EUR/USD has posted considerable gains on Tuesday. In the European session, EUR/USD is trading at 1.1450. On the release front, German CPI and WPI numbers beat expectations. There are no major US releases on Tuesday. We’ll get a look at some key US data on Wednesday, with the release of retail sales reports and PPI.

The Eurozone remains gripped by weak inflation levels, which underscore the lack of growth in the economy. There was good news on Tuesday, as German consumer inflation numbers beat expectations. Final CPI impressed in March, with a strong of 0.8%, matching the forecast. This marked the index’s strongest gain in 12 months. German WPI broke a nasty streak of 7 declines, posting a gain of 0.3%, which also matched the forecast. We’ll get a look at Eurozone CPI numbers on Thursday, and if these readings are above expectations, the euro could gain ground.

Last week, the ECB released the minutes of its March policy minutes, but there was little reaction from EUR/USD. At that meeting, the ECB implemented significant monetary steps, lowering all three of its interest rates and increasing its asset-purchase program (QE) from EUR 60 billion to 80 billion/mth. The ECB has pumped some EUR 700 billion into its asset-purchase program, but the results have been disappointing, as the Eurozone continues to grapple with weak growth and inflation levels. The minutes indicated that the ECB Governing Council was broadly unified behind ECB president Mario Draghi, supporting the monetary package which the ECB adopted at the March meeting. The minutes acknowledged the soft Eurozone economy, noting that the pace of recovery is expected to remain weak and uncertainties in the global economic environment pose significant risks to the Eurozone. Governing Council members also called for structural reforms, a theme that has often been mentioned by Draghi.

The Federal Reserve has dampened recent enthusiasm about an imminent rate hike. In recent comments, Fed chair Janet Yellen acknowledged that although domestic growth was steady, the US economy remained prone to risks due to turbulent conditions in the global economy. New York Federal Reserve president William Dudley reiterated Yellen’s message, saying that the Fed must approach future rate hikes with caution. The Fed released the minutes of its March policy meeting last week, and the tone was more dovish than expected, although some members did express support for an April hike. The minutes also pointed to a split as to whether the recent pickup in inflation will continue. Higher inflation levels would increase the likelihood of a rate hike in June. Most analysts are expecting no more than two rate hikes in 2016, although stronger than expected economic data could change this forecast.

EUR/USD Fundamentals

Tuesday (April 12)

- 6:00 German Final CPI. Estimate 0.8%. Actual 0.8%

- 6:00 German WPI. Estimate 0.3%. Actual 0.3%

- 10:00 US NFIB Small Business Index. Estimate 93.9

- 12:30 US Import Prices. Estimate 1.0%

- 18:00 US Federal Budget Balance. Estimate -106.5B

Upcoming Key Events

Wednesday (April 13)

- 12:30 US Core Retail Sales. Estimate 0.4%

- 12:30 US PPI. Estimate 0.3%

- 12:30 US Retail Sales. Estimate 0.1%

*Key events are in bold

*All release times are GMT

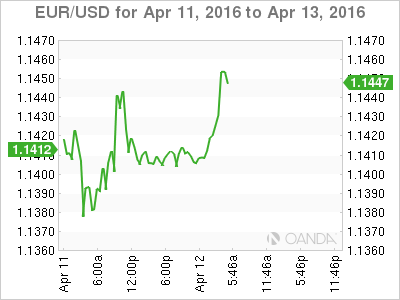

EUR/USD for Tuesday, April 12, 2016

EUR/USD April 12 at 9:00 GMT

Open: 1.1410 Low: 1.1307 High: 1.1465 Close: 1.1453

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1172 | 1.1278 | 1.1378 | 1.1495 | 1.1609 | 1.1712 |

- EUR/USD was flat in the Asian session and has posted gains in the European session

- 1.1378 has strengthened in support as EUR/USD has posted gains in Tuesday

- There is resistance at 1.1495

Further levels in both directions:

- Below: 1.1378, 1.1278, 1.1172 and 1.1087

- Above: 1.1495, 1.1609 and 1.1712

- Current range: 1.1378 to 1.1495

OANDA’s Open Positions Ratio

EUR/USD ratio remains unchanged on Tuesday. Short positions have a strong majority (65%), indicative of strong trader bias towards EUR/USD moving to lower levels.