For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.3767.

The US Dollar gained ground after data showed that factory orders in the US rose more-than-expected 1.6% (MoM) in February, the most in five months and compared to a 1.0% drop in the previous month. Positive sentiment was also fuelled after a separate report from the ADP revealed that US private employers added 191,000 workers in March, slightly below economists’ expectations but higher than a gain of 178,000 private payrolls registered in the previous month.

Meanwhile, St. Louis Fed President, James Bullard, citing a quicker-than-expected fall in the US jobless rate by the end of this year, projected the first rate hike to come in the first quarter of next year but at the same time also warned that a further slowing of the nation’s inflation rate could prompt Fed policymakers to suspend tapering of bond purchases. Separately, in a business event in Miami, Atlanta Fed Chief, Dennis Lockhart stated that an interest rate hike in the second half of 2015 can only be justified if the economy registers a 3% annual growth.

In the Euro-zone, official data showed that, on a seasonally adjusted basis, the GDP rose 0.2% (QoQ) in the fourth quarter, less than preliminary estimates for a 0.3% rise and compared to a 0.1% (QoQ) increase registered in the preceding quarter. Another report showed that producer price index in the region fell more-than-expected 0.2% (MoM) in February, compared to a 0.3% drop recorded in the previous month.

In a noteworthy event, the IMF Managing Director, Christine Lagarde, suggested the ECB to ease its monetary policy in order to combat “low inflation” in the Euro-zone economy. Furthermore, she projected global economic growth to register modest improvements in 2014 and 2015, following a 3.0% growth in 2013.

In the Asian session, at GMT0300, the pair is trading at 1.3759, with the EUR trading 0.06% lower from yesterday’s close.

Earlier today, in an interview with Reuters, San Francisco Fed President, John Williams opined that, “given the US economic outlook, the nation need to have relatively low levels of interest rates for quite some time.” However, he also hinted towards the possibility for the US Fed to start raising its key interest rates in the second half of 2015.

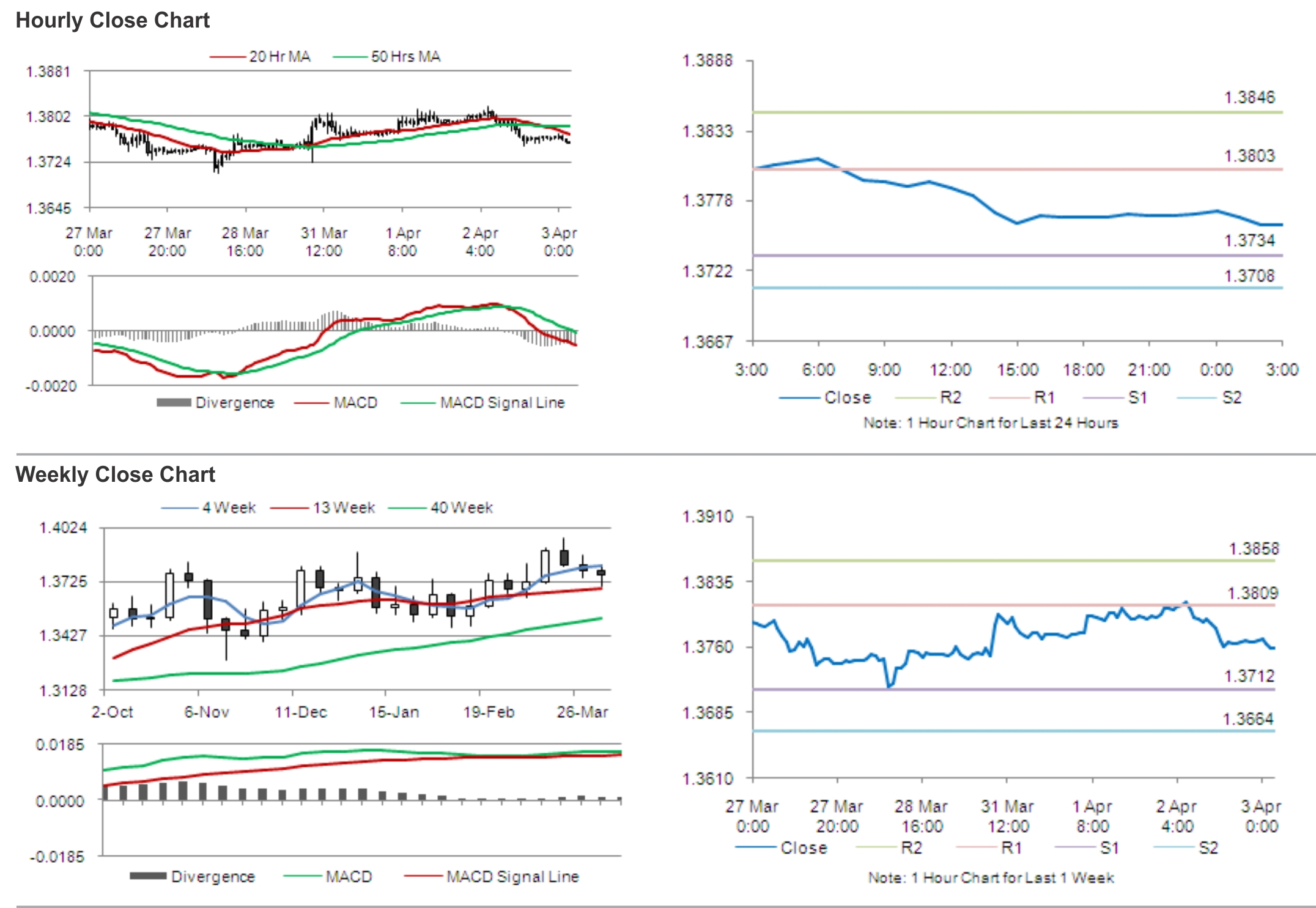

The pair is expected to find support at 1.3734, and a fall through could take it to the next support level of 1.3708. The pair is expected to find its first resistance at 1.3803, and a rise through could take it to the next resistance level of 1.3846.

Meanwhile, after disappointing consumer and producer prices data from the Euro-zone, traders keenly await the ECB’s interest rate decision, due later today, in order to gauge the ECB officials’ future course of action. Market participants also look forward to Markit Economics’ service, composite PMI and Eurostat’s retail sales data, for further cues in the Euro.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.