The S&P 500 slipped for the fourth day out of the last five trading sessions. This time we were brought down when the British Prime Minister shocked everyone by announcing a snap election in a few weeks. That launched the pound higher while punishing the export heavy London stock market. This weakness carried over to our shores, but to a far lesser extent since we only lost 0.3% as compared to the FTSE’s 2.5% drubbing.

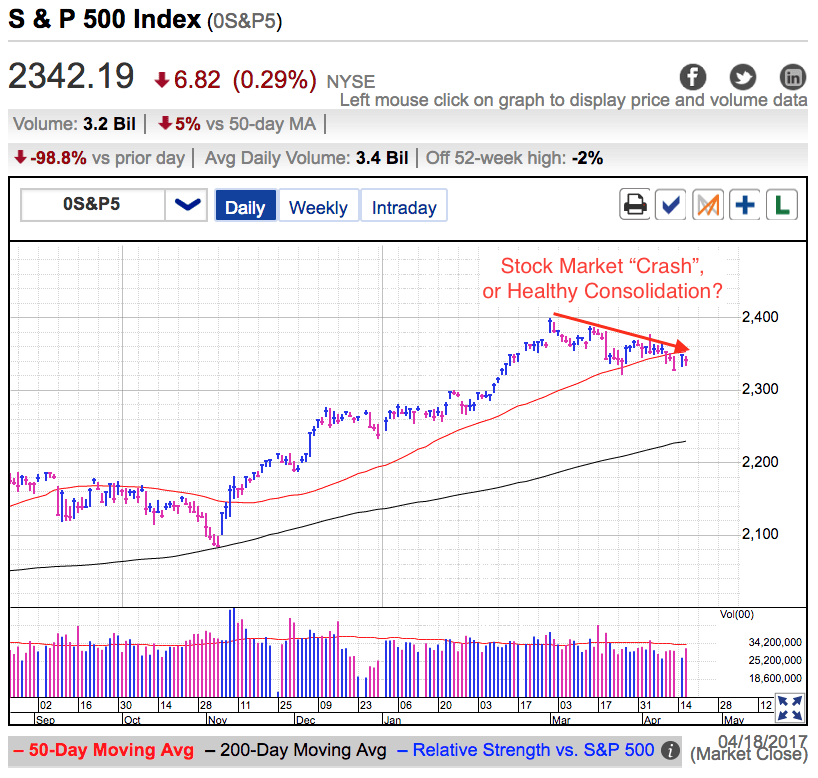

My last free blog post was nearly a week ago when I wrote how this was a buyable dip. At that point we had been down for six sessions over the previous two weeks. It didn’t get much better since then because almost every day over the last week has ended in the red. Given the huge number of down-days over the last few weeks, you would expect stocks to be dramatically lower. But that’s hardly the case. After more than six-weeks of selling, the best bears can manage is a 2.2% dip from all-time highs! That hardly seems like something to worry about.

I’ve been trading for nearly two decades and the one thing I can tell you is market crashes are breathtakingly fast. They happen so quickly most traders don’t have the time to react, let alone understand what is going on. The “selloff” we find ourselves in the middle of is the exact opposite. It is happening so slowly it is almost painful to watch. If stocks crash from unsustainable levels quickly, holding near the highs for nearly two months tells us this is a constructive consolidation, not the verge of a collapse.

If we need further evidence, the healthcare bill blew up a few weeks ago. On Tuesday the Brits interjected more political uncertainty by calling for new elections. Over the last month we’ve seen negative technical price-action pile up as we undercut key price levels and moving averages. But to this point none of the headlines or weak trading has been able to trigger follow-on selling. Instead of being spooked, confident owners are staying confident. When confident owners don’t sell, supply stays tight and prices remain firm. Say what you want about the underlying fundamentals, but it is really hard for a selloff to take hold when no one is selling.

One of the most profitable ways I’ve found to analyze the market is asking myself “what is the market not doing?” Right now the market is definitely not selling off. We have had wave after wave of bearish headlines and so far every violation of support is met with dip-buying, not emotional herd selling. We have been given countless excuses to implode, but the market is clearly not interested in taking the bait. Countless bloody noses have taught me market’s don’t give us this long to sell the top. If that is the case here, that means this cannot be the top.

If this market doesn’t want to go down, that makes this a better place to be buying stocks than selling them. That said, I don’t believe this market is poised to rip higher either. Markets love symmetry and this 2% dip will likely be met with an equally uninspiring rebound. Expect the S&P 500 to stay 2,300/2,400 range-bound until further notice. Nimble traders can trade the swings inside this range, but longer-term investors should stick with their positions and ignore this noise.