EUR/USD has edged upwards on Monday, as the pair trades at 1.0630. The pair has been uneventful since the Thanksgiving holiday on Thursday. With no major economic releases out of the Eurozone or the US, it could be another quiet day. ECB President Mario Draghi will testify before the European Parliament’s Economic Committee later in the day, and the markets will be especially interested in what Draghi has to say about Brexit. There are no US events on the schedule. On Tuesday, Germany releases Preliminary CPI. The US will publish Preliminary GDP for the third quarter, with the markets expecting a sharp gain of 3.0%. As well, we’ll get a look at CB Consumer Confidence, which is expected to improve to 101.3 points.

Donald Trump’s upset win in the US election triggered turmoil in global markets, and there has been concern that the Eurozone economy could be negatively affected by Trump’s declarations to pull out of free trade agreements. So far, however, recent Eurozone and German indicators have been solid. Germany business confidence levels remain high, as underscored in the November Ifo Business Climate report. The index continues to hover around the 110 level, pointing to strong optimism about the German economy. This report is the first look at the German business sector’s reaction to the Trump election victory, and the reading appears to show that German companies are not worried about the US election results. However, the ECB Financial Stability Review was less sanguine. The report warned about the risk of sudden corrections in global markets due to “higher political uncertainty”, which could hurt economic growth. The report didn’t give examples, but it’s a good bet that the report was referring to the Brexit vote and Donald Trump’s election as president. With Brexit negotiations expected to start shortly and Trump taking over as president in January, we could see plenty of volatility from the euro in the coming weeks. The euro remains under pressure and dropped down to 1.0517 on Thursday, its lowest level since November 2015. EUR/USD is down 3.0 percent in November, and there is growing talk of the euro dropping to parity with the high-flying US dollar.

The Federal Reserve appears poised to raise interest rates by a quarter-point in December, with the odds of a rate hike at 93 percent. The Fed minutes were released on Thursday, indicating that policymakers felt it appropriate to raise rates “relatively soon”. Earlier this month, Fed Chair Janet Yellen used the same phrase in her testimony before a congressional committee. The minutes indicated that some members argued that the Fed needs to raise rates in December in order to preserve the bank’s credibility – despite some broad hints of rate hikes during 2016, the Fed has stayed on the sidelines throughout 2016, causing significant disappointment and frustration in the markets.

EUR/USD Fundamentals

Monday (November 28)

- 9:00 Eurozone M3 Money Supply. Estimate 5.0%. Actual 4.4%

- 9:00 Eurozone Private Loans. Estimate 1.9%. Actual 1.8%

- 14:00 ECB President Mario Draghi Speech

Tuesday (November 29)

- All Day – German Preliminary CPI. Estimate 0.1%

- 13:30 US Preliminary GDP. Estimate 3.0%

- 15:00 US CB Consumer Confidence. Estimate 101.3 points

*All release times are GMT

* Key events are in bold

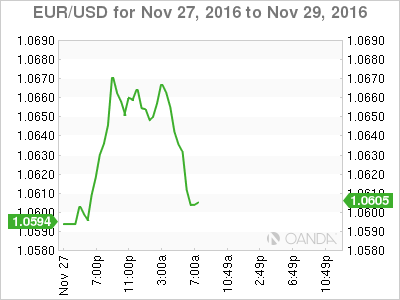

EUR/USD for Monday, November 28, 2016

EUR/USD November 28 at 6:10 GMT

Open: 1.0608 High: 1.0685 Low: 1.0606 Close: 1.0627

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0414 | 1.0506 | 1.0616 | 1.0708 | 1.0821 | 1.0957 |

- EUR/USD posted gains in the Asian session but has retracted in European trade

- 1.0616 has switched to a support role and is a weak line

- There is resistance at 1.0708

Further levels in both directions:

- Below: 1.0616, 1.0506, 1.0414 and 1.0287

- Above: 1.0708, 1.0821 and 1.0957

- Current range: 1.0616 to 1.0708

OANDA’s Open Positions Ratio

EUR/USD ratio is unchanged in the Monday session. Currently, short positions have a majority (65%), indicative of trader bias towards EUR/USD reversing directions and moving to lower ground.