Italian oil giant Eni S.p.A. (NYSE:E) and U.K.-based vehicle company, Fiat Chrysler Automobiles N.V. (NYSE:FCAU) have recently signed a Memorandum of Understanding (MoU) to jointly develop research projects and applications that reduce carbon emission from modes of transport. The agreement in the presence of Italian Prime Minister, Paolo Gentiloni is in line with both companies' strategy to focus on carbon emission reduction.

Per Eni, the agreement will enable the companies to research extensively on technologies related to compressed natural gas (CNG) and liquefied natural gas (LNG). These technologies are expected to enable the companies to reduce tank weights and increase mileage. Moreover, Eni announced that it has developed a new kind of petrol, which includes 15% methanol and 5% bioethanol to reduce emissions. Usage of methanol in the fuel enables to significantly reduce emissions. Eni and Fiat Chrysler will together test this new type of petrol in five Fiat 500 Enjoy fleet cars. Eni believes this type of petrol can reduce around 4.3% carbon emissions.

Of the total carbon emissions, road transport vehicles alone are responsible for approximately 23%. The companies are also taking this matter into consideration and testing new types of fuels in existing modes of transport to assess their importance. The companies are testing the use of increased proportion of Hydrotreated Vegetable Oil or HVO in diesel for existing motors, which reduces emissions by 60% during the production process.

About the Company

Eni with its consolidated subsidiaries is engaged in oil and gas, electricity generation, petrochemicals, oilfield services and engineering industries. The company’s major business segments are Exploration and Production (E&P), Gas and Power, and Refining and Marketing. The company conducts its major exploration and production activities for hydrocarbons. In addition, Eni is involved in offshore and onshore hydrocarbon field construction.

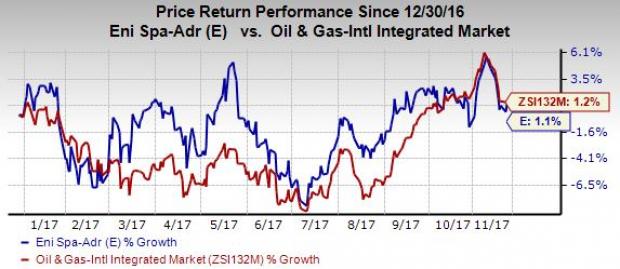

Price Performance

Eni has gained 1.1% year to date compared with 1.2% growth of its industry.

Zacks Rank and Stocks to Consider

Eni carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector include ConocoPhillips (NYSE:COP) and Northern Oil and Gas, Inc. (NYSE:NOG) . All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based ConocoPhillips is a major global exploration and production company. The company’s sales for 2017 are expected to increase 24.4% year over year. The company delivered an average positive earnings surprise of 152.3% in the last four quarters.

Minnetonka, MN -based Northern Oil and Gas is an independent energy company. The company’s sales for the fourth quarter of 2017 are expected to increase 51.9% year over year. The company delivered an average positive earnings surprise of 175% in the last four quarters.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Fiat Chrysler Automobiles N.V. (FCAU): Free Stock Analysis Report

ENI (MI:ENI) S.p.A. (E): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post