The euro is unchanged on Friday, as EUR/USD trades just below the 1.13 level. The pair has hugged the 1.13 line all week, but that could change dramatically during the North American session.

The US will release Preliminary GDP, a key indicator, as well as the Preliminary GDP Price Index. This will be followed by a speech from Fed chair Janet Yellen at Jackson Hole.

The week wraps up with the UoM Consumer Sentiment report. In the Eurozone, GfK Consumer Confidence came in at 10.2 points, matching the forecast.

Germany is the Eurozone’s largest economy, and German indicators often act as bellwethers of the strength of the Eurozone economy. Recent numbers are showing softness in the second quarter compared to Q1, as Brexit aftershocks are taking a toll on a fragile Eurozone economy.

German Ifo Business Climate dropped to 106.2 points in the August report, its lowest level in six months. More significantly, the decline from 108.6 points in July marked the indicator’s largest drop since May 2012.

The weak reading underscores concerns that European businesses are taking a “wait and see” attitude after the Brexit referendum, as Britain and Europe must begin the long and arduous negotiations process of Britain’s departure from the EU.

Although the German economy expanded in the second quarter, it failed to keep up with the first quarter’s pace. Final GDP climbed 0.4%, within expectations but well behind the first quarter gain of 0.7%. Domestic consumption continues to power the economy, with low inflation and zero interest rates helping to spur consumer spending.

Earlier in the week, there was some positive news from the manufacturing sector, as German and Eurozone Manufacturing PMIs both pointed to expansion. As well, both indicators were showed little changed from the July readings, which indicates that manufacturers continue to be optimistic, even after the Brexit vote.

The markets will be paying close attention to the Federal Reserve on Friday, but the venue will be in scenic Wyoming rather than busy Washington, D.C. Federal chair Janet Yellen will address the Jackson Hole economic summit, where central bankers and other senior policymakers are gathered to discuss economic and monetary policy.

The markets will be looking for clues about the timing of a rate hike, and if Yellen delivers, we could see an immediate reaction from the markets. Federal policymakers are divided over a rate hike, as the US labor market is red-hot, but inflation levels remains very low.

Yellen will address the conference shortly after the release of Preliminary GDP for the second quarter and the GDP deflator. In July, a soft Advance GDP sent the dollar downwards, as the economy expanded 1.2%, well short of the forecast of 2.6%. The estimate for the Preliminary GDP report stands at 1.1%.

EUR/USD Fundamentals

Friday (August 26)

- 6:00 Eurozone GfK German Consumer Climate. Estimate 10.2 Actual 10.2

- 8:00 Eurozone M3 Money Supply. Estimate 5.0%. Actual 4.8%

- 8:00 Eurozone Private Loans. Estimate 1.8%. Actual 1.8%

- 12:30 US Preliminary GDP. Estimate 1.1%

- 12:30 US Goods Trade Balance. Estimate -62.3B

- 12:30 US Preliminary GDP Price Index. Estimate 2.2%

- 14:00 Federal Reserve Chair Janet Yellen Speaks

- 14:00 US Revised UoM Consumer Sentiment. Estimate 90.6

- 14:00 US Revised UoM Inflation Expectations

- All Day – Jackson Hole Symposium

*All release times are EDT

* Key events are in bold

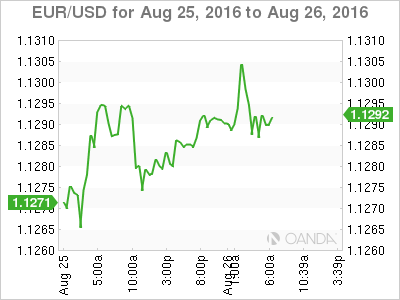

EUR/USD for Friday, August 26, 2016

EUR/USD August 26 at 8:45 GMT

Open: 1.1287 High: 1.1308 Low: 1.1283 Close: 1.1293

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1054 | 1.1150 | 1.1278 | 1.1376 | 1.1467 | 1.1534 |

- EUR/USD has showed limited movement in the Asian and European sessions

- 1.1278 remains a weak support line. It could be tested in the Friday session

- There is resistance at 1.1376

Further levels in both directions:

- Below: 1.1278, 1.1150 and 1.1054

- Above: 1.1376, 1.1467 and 1.1534

- Current range: 1.1278 to 1.1376

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged in short positions. Currently, short positions have a strong majority (65%), indicative of trader bias towards EUR/USD resuming its upward movement.