Forex News and Events:

The week starts with important information flow to be integrated in the FX prices. The escalating tensions in Ukraine, the emergency meeting of UN’s Security Council last night, the ECB officials EUR-negative comments over the week-end trigger position adjustments this Monday. Ahead of us, a data full week will define G10 trading. US, UK and EZ inflation data are due this week. China releases 1Q growth on Wednesday. We hear rumors on a meeting between BoJ Governor Kuroda and PM Abe before the month-end, the PM Abe should express his discontent on BoJ’s decisions. The US dollar is broadly in demand, EUR and GBP pare gains.

ECB efforts to fight the EUR strength

Last week’s 2-figure rally resulted in dovish comments from ECB officials over the week end. ECB President Draghi voiced his dissatisfaction with strengthening EUR. He said stronger EUR will trigger looser monetary policy, yet warning that this is an “important dimension” for the price stability: lower rates threaten the financial stability. In fact, the inflation would have been about 1% if FX effect is isolated, this is twice the latest 0.5% printed in March estimates. Euro-zone will publish the final inflation in March, the CPI y/y is expected to confirm expectations of a slowdown to 0.5%, and the core inflation is expected back at 0.8%. Similarly, the ECB’s Executive Board member Coeure insisted that ECB’s inflation mandate will require more accommodation to counter EUR strength. IMF’s Lagarde encouraged ECB comments.

EUR-complex gap opened the week, yet the market reaction to dovish comments remained short-lived. A clear majority of market participants still believe that the ECB’s verbal intervention will not result in concrete action. Société Générale said to not expect imminent policy action “unless EUR/USD approaches 1.5000”.

EUR/USD finds buyers above the 21-dma (1.3808) this morning. Trend and momentum indicators remain bullish, option bids for today’s expiry trail above 1.3810, stops are eyed below. Tensions in Ukraine and the deflationary fears keep the EUR in demand. The peripheral bonds show mixed performance. Government bonds in Spain, Italy and Portugal perform well this Monday, yet the Greek government yields climb sharply. Given the high ECB risk, we expect EUR/USD resistance to stay solid pre-1.3906 (Friday, April 11th high).

GBP-appetite contained as UK faces softer inflation

The UK will publish the March inflation figures on Tuesday and February jobs data on Wednesday. The consumer price inflation is expected to have further slowed down in March. The consensus is 0.2% m/m (vs. 0.5% in Feb) and 1.6% y/y (vs. 1.7% in Feb). The expectations on producer and retail prices are flat-to-negative. Given the weakness in UK’s exports and foreign investments, the BoE is expected to persist on its forward guidance, the lower inflation readings (well below BoE’s 2% target) are clearly supportive of BoE’s longer lose policy outlook. Despite expectations on UK jobs back to improving path, the option bets in GBP/USD are negatively skewed below 1.6750 for the week ahead. Technically, GBP/USD fluctuates in the mid-line of Nov’13-Mar’14 ascending trend. The first line of support stands at 21 & 50 dma (1.6624/1.6615). More bids should come into play at the trend bottom (1.6550).

EUR/GBP consolidates losses below its 50-dma (0.82839). Trend and momentum indicators point downwards, offers remain solid pre-0.83000.

Today's Key Issues (time in GMT):

2014-04-14T12:30:00 USD Mar Retail Sales Advance MoM, exp 0.90%, last 0.30%2014-04-14T12:30:00 USD Mar Retail Sales Ex Auto MoM, exp 0.50%, last 0.30%

2014-04-14T12:30:00 USD Mar Retail Sales Ex Auto and Gas, exp 0.40%, last 0.30%

2014-04-14T12:30:00 USD Mar Retail Sales Control Group, exp 0.60%, last 0.30%

2014-04-14T13:00:00 CAD Mar Teranet/National Bank HPI MoM, last 0.30%

2014-04-14T13:00:00 CAD Mar Teranet/National Bank HP Index, last 160.41

2014-04-14T13:00:00 CAD Mar Teranet/National Bank HPI YoY, last 5.00%

2014-04-14T14:00:00 USD Feb Business Inventories, exp 0.50%, last 0.40%

The Risk Today:

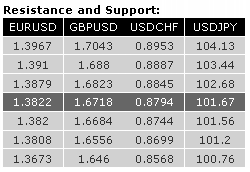

EUR/USD correction is nearing hourly support at 1.3820 (old resistance). Failure to find support here, followed by a break under 1.3820 (02/02/2014) will warn of a larger downside corrective phase to1.3673. In the meantime, the bullish daily structure remains. In the longer term, EUR/USD is still in a dominate uptrend, suggesting additional upside can be anticipated. A significant resistance now lies at 1.3876 (24/03/2014 high).

GBP/USD strong bullish run was halted at key resistance 1.6823. Failure to break key level suggest a degree of exhaustion and suggests more further downside to 1.6684 (31/03/2013 high). The short-term bullish momentum is intact as long as the hourly support at 1.6684 (previous resistance) holds. Another support lies at 1.6556. In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6460 holds. A major resistance stands at 1.7043 (05/08/2009 high).

USD/JPY has broken the support at 102.68 (19/03/2014 high), leading to a sharp decline. Even though the support at 101.72 has been breached, prices are now close to a key support between 101.56 (see the rising trendline from 100.76 (04/02/2014 low)) and 100.76 (see also the 200 day moving average). A resistance now stands at 102.68 (previous support). A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.80) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF has eased off recent lows at 0.8750 (11/04/2014). The weakening momentum has been confirmed by the break of the support implied by the rising trendline. Dominate bearish momentum suggests a challenge to key support at 0.8699 (13/03/14). From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. The recent technical improvements suggest weakening selling pressures and a potential base formation. A decisive break of the key resistance at 0.8930 would open the way for further medium-term strength.