Dollar trades mildly higher in Asian session today. Trading is subdued with China, Swiss, France, Germany, Italy and UK on holiday. The greenback is lifted mildly by news that the US Congress has reached a tentative agreement on a USD 1T bill to keep the government running through the end of September. A vote could be held as early as Tuesday to confirm. And this would prevent a government shut down. But the real tests for the greenback would be from economic data and FOMC meeting. Fed is widely expected to keep policies unchanged this week. But at this point, Fed fund futures are pricing in over 60% of a June hike. Markets would be eager to get some hints for that in this week's FOMC statement. Meanwhile, ISM indices and non-farm payroll would shed some lights on how the US economy would rebound after a weak Q1.

EU showed unity on Brexit negotiation approach

EU leaders approved, over the weekend, the guidelines for Brexit negotiation. European Council President Donald Tusk described the guidelines as "firm but fair". And he emphasized an orderly Brexit would eventually followed by a "balanced, ambitious and wide-ranging" agreement on trade. The unanimous agreement on the guidelines showed unity among EU leaders on the approach. And that is, the exit deal should be completed before trade negotiations. It's reported that UK will be required to "respect the obligation resulting from the whole period" of the membership and pay the agreed seven-year budget that concludes in 2020. The sum is estimated to be between EUR 40b and EUR 60b.

UK PM May: Strong leadership needed in Brexit negotiation.

UK Prime Minister Theresa May responded that there is no Brexit deal on the table yet. And, she said that "we have their negotiating guidelines, we have our negotiating guidelines through the Article 50 letter and the Lancaster House speech I gave on this issue in January." May emphasized that "what matters sitting around that table is a strong Prime Minister of the United Kingdom, with a strong mandate from the people of the United Kingdom which will strengthen our negotiating hand to ensure we get that possible deal."

The European Commission will come up with a more detailed proposal for governments to approve on May 22. Formal negotiation will start after election in UK on June 8.

RBA watched tomorrow

RBA rate decision will be another focus this week. The central bank is widely expected to keep the cash rate unchanged at 1.50%. Rate has been staying at this record low since last August. Also, RBA would likely continue to adopt a neutral stance even though inflation has returned to target band of 2-3% in Q1. Meanwhile, one of the keys to shape the policy path this year would be the government budget to be unveiled on May 9.

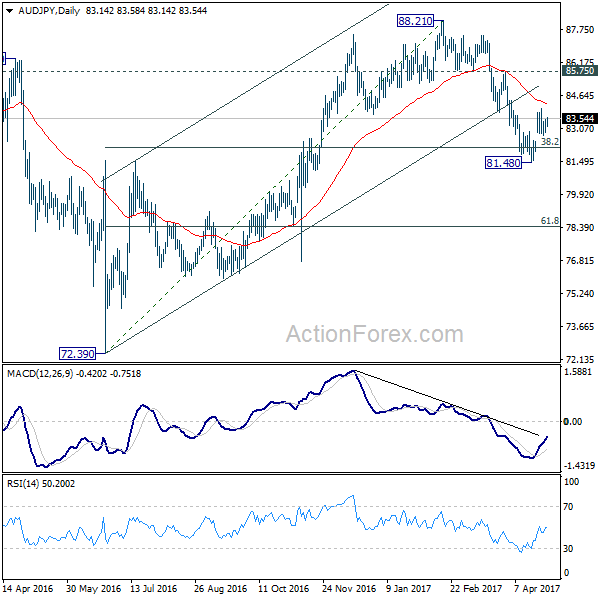

Aussie has been the more resilient commodity currencies last month, comparing to Canadian and New Zealand Dollar. AUD/JPY 's strong rebound from 81.48 suggests that the corrective pull back from 88.21 has completed already. And, 38.2% retracement of 72.39 to 88.21 at 82.17 was defended after brief trading below. Further rise would now be seen to 55 day EMA (now at 84.25). Sustained break there should then pave the way for a retest on 88.21 high.

China PMIs point to slowing growth

Released yesterday, the official China PMI manufacturing dropped to 51.2 in April, down from 51.8, and below expectation of 51.7. PMI non-manufacturing dropped to 54.0, down from 55.1. The data suggests that growth in China would slow after the unexpected pickup in first quarter. In particular, the employment component dipped into contraction region at 49.2 while output also dropped 0.4 pt to 53.8. There are also expectations that the government's policy would turn into a more cautious approach ahead. Nonetheless, the economy in China will likely remain robust.

For today...

Swiss will release retail sales in European session. US will release personal income and spending, PCE, ISM manufacturing and construction spending later in the day.