As expected, the euro rejected the 1.2450-level in a first attempt but the single currency was able to hold above $ 1.24 ahead of the upcoming ECB monetary policy announcement. While no changes in interest rates are expected, the focus will be on a fresh set of economic projections and ECB President Draghi’s commentary on what could happen to the central bank’s QE program which is due to run until September.

There is still a high degree of ECB optimism in the market and given that optimistic sentiment market participants may tend to push the EUR/USD higher even though Mario Draghi is unlikely to signal an early exit to their QE program. Traders should bear in mind that making significant adjustments to their communication right now could cause confusion which is why ECB policymakers could maintain a cautious stance for the time being. Mr. Draghi is not in a hurry to announce a change right now. Therefore, the ECB could hold off until the summer to start talking about unwinding QE and tell the market when rates will begin to rise.

The ECB will announce its rate decision at 12:45 UTC, followed by the ECB’s press conference 45 minutes later.

EUR/USD

The euro is still calm but, as usual, we will prepare for heightened volatility during the day.

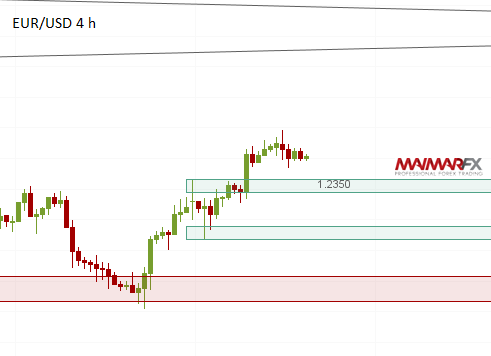

For bullish momentum to continue we would need to see a break above 1.2480 and 1.25. A higher target could then be at around 1.2560. In the chart below we have sketched out potential support areas which could be tested in case of a bearish twist. The nearest support comes in at 1.2350 from where buyers could swoop in – depending on the ECB’s commentary. A break below 1.2330 could send the euro lower towards 1.2280.

Let us be surprised.

GBP/USD: The price action in the cable is still messy with the pair struggling to find a clear direction. Yesterday we saw the pound confined to a small trading range between 1.3910 and 1.3845. In terms of profitable trading opportunities, the recent price development leaves much to be desired for day traders.

Here are our daily signal alerts:

EUR/USD

Long at 1.2420 SL 25 TP 20, 50

Short at 1.2383 SL 25 TP 20, 50

GBP/USD

Long at 1.3915 SL 25 TP 15, 40

Short at 1.3885 SL 25 TP 20, 60

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.