The DAX index has started the new trading week with considerable gains. Currently, the index is at 11,607, up 0.47% on the day. The sole event on the schedule is the German Bundesbank monthly report. On Tuesday, Germany releases PPI and eurozone consumer confidence.

Relations between the U.S and China are strained, with global markets nervous that the trade war between the world’s two largest economies could worsen. The U.S Treasury Department released its semi-annual report on foreign exchange rates, and there was some relief in the markets as the report did not name China as a currency manipulator. Still, the report said that the U.S was “deeply disappointed’ with that China refuses to disclose the extent of its foreign currency intervention. The Chinese yuan has slipped some 9 percent since April, and U.S officials are concerned that China has deliberately weakened the currency in order to counter U.S tariffs on Chinese goods, and will continue to monitor China’s currency practices.

Italy’s draft budget has become the latest crisis for the European Union. The budget boosts public spending and cuts taxes, would raise the country’s deficit, which breaches EU rules. The government has sent the budget for approval to the European Union. On Thursday, the European Commission told Italy that the budget was not acceptable, and demanded a reply by Monday. This could put Rome and Brussels on a collision course, and the sour mood has sent Italian bond prices higher. The yield on 10-year Italian bonds stands at 3.73%, some 3.33% over the equivalent German bonds, as the gap between the two continues to widen. Bond prices in Spain, Portugal and Greece have also increased, making investors nervous. Italy’s debt stands at an astounding 132% of GDP, and there is a real risk that the country’s financial woes could destabilize the entire eurozone.

Economic Calendar

Monday (October 22)

Tuesday (October 23)

- 2:00 German PPI. Estimate 0.3%

- 10:00 Eurozone Consumer Confidence. Estimate -3

*All release times are DST

*Key events are in bold

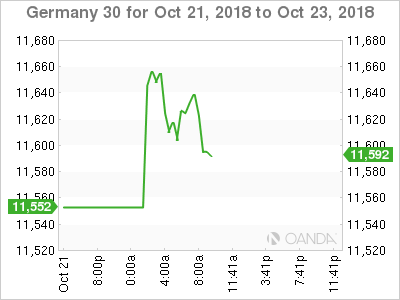

DAX, Monday, October 22 at 8:55 DST

Previous Close: 11,553 Open: 11,646 Low: 11,580 High: 11,676 Close: 11,607