EUR/USD Daily Outlook

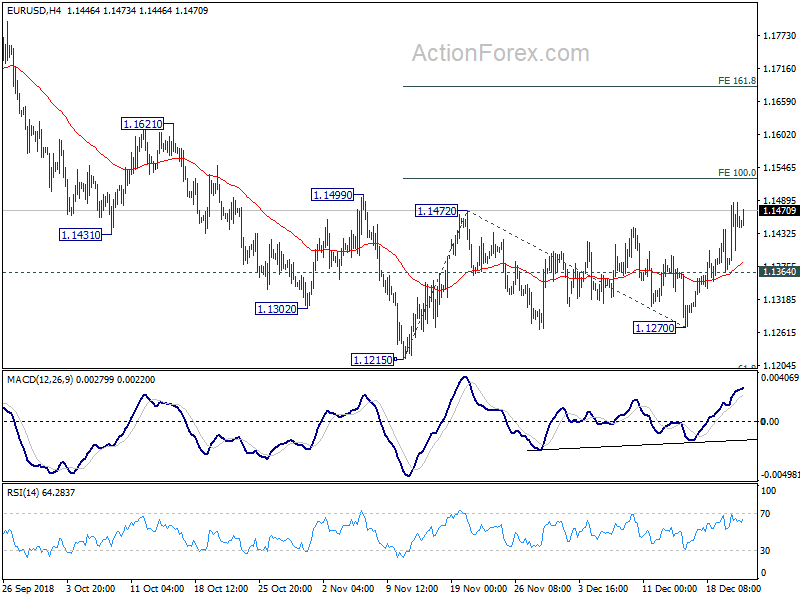

Daily Pivots: (S1) 1.1383; (P) 1.1434; (R1) 1.1498;

Intraday bias in EUR/USD remains on the upside. Current rise from 1.1215 would target 100% projection of 1.1215 to 1.1472 from 1.1270 at 1.1527 first. Break will target 161.8% projection at 1.1686 next. On the downside, however, break of 1.1364 minor support will suggest that the rebound is completed and turn bias back to the downside for 1.1215 low.

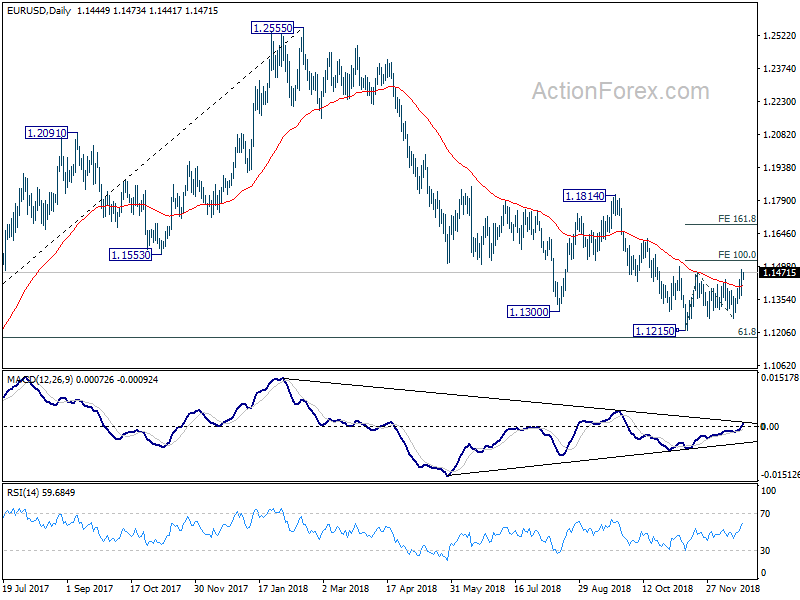

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

AUD/USD Daily Outlook

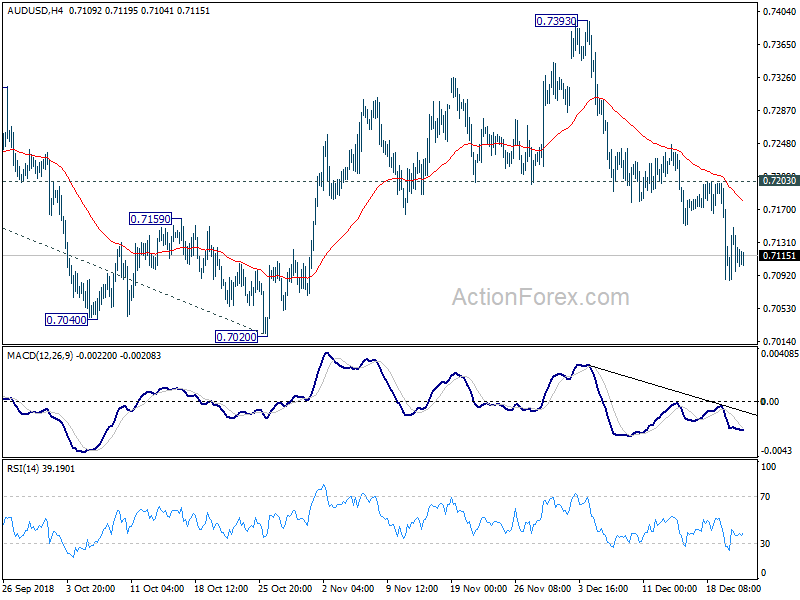

Daily Pivots: (S1) 0.7081; (P) 0.7115; (R1) 0.7144;

Intraday bias in AUD/USD remains on the downside. Fall from 0.7393 is in progress for retesting 0.7020 low. Decisive break there will resume larger decline from 0.8135 for 0.6826 key support. On the upside, break of 0.7203 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

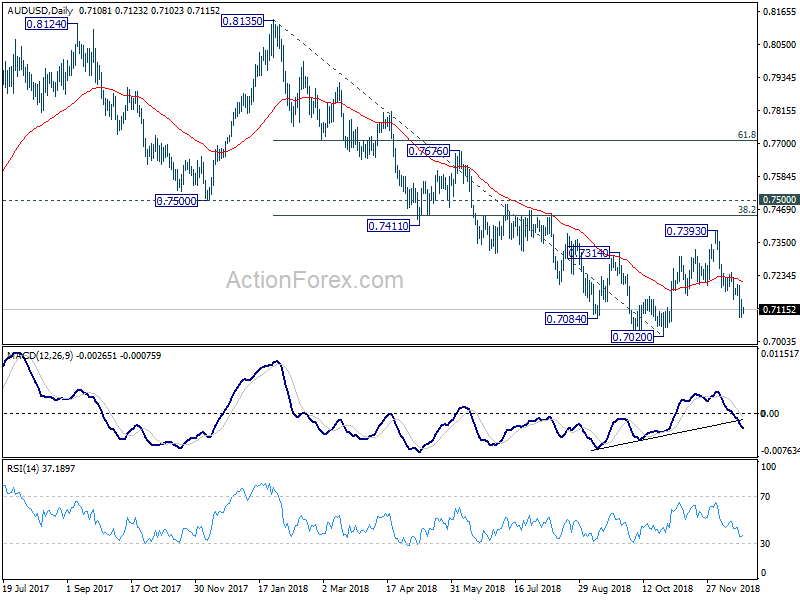

In the bigger picture, a medium term bottom is in place at 0.7020 ahead of 0.6826 key support (2016 low). Stronger rebound could still be seen to correct the whole fall from 0.8135 high. But we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should resume later and extend to take on 0.6826 low at a later stage, after the correction from 0.7020 completes.