USD/NOK

The dollar was virtually unchanged against most of its G10 counterparts during a quiet European morning. It gained against NOK and was slightly lower against EUR. The day is expected to continue in a quiet mode since the only release coming out later in the day is the US weekly jobless claims for Dec 21. The figure is expected to show a fall in claims to 345k from 379k the previous week, but seasonal adjustments because of the holidays make the numbers less significant.

More data will be released during the Asian morning Friday, when we have the usual end-of-month data dump from Japan. Jobless rate for November is expected to ease to 3.9% from 4.0% in October. National CPI is expected to have accelerated to +1.5% yoy in November from +1.1% yoy in October, while the Tokyo CPI for December is expected to rise 0.9% yoy, the same as in November. Excluding-food-and-energy inflation is expected to have risen 0.5% yoy in November, a faster pace than +0.3% in October. Positive data may take some pressure off the yen, but I would expect the effect to be limited since today’s BoJ meeting minutes showed that officials considered boosting bond purchases if necessary to achieve their 2% inflation target. Finally the nation’s preliminary industrial production is forecast to slow to +0.4% mom in November from +1.0% mom in October.

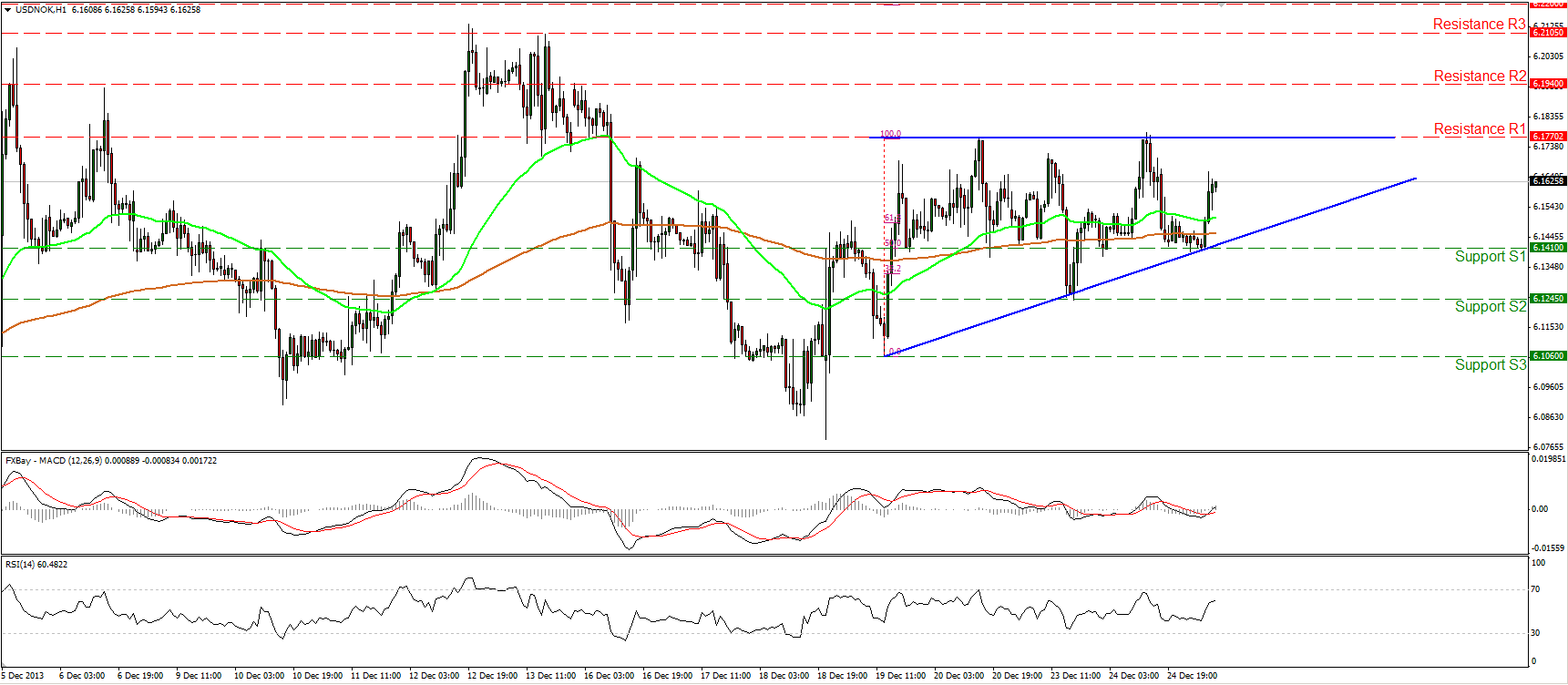

The USD/NOK rebounded from the 6.1410 (S1) support and moved significantly higher. The pair seems to be forming a possible ascending triangle and if the bulls are strong enough to overcome the strong resistance at 6.1770 (R1), I would expect them to trigger extensions towards the 161.8% Fibonacci extension level of the triangle’s width. The MACD oscillator lies near its neutral level, confirming the non-trending phase of the pair, but managed to cross above its trigger, shifting the odds slightly to the upside. As long as the pair is trading in a sideways formation, I remain neutral until the exit occurs.

• Support: 6.1410 (S1), 6.1245 (S2), 6.1060 (S3)

• Resistance: 6.1770 (R1), 6.1940 (R2), 6.2105 (R3)

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders.

This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)