The EU referendum in the UK is set to take place on Thursday. The latest polls showed that the lead of supporters of Brexit diminished or even reversed. What does it imply for the gold market?

Since our last article on the British referendum a lot has changed, again. For example, the Economist’s Brexit Tracker from June 20 shows that 44 percent of voters are in favor of remaining within the EU, while 43 percent support a divorce. Last time, the supporters of Brexit led the race by two percentage points. Other polls suggest a tie or a slight lead for the “leave” camp. Anyhow, those who prefer status quo have gained recently in the polls. The reason for that change may be the tragic murder of Jo Cox, the British Labour Party Member of Parliament. Her murder probably had a political context, as she was a prominent campaigner for remaining in the EU while her killer allegedly shouted “Britain first”.

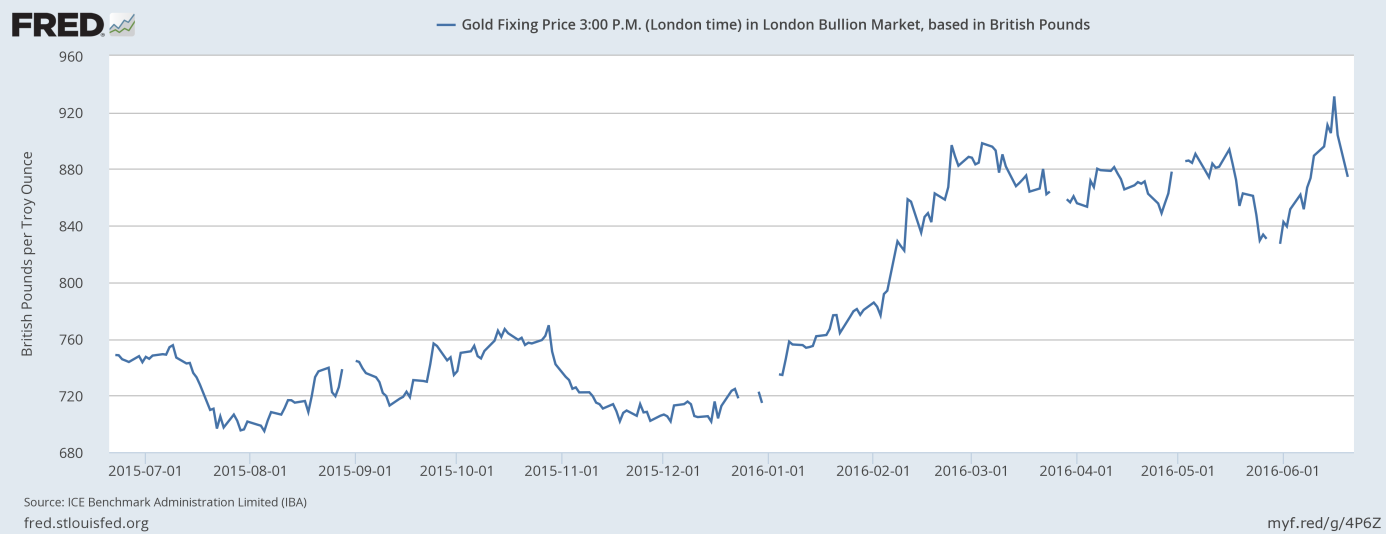

The decreased chances of Brexit are bad news for the gold market. Indeed, the price of gold in the British pound was declining last week, as one can see in the chart below.

Chart 1: The price of gold in British pounds over the last 12 months.

However, we can witness last minute safe-haven bids for gold before the referendum. If Britain leaves, there will probably be a knee jerk reaction in the gold market, but investors should not expect permanent increases – after all, there is a life and trade after divorce and it would take at least two years for Britain to exit from the EU. Moreover, we bet dollars to doughnuts that the UK’s government and parliament could try to renegotiate another deal and offer another referendum. Democracy is a great institution, provided that people vote “accordingly”.

If Britain remains within the EU, the sterling will rally, while the price of gold should fall due to withdrawal of safe-haven bids. However, the decline may be limited due to the rise of the euro against the U.S. dollar.

Summing up, in just a few days, there will be a historic referendum on British membership in the EU. The results will affect the gold market, independently of the outcome. The polls are close, but we believe that the UK will remain within the EU, because the undecided usually vote for status quo. In such a scenario, gold may lose some of its appeal. However, investors should not forget that a lot of gold’s trade is about the Fed’s actions. The current dovish stance of the U.S. central bank is supportive for the price of gold.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.