Talking Points

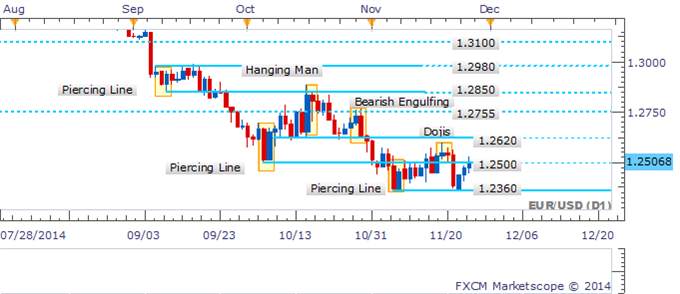

- Strategy:Short (From 1.2480), Stop: 1.2500 (Daily Close), Target 1: 1.2360, Target 2: 1.2250

- Slow Grind Higher Encounters Pressure At 1.2500 Barrier

- Awaiting Bearish Signals In Intraday Trade To Signal A Pullback

EUR/USD’s slow grind higher has endured, yet a lack of key bullish reversal patterns makes a more sustained recovery questionable. Sellers may look to keep the pair capped below the psychologically-significant 1.2500 handle. This in turn suggests current levels may offer a fresh short opportunity. An initial downside target is offered by the 1.2360 floor, which if broken would potentially open a run on the 1.2250 mark.

EUR/USD: Rebound May Struggle To Find Further Momentum

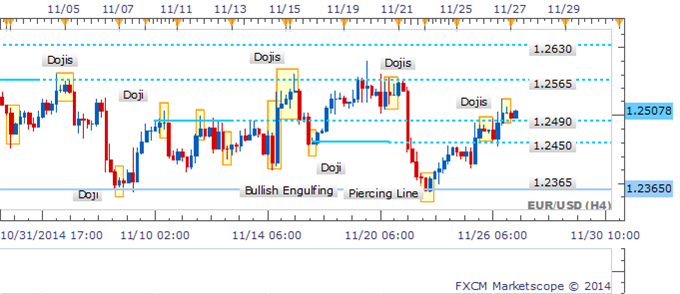

The four hour chart already reveals signs of hesitation from the bulls in the form of a Doji candlestick near the 1.2500 handle. Yet with more definitive reversal signals absent the potential for a pullback is questionable.

EUR/USD: Doji Signals Reluctance From The Bulls Near 1.2500