The euro remains is steady on Monday, following sharp losses in the Friday session, EUR/USD is trading at the 1.09 line in Monday’s European session. On the release front, Eurozone CPI missed expectations, coming in at -0.2%, short of the forecast of 0.0%. This was the lowest reading since March 2015. Core CPI came in at 0.7%, shy of the estimate of 0.9%. In the US, there are two economic releases to kick off the week – Chicago PMI and Pending Home Sales.

Eurozone CPI missed expectations and dropped into negative territory in January. This key indicator comes on the heels of weak CPI numbers out of France and Spain, both of which missed expectations. These weak numbers will put increased pressure on ECB head Mario Draghi to take monetary action at the ECB policy meeting in March. Possible monetary moves include adopting negative interest rates (a step recently taken by the BoJ) as well as expanding quantitative easing scheme, which currently involves asset purchases of 60 billion euros/mth. Either of these moves would likely push the euro to lower levels, so the markets will be keeping a close eye on the March ECB policy meeting.

It’s been a lukewarm start to 2016 for the US economy, which has seen growth and employment numbers soften in comparison with the red-hot numbers which characterized the second half of 2015. One sector which has been struggling is the manufacturing industry. The US economy has been grappling with a downturn in global demand, which has taken its toll on the export and manufacturing sectors. A strong US dollar, which has posted broad gains in recent months, has only exacerbated the situation. However, there was some positive news late in the week. US Preliminary GDP posted a strong gain of 1.0%, well above the estimate of 0.4%. There was also positive news from the manufacturing sector, as durable goods sparkled. Core Durable Goods rose 1.8%, crushing the estimate of 0.2%. This marked the key indicator’s strongest showing since March 2014. Durable Goods Orders followed suit with a sharp rise of 4.9%, rebounding from the previous reading of -5.1%. This was stronger than the estimate of 3.0%. Meanwhile, housing numbers have not impressed, as New Home Sales slipped to 494 thousand in January, compared to 544 thousand a month earlier. This figure was well short of the estimate of 522 thousand. Pending Home Sales will be released later on Monday, with the markets expecting a gain of 0.6%. If this housing release also misses expectations, the US dollar could respond with losses.

Monday (Feb. 29)

- 2:00 German Retail Sales. Estimate 0.3%. Actual 0.7%

- 2:00 German Import Prices. Estimate -0.9%. Actual -1.5%

- 5:00 Eurozone CPI Flash Estimate. Estimate 0.0%. Actual -0.2%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 0.9%. Actual 0.7%

- 5:00 Italian Preliminary CPI. Estimate +0.1%. Actual -0.2%

- 9:45 Chicago PMI. Estimate 52.1 points

- 10:00 US Pending Home Sales. Estimate 0.6%

- 23:30 FOMC Member William Dudley Speaks

*Key events are in bold

*All release times are EST

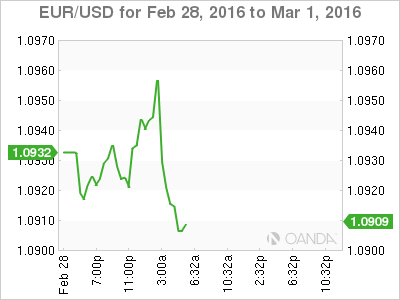

EUR/USD for Monday, February 29, 2016

EUR/USD February 29 at 5:25 EST

Open: 1.0924 Low: 1.0896 High: 1.0962 Close: 1.0902

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0616 | 1.0708 | 1.0847 | 1.0941 | 1.1087 | 1.1172 |

- EUR/USD posted gains in the Asian session but has retracted in the European session

- 1.0847 is providing support

- 10941 has switched to a resistance role following sharp losses by EUR/USD on Friday

- Current range: 1.0847 to 1.0941

Further levels in both directions:

- Below: 1.0847, 1.0708 and 1.0616

- Above: 1.0941, 1.1087, 1.1172 and 1.1278

OANDA’s Open Positions Ratio

EUR/USD ratio has movement towards short positions, which currently have a majority (46%). This points to trader bias towards EUR/USD continuing to lose ground.