The US dollar gave back a few pips in the Asian session on Thursday as traders booked profits. The greenback is trading at 81.48. The Federal Reserve late yesterday reaffirmed it was in no rush to raise interest rates, even as it upgraded its assessment of the U.S. economy and expressed some comfort that inflation was moving up toward its target. After a two-day meeting, Fed policymakers took note of both faster economic growth and a decline in the unemployment rate, but expressed concern about remaining slack in the labor market. Data separately showed that the U.S. economy rebounded sharply in the second quarter as consumers stepped up spending and businesses restocked. Gross domestic product expanded at a 4 percent annual rate after shrinking at a revised 2.1 percent pace in the first quarter.

Significant dollar demand from state run banks for oil and defense related payments capped sharp upside in the currency.

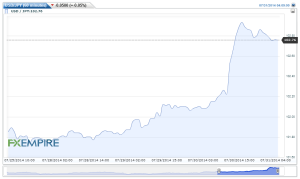

In the Asian session on Thursday the JPY is trading at 102.76 soaring well above its average trading range after the FOMC release. The Japanese yen traded on a negative note and depreciated around 0.66 percent yesterday on the back of upbeat market sentiments in early part of the trade which led to fall in demand for the low yielding currency. Unfavorable economic data from the country exerted further downside pressure on the currency. The yen touched an intra-day low of 103.08 and closed at 102.78 on Wednesday. Japan’s Average Cash Earnings was at 0.4 percent in June from 0.6 percent in May. Reports showed that wage growth in Japan remains non-existent, which will harm the goals of Abenomics, which needs salaries to increase so that inflation does not harm consumer sentiment and growth.

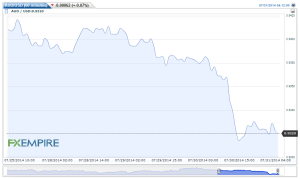

The Australian dollar eased by 11 points, weighed down by a sharp decline in building approval, while existing home prices continue to soar creating a housing bubble. The Australian Bureau of Statistics data showed the number of buildings approved fell a seasonally adjusted 5 per cent to 15,659 in the month. That compares with 16,425 approvals in May, seasonally adjusted. The AUD’s cousin the kiwi gained 11 points as traders adjusted yesterday decline as the currency is trading at 0.8502. Yesterday reports showed a large decline in dairy prices, New Zealand’s prime export, which weighed on the currency today traders are buying up the cheapened commodity currency.

The euro is trading flat this morning, just under the 1.34 price and is expected to continue its decent. The euro traded on a negative note and declined around 0.1 percent yesterday on the back of strength in the DX. Further, weak global market sentiments in later part of the trade exerted downside pressure in the currency. Favorable economic data from the region cushioned sharp fall in the currency. The euro touched an intra-day low of 1.3365 and closed at 1.3396 on Wednesday. Spanish Flash Consumer Price Index declined by 0.3 percent in July as against a rise of 0.1 percent in June. Spanish Flash Gross Domestic Product grew by 0.6 percent in June from 0.4 percent a month ago. The euro is expected to continue to ease today.