In a special note to clients today, Goldman Sachs (NYSE:GS) updates its outlook on EUR/USD and USD/JPY noticing that the latest messages form the ECB and BoJ seem to be 'lost in translation'. The following are the key points in GS' note along with its latest forecasts for EUR/USD and USD/JPY.

1- "When central banks are implementing QE – as the ECB and Bank of Japan clearly are – they deliver two basic messages. First, they comment on whether the current pace of asset purchases is still appropriate and, when it isn’t, they provide more accommodation, as the BoJ did in October. Second, because QE is controversial, they sing the praises of asset purchases, pointing to rising inflation expectations and an improving growth picture," GS argues.

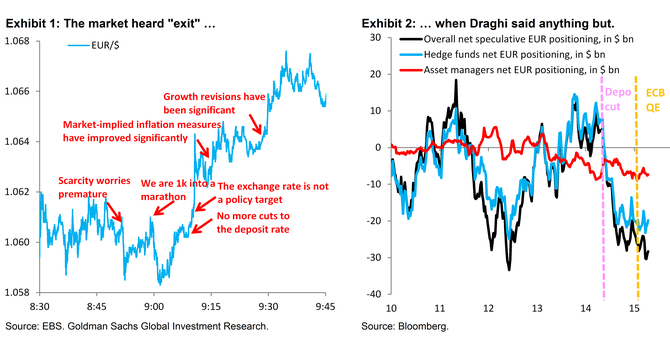

2- "We think this is what happened towards the end of the ECB press conference on Apr. 15, when President Draghi made favorable comments on the inflation and growth picture. The market heard exit, but in our view this is a clear case of “lost in translation." GS adds.

3- "After all, President Draghi earlier in the press conference argued forcefully that focus on early exit is premature and that having this debate now is like “quitting a marathon after 1k.” Our European economists continue to expect “full implementation” of ECB QE, meaning an unchanged pace of asset purchases through at least Sep. 2016. This is key to our view that a cyclical recovery in the Euro zone is not a force for EUR/USD higher," GS clarifies.

4- "There was more “lost in translation” in Governor Kuroda’s speech on Apr. 19. The market picked up headlines that “the underlying trend of inflation has improved markedly,” but the more important message in the speech, in our opinion, is that low inflation momentum is threatening to pull inflation expectations lower (Exhibit 4), which will then set the stage for additional monetary easing," GS notes.

5 "Our Japan Chief Economist forecasts additional stimulus for July by way of duration extension of JGB purchases (akin to "Operation Twist" in the US). Given how small speculative long $/JPY positioning now is, we think there is room for the market to catch up with real story in Japan, which is that another round of monetary easing is coming," GS adds.