The EUR/USD is under pressure on Monday, as has lost ground and is trading just above the 1.36 line in the European session. In economic news, Eurozone Manufacturing PMIs continues to show slight expansion. We’ll get a look at German Preliminary CPI later in the day. In the US, today’s highlight is ISM Manufacturing PMI. The index has been steadily moving higher throughout 2014, and the upward trend is expected to continue in the May release.

Eurozone data did not look sharp last week. German Retail Sales, the primary gauge of consumer spending, had a rough April, posting a decline of -0.9%, the worst showing we’ve seen in 2014. The markets had expected a gain of 0.4%. This follows a disastrous German Unemployment Change, which moved higher for the first time in six months. In France, another major economy, Consumer Spending declined in April, dropping 0.3%. Clearly, Eurozone consumers are concerned about the economy, and a spendthrift consumer is something the shaky Eurozone economy can ill afford. These kinds of soft numbers add urgency to the ECB finally taking off the gloves and making some kind of move at its June policy meeting.

Key numbers out of the US were mostly a disappointment on Thursday. Preliminary GDP, the primary gauge of economic activity, posted its first decline since Q2 of 2009. The indicator came in at -1.0% for Q1, worse than the estimate of -0.6%. Harsh winter conditions took their toll on the US economy in Q1, and analysts expect a rebound in Q2. After a strong gain in March, Pending Home Sales softened, coming in at 0.4%. This was nowhere near the gain of 1.1%. On a brighter note, Employment Claims dropped to 300 thousand, easily beating the estimate of 321 thousand.

As if the EU didn’t have enough trouble with the region’s listless economies, there was bad news on the political scene as well as anti-EU parties shocked the establishment by posting huge gains in recent European parliamentary elections. These “euroskeptic” parties did exceptionally well in France, the UK and Greece. With Eurozone countries suffering from weak growth and high unemployment, voters had a chance to lash back in the elections, and their frustration and anger was heard loud and clear at the ballot box. French Prime Minister Manuel Valls called the results an “earthquake” and the elections could weigh on the euro, although so far the currency has remained firm. At the same time, the EU cannot afford a ‘business as usual’ approach after such elections results, so we could soon see changes in economic policies which could affect the euro.

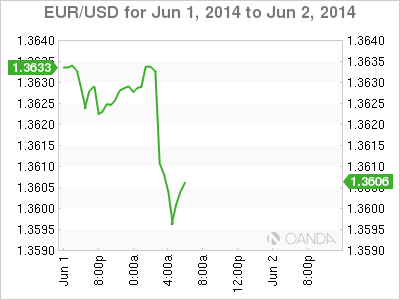

EUR/USD June 2 at 10:30 GMT

EUR/USD 1.3604 H: 1.3636 L: 1.3594

- EUR/USD has edged lower on Monday and is trading close to the 1.36 line.

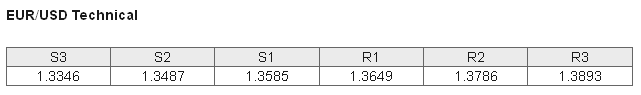

- 1.3585 continues to provide support, but is a weak line. There is stronger support at 1.3487.

- 1.3649 is the next resistance line. 1.3786 is stronger.

Further levels in both directions:

- Below: 1.3585, 1.3487, 1.3346 and 1.3219

- Above: 1.3649, 1.3786, 1.3893, 1.4000 and 1.4149

OANDA’s Open Positions Ratio

EUR/USD ratio is pointing to gains in short positions in Monday trading. This is consistent with the movement we are seeing from the pair, as the euro has posted modest losses. The ratio has a majority of long positions, indicative of a trader bias towards the euro reversing direction and moving higher.

EUR/USD is trading slightly above the 1.36 line. The euro is under pressure in the European session.

EUR/USD Fundamentals

- All Day – German Preliminary CPI. Estimate 0.1%.

- 7:15 Spanish Manufacturing PMI. Estimate 52.6 points. Actual 52.9 points.

- 7:45 Italian Manufacturing PMI. Estimate 54.3 points. Actual 53.2 points.

- 8:00 Eurozone Final Manufacturing PMI. Estimate 52.5 points. Actual 52.2 points.

- 12:40 US Treasury Secretary Jack Lew Speaks.

- 13:45 US Final Manufacturing PMI. Estimate 56.2 points.

- 14:00 US ISM Manufacturing PMI. Estimate 55.7 points.

- 14:00 US Construction Spending. Estimate 0.8%.

- 14:00 US ISM Manufacturing Prices. Estimate 56.8 points.