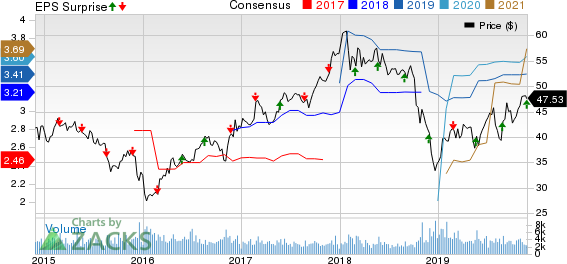

Eaton (NYSE:ETN) Vance Corp.’s (NYSE:EV) fourth-quarter fiscal 2019 (ended Oct 31) adjusted earnings of 95 cents per share surpassed the Zacks Consensus Estimate of 89 cents. Also, the bottom line increased 12% year over year.

Results were driven by improvement in assets under management (AUM) balance and a slight rise in revenues. However, higher operating expenses acted as a headwind. This perhaps was the reason why the company’s shares declined 2.4% following the release.

Net income attributable to shareholders (GAAP basis) was $109.2 million, up 4% from the year-ago quarter.

For fiscal 2019, adjusted earnings of $3.45 per share beat the Zacks Consensus Estimate of $3.41 and jumped 7% year over year. Net income attributable to shareholders (GAAP basis) grew 5% to $400 million.

Revenues & Expenses Rise

Total revenues in the reported quarter were $433.7 million, up 1% year over year. Rise in management fees and performance fees were partially offset by lower distribution and service fees. The top line lagged the Zacks Consensus Estimate of $439.6 million.

For fiscal 2019, total revenues declined 1% to $1.68 billion. Also, it missed the consensus estimate of $1.69 billion.

Total expenses increased 4% from the prior-year quarter to $298.3 million, largely due to higher amortization of deferred sales commissions and fund-related costs.

Total operating income declined 6% year over year to $135.4 million.

Liquidity Position Strong, AUM Balance Improves

As of Oct 31, 2019, Eaton Vance had $557.7 million in cash and cash equivalents compared with $600.7 million on Oct 31, 2018. The company had no borrowings outstanding against its $300-million credit facility.

Eaton Vance’s consolidated AUM grew 13% year over year to $497.4 billion as of Oct 31, 2019. Net inflows and market price appreciation drove this rise.

Share Repurchase Update

During fiscal 2019, Eaton Vance repurchased and retired nearly 7.4 million shares of its Non-Voting Common Stock for $299.9 million under the company’s existing repurchase authorization.

As of Oct 31, 2019, nearly 6.3 million shares remained available under buyback authorization.

Our Take

Eaton Vance’s improving AUM balance and higher revenues are likely to support growth in the quarters ahead. However, increasing expenses might hamper its bottom line to quite an extent.

Currently, Eaton Vance carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers

Cohen & Steers’ (NYSE:CNS) third-quarter 2019 adjusted earnings of 65 cents per share beat the Zacks Consensus Estimate of 63 cents. Also, the bottom line was 1.6% higher than the year-ago quarter figure.

BlackRock, Inc.’s (NYSE:BLK) third-quarter 2019 adjusted earnings of $7.15 per share surpassed the Zacks Consensus Estimate of $6.95. However, the figure was 4.9% lower than the year-ago quarter’s number.

Invesco (NYSE:IVZ) reported third-quarter 2019 adjusted earnings of 70 cents per share, beating the Zacks Consensus Estimate of 57 cents. Also, the bottom line was 6.1% up from the prior-year quarter.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Invesco Ltd. (IVZ): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Cohen & Steers Inc (CNS): Free Stock Analysis Report

Eaton Vance Corporation (EV): Free Stock Analysis Report

Original post