already priced in the EUR/USD level.

- The ECB’s decision will be announced at 12:45 GMT and Mario Draghi’s press conference is scheduled for 13:30 GMT.

- Let’s assume the consensus scenario. In the opinion of GrowthAces.com this would lead to “buy the rumor sell the fact” reaction on the forex market. We expect the EUR/USD to rise on profit taking near 1.1800 or even slightly above, in line with our EUR/USD long position.

- What will happen if the ECB disappoints? The ECB has stepped up its rhetoric considerably creating expectations for the QE in recent days. That is why there is also strong the risk that the ECB may disappoint. ECB Governing Council member Ewald Nowotny said yesterday: “Central bankers, bankers, policy makers should always have more of a relaxed attitude to news and not get too excited to news of one day.” This comment may be interpreted as an effort to lower expectations. The programme of EUR 500 bn or lower could be slightly disappointing for markets and in this case we can expect immediate strengthening of the EUR/USD and a return to 1.2000 soon.

- What will happen in case of upside surprise? The upside surprise could take various forms. A larger-than-expected amount of sovereign bonds to be purchased, for example EUR 1 trillion will be considered as bullish. The ECB may leave the programme open-ended or increase the targeted balance sheet expansion. In this scenario the EUR/USD is likely to fall below 1.1400.

- In our opinion the upside surprise scenario is the least possible one of the three above mentioned. Macroeconomic data from the Euro zone has improved slightly in recent weeks, a significant fall of the EUR/USD rate has given a support to exporters and core inflation is still positive which means that deflation is driven mainly by supply-side factors. Given strong objection from Germany we should also expect some limitation to risk sharing. We should also remember that there will be no real economic benefit from pushing government bond yields lower, because most of them has already hit the bottom.

- Our baseline scenario is to stay EUR/USD. We raised our target to 1.1900. The medium-term outlook for the EUR/USD is also slightly bullish due to possible delay of interest rates hikes in the USA.

Significant technical analysis' levels:

Resistance: 1.1680 (hourly high Jan 21), 1.1792 (high Jan 15), 1.1871 (high Jan 12)

Support: 1.1540 (low Jan 20), 1.1530 (low Jan 19), 1.1460 (low Jan 16, 2015)

USD/CAD: BOC Adds To Central Bank Surprises

(profit taken, looking to get long again)

- The Bank of Canada shocked the market and cut its overnight benchmark to 0.75% from 1%, where it had been since September 2010.

- Governor Stephen Poloz said the central bank's surprise move to stimulate the economy provides insurance against risks for Canada, a major oil producer, stemming from the oil price shock. In his opinion oil's plunge could worsen household debt burdens by driving up unemployment and cutting incomes. Poloz said that before taking into account the rate cut, the bank had projected it would take until late 2017 for the economy to use up excess capacity. That is at least another year later than the bank had forecast in October, a delay it found unacceptable.

- The Bank of Canada slashed its economic growth estimate for the first half of 2015 to 1.5%from 2.4%. The bank said, however, that growth should pick up to 2.4% next year from 2.1%for full-year 2015. The central bank expect inflation to be below its target range of 1% to 3% for most of 2015 and as low as 0.3% in the second quarter.

- The bank's latest forecast was based on oil price at USD 60, well above current prices. The BOC expects that prices over the medium term are likely to be higher. The bank acknowledged oil prices below forecast could turn inflation briefly negative. Stephen Poloz made clear, however, he did not consider that to be deflation in the full sense of the term since it would not reflect a broad price fall.

- The CAD retreated nearly its weakest level since April 2009 after interest rate cut. We should note that the USD/CAD already had a very large bullish sentiment behind it and the decision fueled the upward trend. The USD/CAD hit a day’s high at 1.2420 yesterday.

- We expect a retreat of the USD strength against most of major currencies, because we expect a delay in monetary tightening by the Fed. However, we reiterate this does not change our bullish forecast for the USD/CAD due to weakening macroeconomic outlook in Canada that resulted already in surprising interest rate cut. In our opinion the medium-term outlook for the USD/CAD remains bullish.

- We took profit on our USD/CAD long position opened at 1.1880 yesterday and we are looking to get long again at 1.2240.

Significant technical analysis' levels:

Resistance: 1.2394 (hourly high Jan 22), 1.2420 (high Jan 21), 1.2507 (high Apr 21, 2009)

Support: 1.2200 (psychological level), 1.2062 (low Jan 21), 1.1940 (low Jan 20)

Source: Growth Aces