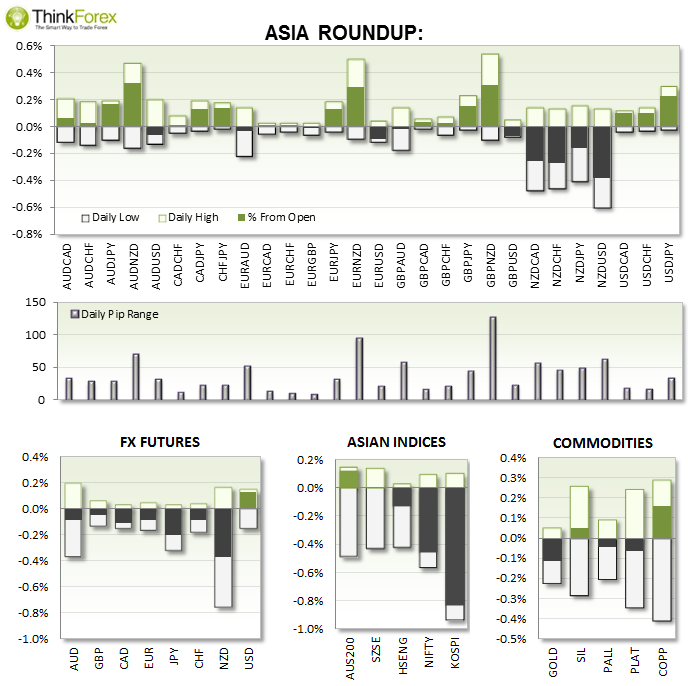

- AUD: Glen Stevens addressed parliament and stated that intervention "is on the table" for the overvalued Aussie. Regardless, traders pushed the Aussie higher throughout the speech but remains well below yesterday's losses following good housing stats from America.

- NZD: By fa the biggest loser from today it has broken a key level against the greenback and very close to breaking levels against EUR, JPY and CAD. EUR/NZD still remains below the 61.8% level so the question of a market top has not yet been eradicated until it breaks above the August high.

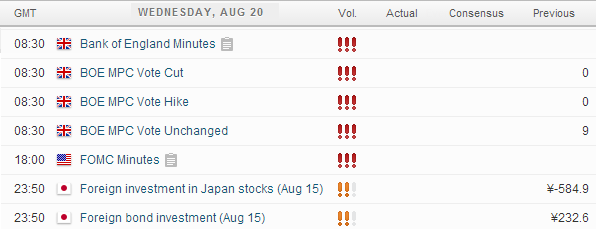

UP NEXT:

- GBP: If we see any change in the voting tonight then this will be GBP bullish. However in light of consistently poor data from UK and continued mixed messages from Carney it remains highly unlikely to see any change here. Traders will pay more attention to the BoE Minutes.

- USD: The Greenback has provided excellent bullish opportunities but we can expect a slow down as we approach the FOMC minutes. Particular attention will be paid to employment and inflation comments and trades will assess how dovish (generally bearish for USDD) or hawkish (generally bullish) will be. Volatility can be expected but due to the dominant bullish trend on USD we would prefer to hear hawkish comments to trade in line with the trends across the majors.

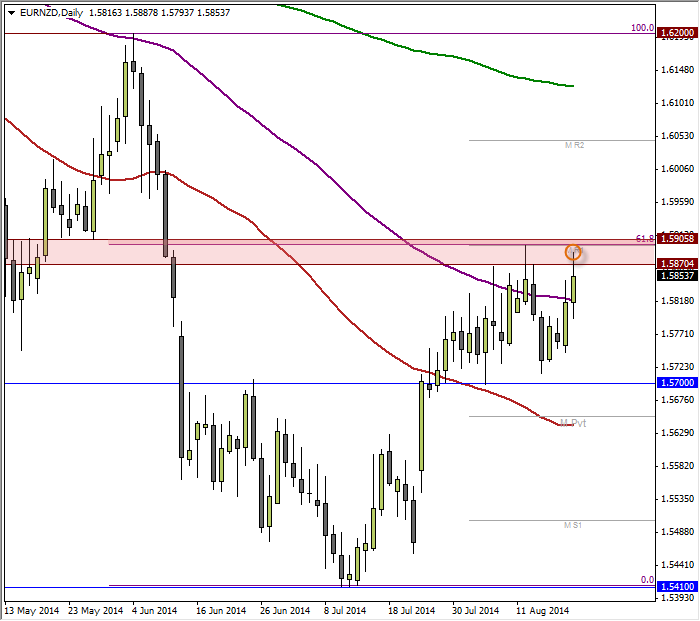

TECHNICAL ANALYSIS:

EUR/NZD: Close, but the top isn't quite invalidated

At the time of writing euro and Kiwi are two of the weaker currencies, so until one becomes the stronger we can expect choppy price action on the EUR/NZD. However in light of the recent sell off of the Kiwi it should be noted that euro failed to take full advantage of kiwi Weakness, as EUR/NZD has failed to trade above the recent swing high (and resistance zone) previously highlighted.

This may provide a clue going forward. For the brave this may provide a decent opportunity to get short with a tight stop and higher reward / risk ratio.

In the event we break above 1.59 high then the analysis will have to be revised, but it is not until we break above 1.62 that the longer-term bearish trend becomes under doubt. Until then I still favour a continuation of the dominant weekly bearish trend and for the yield differentials between the 2 counties to favour carry trades.

To become more confident of the trend continuation we need to break below 1.57 and we do run the risk of sideways / wild oscillations between 1.57-59 until the trend becomes full established, leaving room for a double / triple top or bullish continuation.

EUR/CAD: Targets 1.459 above 1.456

A simple 1-2-3 setup where the impulsive move from the 1.452 lows broke above a previous swing high and has since drifted lower as part of the 'phase 2' retracement. What we seek here is the beginning of the next anticipated 'phase 1' bullish move.

Currently trading above the Daily Pivot we have also been provided a small and subtle clue that a bottom may be in process. The Small bodied Doji (blue arrow) is accompanied with relatively high volume to suggest a change in hands. If this is a swing low then it may provide a logical place to put your stop loss behind, however you can be more conservative and consider below the daily pivot. To attempt an improvement in reward/risk ratio you could also consider a buy-limit order above the daily pivot, to target 1.459 resistance zone.