Gold made a low for the day exactly at strong support at 1668/64 on Monday and Tuesday. Longs worked perfectly on the bounce through the 200 week moving average at 1690 for the next buy signal. If you added to longs gold then beat the 4 week high and trend line resistance at 1699/1701( not unexpected!) with a high for the day exactly at the next target and the 100 day moving average at 1716/19.

A huge profit on longs with a full 6000 tick move in hours. Easy money.

Silver doing well for our longs too of course with an easy 1000 ticks.

WTI Crude December unexpectedly collapsed back below strong support at 8940/00. Unfortunately this week's breakout has failed.

Both targets were hit for a potential 150-200 tick profit. Outlook remains positive.

Today's Analysis

Gold higher as expected and as far as my upper targets, the 100 day moving average at 1716/19. A high for the day but shorts are risky. I am watching for a bull flag pattern to form. A break above 1720 is the next buy signal targeting the October high at 1728/30. A break above the September high at 1734/36 is another buy signal for this week.

Downside is expected to be limited in the short squeeze/bear trap. First support at 1706/03. Below 1700 meets strong support at 1694/90. Longs need stops below 1680.

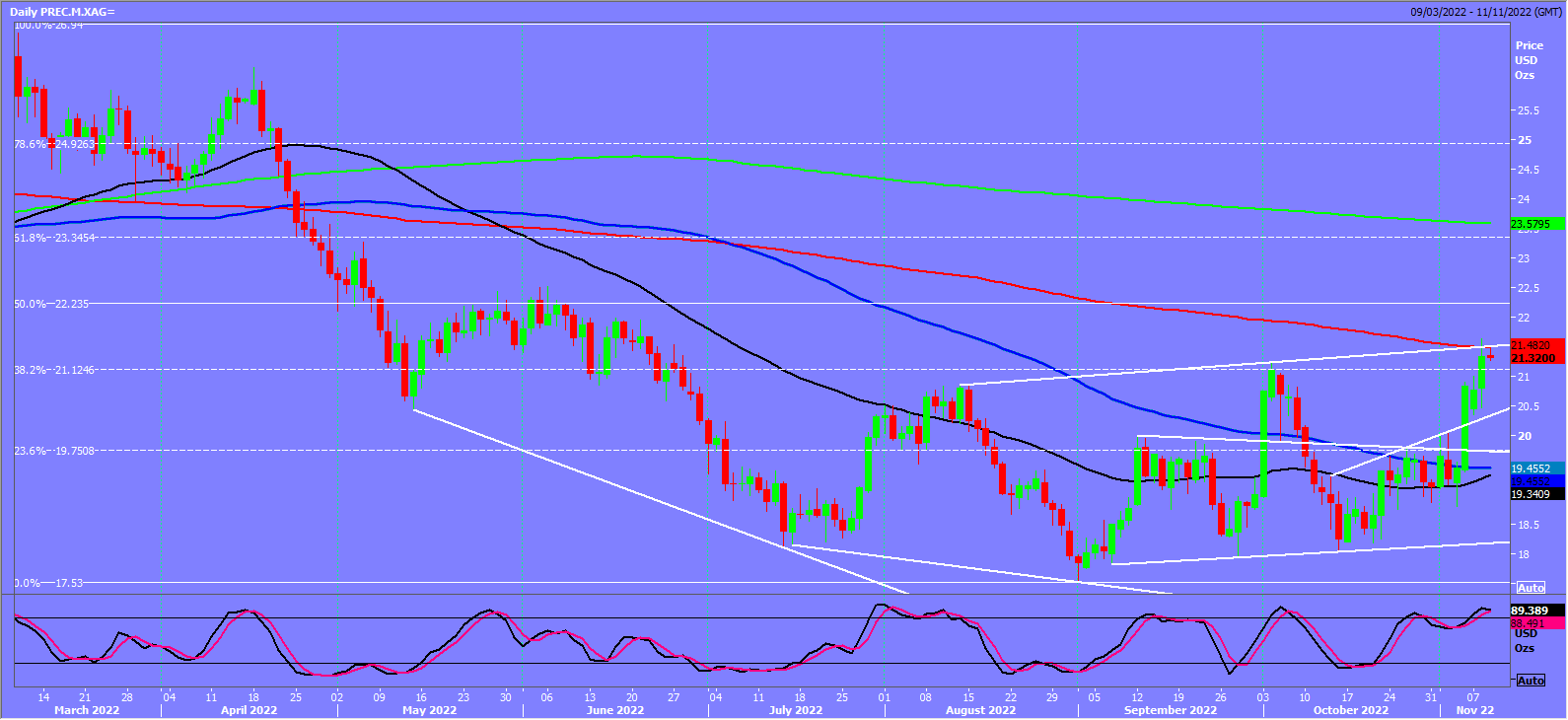

Silver longs at strong support at 2045/40 worked perfectly on the bounce to targets of the October high at 2112/2124 and 3 month trend line and the 200 day moving average at 2145/55 for a 100 tick profit. We wrote: This is the best chance of a high for the day.

A high for the day just 10 ticks above!! Spot on eh!!?? Shorts need stops above 2075. A break higher is a buy signal and probably the start of a bull markets that could last months.

Downside is expected to be limited in the short squeeze/bear trap. First support at 2100/2090 could see a low for the day for profit taking on any shorts. Further losses however meet a buying opportunity at 2060/50. Longs need stops below 2025.

WTI Crude December remains in a sideways trend. 1 month trend line support at 8860/30. Longs need stops below 8800. A break lower can target 8730/10 and 8670/50.

First resistance at 8910/40. Second resistance at 9020/40.