Market Brief

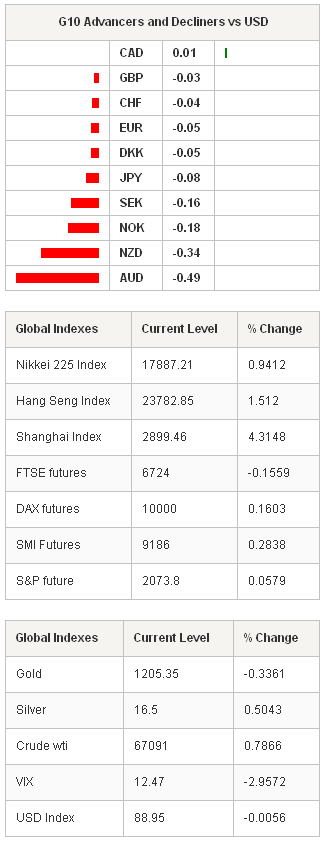

The FX markets are broadly long USD before Friday’s jobs report. Released yesterday, the first US jobs read came in weaker than expected. According to ADP report, the US economy added 208’000 new private jobs through November (verse 222K exp. & 230K last). Confident expectations for November NFPs (230K exp.) and unemployment rate (5.8% exp.) keep traders long in USD. Dallas Fed President Fisher said Fed should start unwinding its balance sheet at slow pace, to avoid any rush to raise rates and rate spikes. After hitting 2.15% on Monday, the US 10-year yields rebounded to 2.30%.

USD/JPY traded tight within 119.75/95 range in Tokyo. Large stops sit above 120-psychological resistance, and short-term break through 120-offers should trigger decent profit taking as uncertainties on Abenomics persist before December 14th snap elections. Our first case scenario is the reelection of the PM Abe and sustainable advance toward higher USD/JPY. Traders already shift eyes toward 130s (last seen at mid-2007). EUR/JPY remains above the daily conversion line (146.89). The bias remains negative, with EUR subject to event risk today.

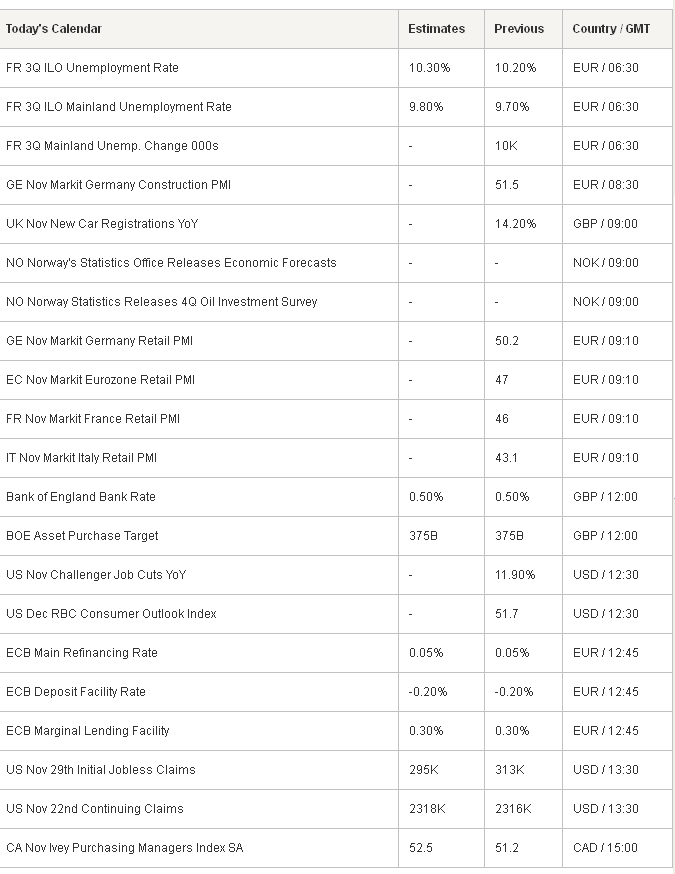

The BoE and the ECB give policy verdict today (at 12:00 and 12:45 GMT respectively). The ECB President Mario Draghi will speak at 13:30 GMT. While the BoE decision is expected to be a non-event, Draghi’s press conference will likely trigger some price action in the EUR-complex. Given the recent wording from the leading ECB officials, we expect the ECB statement to remain meaningfully dovish. EUR/USD legged down to 1.2296 (at the time of writing). For a post-Draghi close below 1.2435/50 (MACD pivot / 21-dma), the bias will remain downwards.

As expected, the Bank of Canada kept the benchmark rate unchanged at 1.0%. In the accompanying statement, the BoC said that weakness in oil prices is an important risk to Canadian inflation outlook. Despite the deepening bear market in oil, the shrinking output gap and optimistic forecast on Canadian recovery hinted at tighter policy preparing for months ahead. USD/CAD sold-off from 1.1418 to 1.1347 post-decision. The MACD will step in the bearish zone for a daily close below 1.1321. EUR/CAD sold-off under 1.40 and remains offered pre-ECB. Negative trend momentum suggests extension of weakness. The key support stands at 1.38375 (August-December downtrend channel base).

The Brazil Central Bank raised the Selic rate by 50 basis point to 11.75% as anticipated by the markets. USD/BRL eased toward 2.55 and stabilized. The November inflation read is due on Friday, with expectations at 6.59% y/y, above the BCB target of 4.5% +/-2%, the downside risks are not totally wiped.

USD/NOK remains well bid above 7.00 on weakness in oil markets. Despite greenish day in oil, the bullish momentum in NOK will likely keep the downside limited.

Norway Statistics will release 4Q oil investment report today. Traders also watch French 3Q Unemployment Rate, German November Construction PMI, UK November New Car Registrations, Italian, French, German and Euro-zone November Retail PMI, US November 29th Initial Jobless & November 22nd Continuing Claims and Canadian November Purchasing Managers Index SA.

Currency Tech

EUR/USD

R 2: 1.2532

R 1: 1.2450

CURRENT: 1.2310

S 1: 1.2280

S 2: 1.2168

GBP/USD

R 2: 1.5826

R 1: 1.5763

CURRENT: 1.5685

S 1: 1.5586

S 2: 1.5423

USD/JPY

R 2: 120.50

R 1: 120.00

CURRENT: 119.94

S 1: 119.10

S 2: 117.89

USD/CHF

R 2: 0.9972

R 1: 0.9839

CURRENT: 0.9783

S 1: 0.9715

S 2: 0.9595