GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/CHF: long at 1.0670, target 1.0990, stop-loss 1.0570

Pending Orders

EUR/USD: sell at 1.0700, if filled – target 1.0335, stop-loss 1.0850

USD/JPY: buy at 120.90, if filled – target 123.55, stop-loss 119.60

USD/CHF: buy at 0.9975, if filled – target 1.0300, stop-loss 0.9830

USD/CAD: buy at 1.2600, if filled - target 1.2780, stop-loss 1.2545

AUD/USD: sell at 0.7680, if filled – target 0.7450, stop-loss 0.7820

NZD/USD: sell at 0.7325, if filled – target 0.7130, stop-loss0.7450

EUR/GBP: sell at 0.7100, if filled - target 0.6660, stop-loss 0.7260

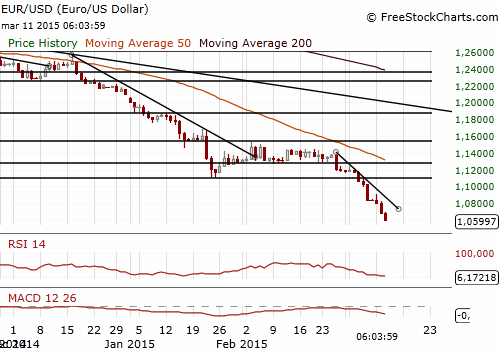

EUR/USD: Is There No Bottom For The EUR/USD Fall?

(sell on corrective upticks, short-term target 1.0335)

- There is only one direction on the EUR/USD. There are no signs of any support barriers and EUR/USD are reaching their targets easily. The pace of the sell-off suggests the potential for even bigger decline. The nearest strong support level is 1.0501 – monthly low on March 2003.

- In our opinion the EUR/USD may fall to long-term fibo support at 1.0072 (76.4% of 0.8828-1.6040) soon. We have a support at 1.0335 (monthly low on January 2003), but given the strength of the EUR/USD bears this level may be broken easily.

- In our opinion selling EUR/USD on corrective upticks is reasonable. We have lowered our offer to 1.0700. If the order is filled, the short-term target will be 1.0340.

Significant technical analysis' levels:

Resistance: 1.0855 (hourly high Mar 10), 1.0906 (hourly high March 6), 1.1033 (high, Mar 6)

Support: 1.0734 (low Mar 10), 1.0500 (psychological level), 1.0072 (76.4% of 0.8228-1.6040)

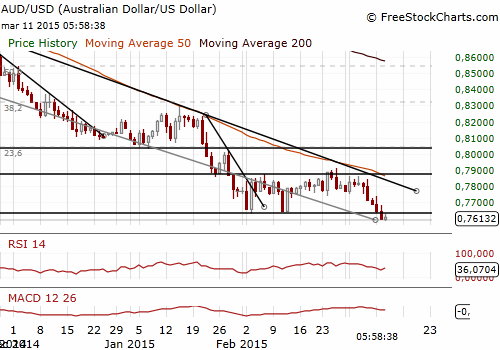

AUD/USD: Bears Targeting May 2009 Lows

(sell at 0.7680)

- The Melbourne Institute and Westpac Bank consumer sentiment index slipped a seasonally adjusted 1.2% in March. Consumer sentiment dipped from 13-month highs in March. Survey respondents recalled news about the budget and taxation, economic conditions and employment as being mostly unfavourable.

- The index of family finances compared to a year ago rose 1%, but that for the next 12 months fell 1.9%. The survey's index for economic conditions over the next 12 months edged up 0.3%. The greatest weakness was shown in the index on whether it was a good time to buy a major household item which fell 5.1% in the month. Such a low reading may be a reaction to the AUD weakening and concerns about the prices of imported goods.

- The AUD dropped on diverging interest rate outlooks between the Federal Reserve and the Reserve Bank of Australia and weak consumer sentiment reading. The AUD may be under influence of the Reserve Bank of New Zealand’s decision today. It is widely expected that the RBNZ will reinforce its neutral stance, so the impact of the central bank statement on the currency market will be probably limited.

- We are looking to get short on the AUD/USD at 0.7680. Our target will be 0.7450, which is close to the nearest strong support level – daily low on May 18, 2009.

Significant technical analysis' levels:

Resistance: 0.7707 (high Mar 10), 0.7740 (high Mar 9), 0.7846 (high Mar 6)

Support: 0.7589 (hourly low Mar 11), 0.7605 (low Mar 10), 0.7685 (low Mar 9)

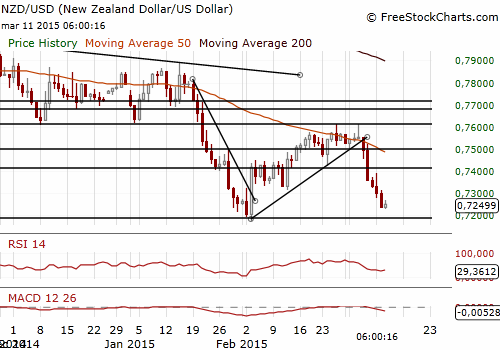

NZD/USD: Focus On The RBNZ

(sell at 0.7325)

- Suspected environmental activists have threatened to contaminate infant formula in New Zealand, the world's largest dairy exporter, in an attempt to halt the use of an agricultural poison on pests such as rats and possums. New Zealand police said letters were sent to the national farmers' group and dairy giant Fonterra in November accompanied by packages of infant formula laced with 1080, demanding that use of the toxic pesticide be stopped by the end of March.

- Trading in New Zealand's dairy companies and futures was halted for a while following the second milk-safety scare to hit the country over a two-year period. The latest threat to the country's dairy industry follows a contamination scare in 2013, when a botulism-causing bacteria was believed to be found in one of Fonterra's products. The incident prompted a recall of infant formula, sports drinks and other products in China, its biggest buyer, and other countries before the discovery was discovered to be false. Dairy products make up more than 7% of New Zealand's GDP.

- The Reserve Bank of New Zealand meets today to decide on interest rates. The central bank is expected to reinforce its neutral stance and point to rates staying on hold for an extended period. In our opinion today’s RBNZ decision will have limited impact on the NZD.

- Our NZD/USD trading strategy is to sell at 0.7325. We expect the NZD to break below the 4-year low on February 3. Our target would be 0.7130 (just above the monthly low from March 2011).

Significant technical analysis' levels:

Resistance: 0.7358 (high Mar 10), 0.7390 (high Mar 9), 0.7515 (high Mar 6)

Support: 0.7177 (low Feb 3), 0.7125 (monthly low Mar 2011), 0.7000 (psychological level)