The euro slightly appreciated against the American dollar on Thursday due to negative statistics on the US labour and real estate market. Initial jobless claims had grown by 10 thousand having exceeded a forecast by 3 thousand. What's more, the existing homes market had recorded a drop in sales, from 5.21 million to 5.04 million.

Final data on German annual and quarterly GDP are to be announced today. Both indicators are expected to decrease by 0,6% and 0,4%, respectively, which may badly affect the Euro rate. ECB President Mario Draghi's speech will be Eurozone's most important event today. Most of the conference will be dedicated to employment and inflation issues. Thus, high volatility should be expected today. The Euro is currently trading at about 1.1145.

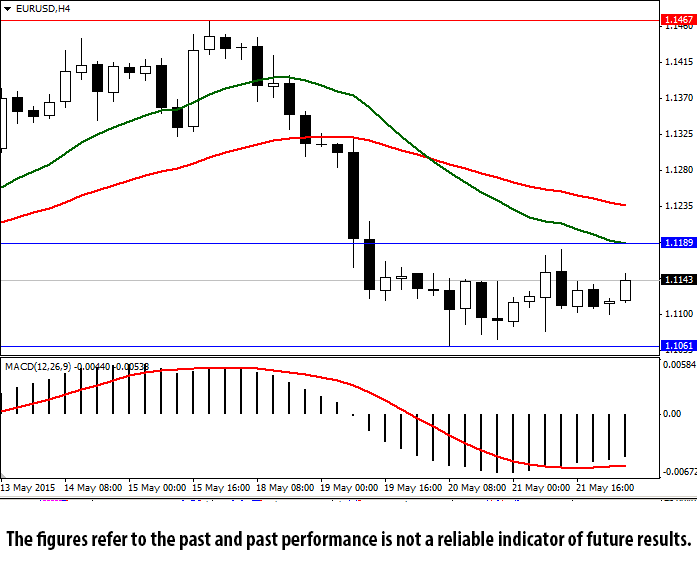

20- and 50-moving averages are situated above the current price on H4 chart, which points to a descending trend. The MACD histogram is in the negative zone, which also indicates a negative trend. A level of 1.1061 (this week's trough) serves as support. The closest resistance level coincides with M20 (1.1322). A level of 1.1467 is a strong resistance level, last week's maximum and the highest value since February.