Well that didn’t last long. The ludicrously ridiculous market moves seen in the immediate hours after the Federal Reserve’s monetary policy decision where they removed the word patient, but remained patient, are quickly being erased. While the USD took a brunt of the abuse once the Fed’s dot matrix was revealed, it is working hard to gain back some respect in the eyes of traders. In addition, equity markets are off their highs and commodities are dropping as well. It’s as if the market is resuming what it had assumed before the Fed did what a majority of market prognosticators expected they would. You could liken it to when a crowd gathers after a traffic accident, and the authorities simply tell everyone to stop rubbernecking and move along. The mess will be cleaned up, and there won’t be anything to see; things will be as they were shortly.

That dynamic of things returning to the way they were is happening right now in the EUR/USD. After squeezing virtually every trader who dared hold a short position in the pair heading in to the Fed’s reveal, the sellers are jumping back on board with renewed aggression. And the reason could be as simple as the expectation of continued US dominance in all things economics against the rest of the world. Sure Janet Yellen and co. are concerned about the strength of the USD and its challenges to multi-national US corporations and GDP, but the European Central Bank’s efforts in Quantitative Easing could well outweigh that concern. Plus, you never know when the next Grexit freak-out will manifest as it seems Greece and Germany are more than willing to take jabs at each other through the press.

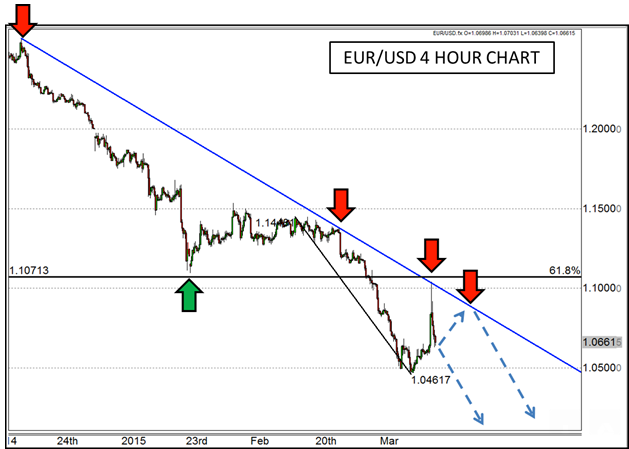

The short-squeeze rally that brought the EUR/USD up to 1.10 yesterday didn’t even break the longer term downtrend that has kept a lid on this pair since late 2014. In fact, it hit that trend line (along with a 61.8% Fibonacci retracement of the February high to March low) and immediately turned tail to run the other way, falling over 300 pips in the process. As traders begin to realize that the environment hasn’t really changed all that much as the Fed looks to raise interest rates at some point this year, the unrelenting fall of the EUR/USD may very well resume and yesterday’s moves could just end up being a blip on the radar on its march toward parity and beyond. In a perfect world, Yellen should have sat at the podium yesterday and said: “We’re not doing anything different right now, so move along…there’s nothing to see here.”

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).