Stocks declined on Wednesday, with small caps and growth stocks selling off, but most stocks were down across the board.

Grandpa Russell "IWM" broke back below its 200-day moving average, and unsurprisingly the S&P 500 also closed below its 200-day moving average. Today, the S&P Index was one point away.

One index is marching on solo. The Dow Jones Industrial Average continues to rise above its 200-day moving average.

The S&P Index has been trading in a range between 4100 and 4200.

There are increasing odds that this rally will fail the longer the SPY ETF trades inside this band so watch carefully for a big break out or a potential drop.

If the present rally stalls in the upcoming days and weeks, value stocks may profit from any shift away from riskier assets.

Growth vs. Value

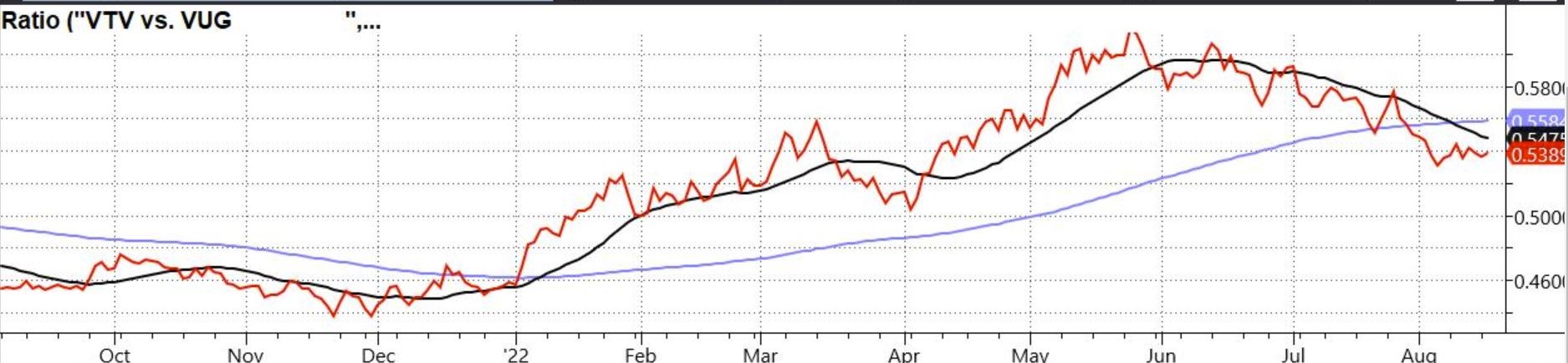

Vanguard Value Index Fund ETF (NYSE:VTV) / Vanguard Growth Index Fund ETF (NYSE:VUG) (October 2021-August 2022)

The above chart displays the value price ratio, or the price spread of value vs. growth since September 2021.

Growth has outperformed over the last several months and has been firmly in control, signaled by the red line moving down. The gap between growth and value has widened considerably since June 2022.

If this rally changes to the downside, we may continue to see a "greater rotation" into value-oriented assets, such as select retailers, re-opening trades, energy, grains, dividend-payers, low vol, fertilizers, renewables, chemicals, utilities, grains, metals, miners, healthcare, REITs, consumer staples, infrastructure, industrials, and insurance companies to name a few value areas.

Risk of Recession Is High

The risk of more than a technical recession is high because global growth is slowing, and several economic indicators are deteriorating.

Evidence of sustained economic weakness and headwinds seems to be everywhere…

- The Federal Reserve is committed to tightening monetary policy. during this economic downturn.

- More companies are beginning to lay off employees.

- Treasury yields are still inverted. The 2-10 yield spread has now inverted to -0.43%.

- The U.S. still has many job positions that have been unfilled for months, hinting that more wage growth will need to be seen to keep up with inflationary pressures and to fill these vacant roles.

- Phenomenal wage inflation has occurred, but not as much as inflation. America is getting poorer in real terms.

- The Fed cannot do much about supply-side inflation.

- Service inflation is sticky, and core inflation will also be sticky.

- The strength of the Euro is in question with another looming debt and European energy crisis on the horizon.

- Quantitative Tightening is set to increase to $90B per month by September in the U.S.

Conclusion

The Fed is conflicted on what to do next because there are so many messages ahead. Companies are continuing to lay off employees, while Treasury yields are still inverted, and job positions remain unfilled. Stay vigilant in your risk governance.

Modern Family Daily Snapshot

Grandpa Russell, IWM -1.68%

Sister Semiconductors, SMH -2.15%

Granny Retail, XRT -2.85%

Brother Biotechnology, IBB -1.95%

Tr., Transportation, IYT -1.64%

Son, Regional Banks, KRE -1.17%

ETF Summary

S&P 500 (SPY) 428.55 now resistance with support at 427.79

Russell 2000 (IWM) 198.68 the resistance with support at 198.21

Dow (DIA) 342 resistance and support at 341.07

Nasdaq (QQQ) 330.24 first level of resistance and support at 329.73.

KRE (Regional Banks) 67.82 resistance, support level at 67.30.

SMH (Semiconductors) 239.46 resistance and support at 238.35.

IYT (Transportation) 246.31 resistance and support at 245.35.

IBB (Biotechnology) 131.99 resistance and 131.02 is support.

XRT (Retail) 72.99 resistance point and with support is at 71.95.