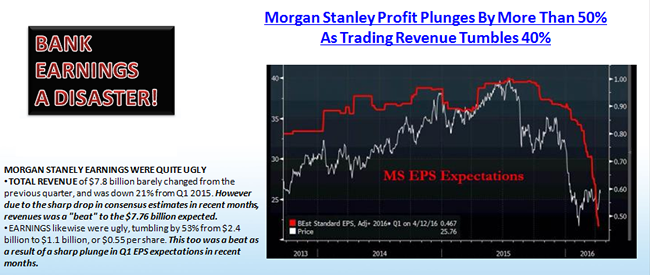

Bank profits are in trouble! Don't be fooled by the "beat analyst estimates" charade, because that is exactly what it is. First quarter bank earnings can only be described as an unmitigated disaster.

With the aid of 24 charts, John Rubino and Gordon T Long discuss what they see in this 32 minute video, what is important to be aware of and what is being hidden from public scrutiny.

THE EARNINGS' SEASON CHARADE

John Rubino recaps the situation as:

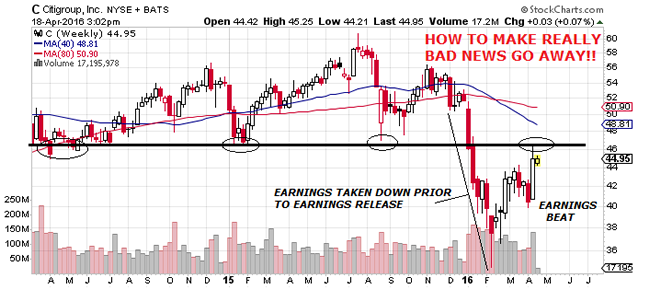

"I think this is hilarious so far! It is the season where banks are reporting earnings and they are reporting really bad numbers Y-o-Y. Citigroup (NYSE:C)'s earnings were down 28% Y-o-Y with a double digit drop in revenue. It is pretty well the same for the Bank of America (NYSE:BAC), JP MorganChase, Wells Fargo (NYSE:WFC) BUT the headline in Bloomberg and other major media outlets are oh "Citigroup beats expectations!"

That is the headline because Wall Street plays this game with their big client accounts where when things are headed south the analysts on Wall Street lower earnings projections even faster than earnings are actually dropping, so the companies can say "yes, we lost money and made less money than we did a year ago BUT we beat Wall Street expectations!". THAT becomes the headline.

The only positive headline out there for the big banks are when the results are horrendous! "

John goes on to say that:

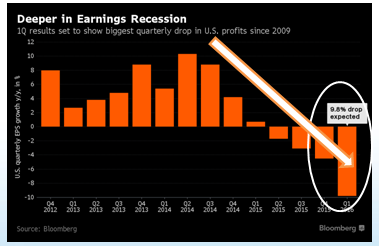

"Year seven in a recovery banks should be reporting phenomenal numbers - they should be reporting 'blowout numbers! This is the point of the cycle when lots of people are borrowing, interest rates are down, funding is cheap for the banks - the bankS should be doing really well!" Instead, the banks are rolling over big time. Their earnings are probably (when all is said and done), they are going to be looking at a low single digit decline in Y-o-Y earnings."

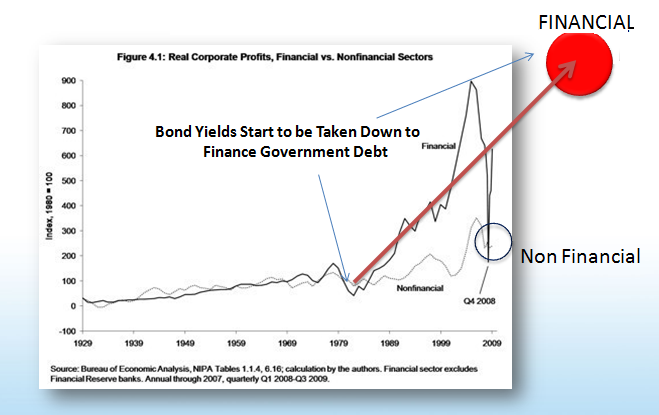

"Finance at this late stage of Capitalism is now the biggest part of the economy, so you can't have banks shrinking, reporting losses or lower numbers Y-o-Y, laying people off or pulling back on lending and at the same time have a growing economy! They are mutually exclusive when banks are such a large part of the economy."

THE FINANCIALIZATION 'GIG' IS UP!

Gordon T Long illustrates that through the growth of Financialization, 45% of the equity markets today are Financials. Their spectacular earnings growth is historic and unprecedented and now excessive debt lending, encumbered collateral and rapidly growing non-performing loans are signalling troubles are looming.

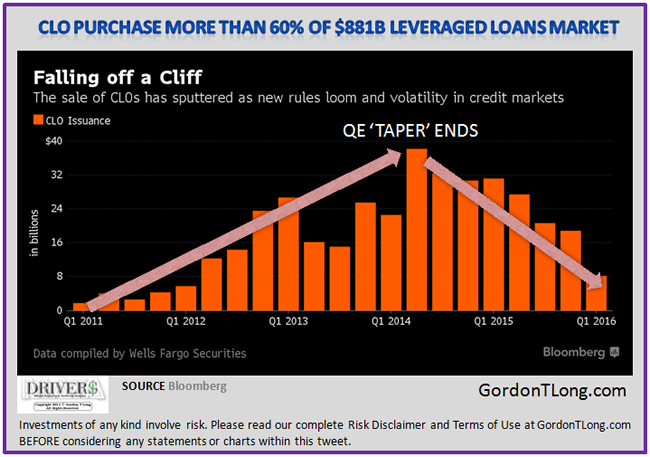

Of particular concern to Gord is problems in the Leveraged Loans area which is critical to sustaining the growth in Collateralized Loan Obligations (CLOs) which has been steadily weakening. The Shadow Banking industry and bank earnings are critically tied to CLO growth and their extremely profitable fees.

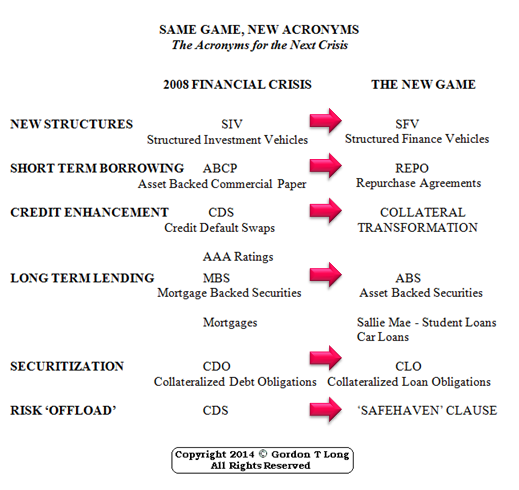

Gord points out that it was the collapse of CDO's that brought the banking industry to its knees in 2008. One the acronyms have changed and the loan problem. It isn't CDO mortgages today but rather CLOs and Student Debt, Auto Debt and Corporate Leverage Debt.

.... there is much, much more in this fascinating 32 minute video exchange..