EUR/USD continues to have a quiet week, as the pair is trading just above the 1.14 line early in the European session. In the Eurozone, the German ZEW Economic Sentiment plunged. There were major events out of the US on Tuesday. Traders should keep a close eye on three key US releases later on Wednesday – Core Retail Sales, Retail Sales, and PPI. Any readings which miss expectations could lead to sharp movement by EUR/USD.

The Fed minutes last week were a disappointment, as the Fed did not provide any indication of when it might raise rates. So the key question remains – will the Federal Reserve press the trigger and raise rates in 2015? The markets had circled September as a likely candidate for a rate hike, but the Federal Reserve remained on the sidelines yet again. The Fed released the minutes of its September policy meeting last week, and indicated that the Fed does not feel that the timing is appropriate for a rate hike, but provided few clues as to when the Fed might take action. Policymakers cited concerns that the sluggish global economy could affect the US economy.

Federal Reserve policymakers are divided on the question of a rate hike in 2015. This was underscored on Monday by FOMC member Lael Brainard, who stated that the Fed should not raise rates before global economic conditions improve. Brainard noted that the Chinese slowdown has caused economic turmoil worldwide, and the US economy could lose steam due to weaker exports and weak global economic conditions. Clearly, Brainard is of the view that the Fed should take its time and proceed with caution. With global economic conditions unlikely to change anytime soon, a rate move may be on hold unless the US posts some key releases, such as GDP or employment numbers, which match or beat expectations.

A very different view was put forth on Monday by another FOMC member, Dennis Lockhart. Lockhart, considered a centrist on monetary policy, sounded more optimistic about a rate hike before the end of 2015. Lockhart did not rule out a rate hike in October, and added that the Fed would have more data to evaluate before its December policy meeting. With FOMC members sending out such conflicting messages, it is no wonder that the markets have been unable to get a handle on the timing of a rate hike, and this failure of the Fed to communicate a clear message to the Fed has hurt the US dollar, as we saw after the release of the Fed minutes last week.

More German releases, more bad news from the Eurozone’s largest economy. This seems to be the pattern of late, as German ZEW Economic Sentiment in October was a disaster. The key indicator fell to just 1.9 points, compared to 12.8 points a month earlier. The markets were braced for a drop, but had expected a stronger release of 6.8 points. This poor release comes on the heels of a disappointing manufacturing and trade balance numbers in August. These dismal numbers should not come as a surprise, keeping in mind that the German economy is heavily dependent on exports, and the country sends a larger proportion of exports to China, compared to other Eurozone countries. The Chinese slowdown shows no sign of improving anytime soon, and investors are nervous that a contraction in the German economy could quickly affect the rest of the bloc and send the fragile Eurozone economy into a tailspin. There was better news from the Eurozone ZEW Economic Sentiment, which slipped to 30.1 points in October, down from 33.3 points but matching the forecast.

EUR/USD Fundamentals

Wednesday (Oct. 14)

- 6:45 French CPI. Estimate -0.4%. Actual -0.4%.

- 9:00 Eurozone Industrial Production. Estimate -0.4%.

- 12:30 US Core Retail Sales. Estimate -0.1%.

- 12:30 US PPI. Estimate -0.2%.

- 12:30 US Retail Sales. Estimate 0.2%.

- 12:30 US Core PPI. Estimate 0.1%.

- 14:00 US Business Inventories. Estimate 0.1%.

- 18:00 US Beige Book.

Upcoming Key Events

Thursday (Oct. 15)

- 12:30 US CPI. Estimate -0.2%.

- 12:30 US Core CPI. Estimate 0.1%.

- 12:30 US Unemployment Claims. Estimate 269K.

- 14:00 US Philly Fed Manufacturing Index. Estimate -1.8 points.

*Key releases are highlighted in bold

*All release times are GMT

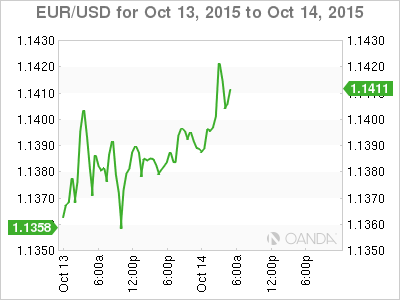

EUR/USD for Wednesday, October 14, 2015

EUR/USD October 13 at 9:30 GMT

EUR/USD 1.1413 H: 1.1427 L: 1.1383

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1204 | 1.1296 | 1.1392 | 1.1470 | 1.1658 | 1.1712 |

- EUR/USD has been uneventful in the Asian and European sessions.

- 1.1470 is an immediate support level.

- 1.1392 remains busy and has switched to a support role following slight gains by the euro.

- Current range: 1.1392 to 1.1470

Further levels in both directions:

- Below: 1.1392, 1.1296, 1.1214, 1.1105 and 1.1017

- Above: 1.1470, 1.1658, 1.1712 and 1.1871

OANDA’s Open Positions Ratio

EUR/USD ratio is not showing any movement on Wednesday, as long positions retain a majority of the open positions (62%). This points to trader sentiment in favor of the dollar gaining ground against the euro.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.