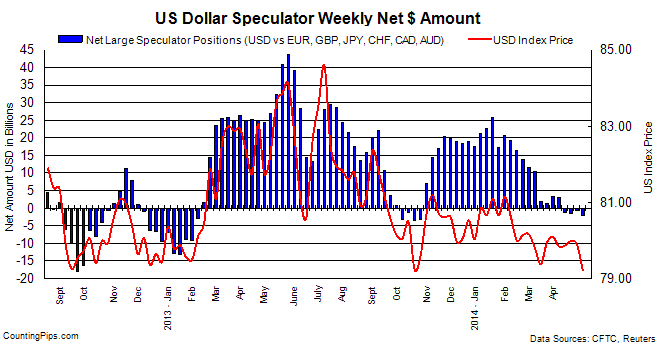

The latest data for the weekly Commitments of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and speculators added to their bearish bets of the US dollar last week and brought the overall USD position to the lowest level of the year.

Non-commercial large futures traders, including hedge funds and large International Monetary Market speculators, had an overall US dollar short position totaling -$2.03 billion as of Tuesday May 6th, according to the latest data from the CFTC and calculations by Reuters. This was a weekly change of -$1.344 billion from the -$0.686 billion total short position that was registered on April 29th, according to Reuters that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

The USD position has now been on the bearish side for the past four weeks after having crossed over into bearish territory on April 15th. The current level is the most bearish level in the dollar since October 29th 2013 when the bearish position equaled -$3.15 billion.

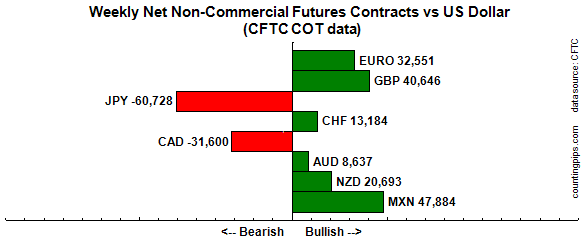

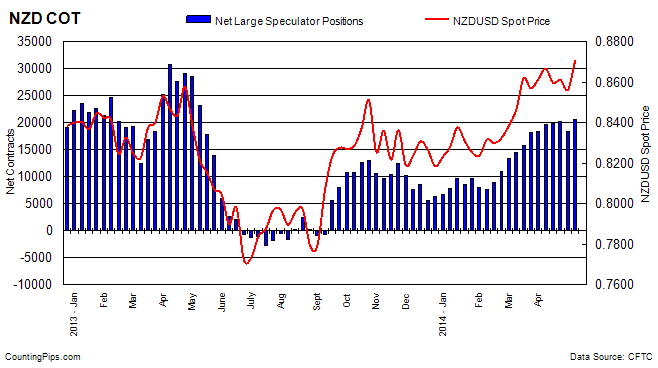

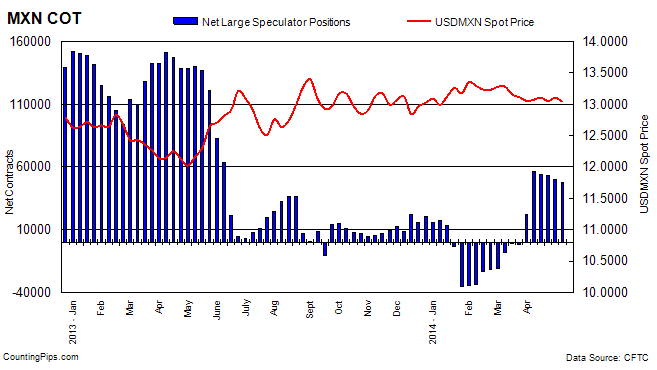

For the week, speculators increased their bets in favor the euro, Japanese yen and the New Zealand dollar while there were weekly declines for the Canadian dollar, British pound sterling, Swiss franc, Australian dollar and the Mexican peso.

Notable changes:

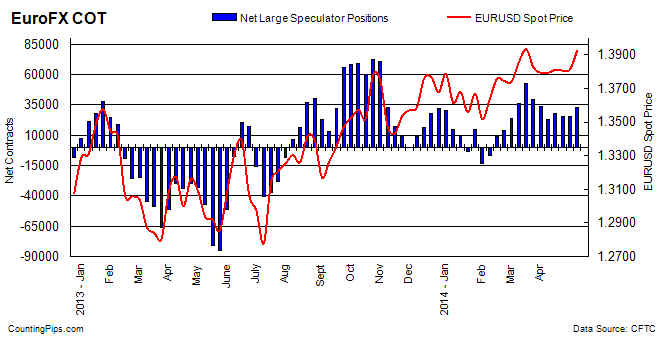

- The euro positions rose to the highest level since April 1st although the data was recorded before the ECB rate decision on Thursday – where the ECB hinted at possible easing policy in June

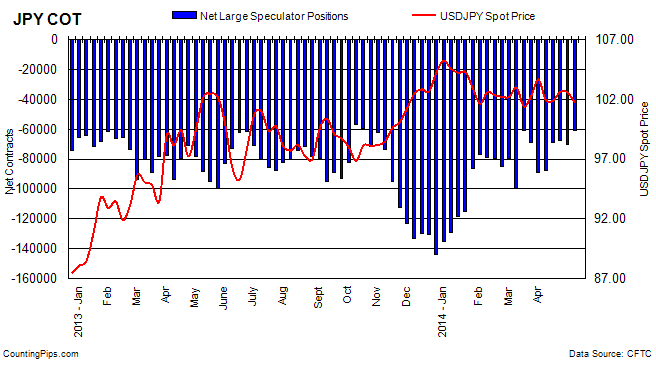

- Japanese Yen net positions fell to the lowest bearish level of 2014 (lowest level since October 15, 2013)

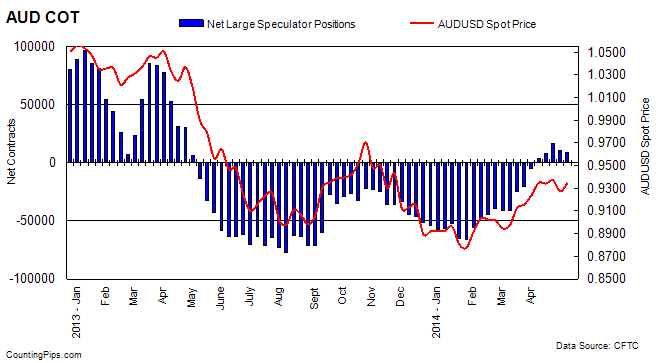

- Australian dollar net positions fell for a 2nd week following a streak of 7 straight weekly increases & remain on bullish side for 5th week

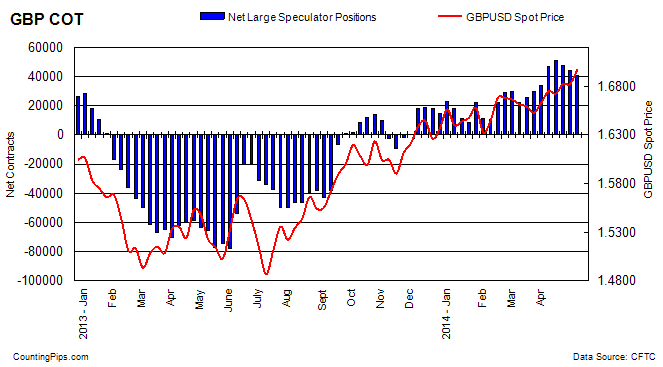

- British pound sterling positions declined for a 3rd week

* All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro. Please see charts and data below.

Weekly Charts: Large Speculators Weekly Positions vs Currency Spot Price

EuroFX:

Last Six Weeks data for EuroFX futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 260075 | 101849 | 68611 | 33238 | -6396 |

| 04/08/2014 | 261439 | 92635 | 69335 | 23300 | -9938 |

| 04/15/2014 | 270722 | 106252 | 78564 | 27688 | 4388 |

| 04/22/2014 | 266259 | 101204 | 75430 | 25774 | -1914 |

| 04/29/2014 | 271515 | 102285 | 76551 | 25734 | -40 |

| 05/06/2014 | 277013 | 110673 | 78122 | 32551 | 6817 |

British Pound Sterling:

Last Six Weeks data for Pound Sterling futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 211437 | 75969 | 42397 | 33572 | 3848 |

| 04/08/2014 | 226667 | 91642 | 45165 | 46477 | 12905 |

| 04/15/2014 | 226688 | 87472 | 36874 | 50598 | 4121 |

| 04/22/2014 | 237055 | 89692 | 41892 | 47800 | -2798 |

| 04/29/2014 | 236030 | 85913 | 41679 | 44234 | -3566 |

| 05/06/2014 | 241264 | 83794 | 43148 | 40646 | -3588 |

Japanese Yen:

Last Six Weeks data for Yen Futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 188464 | 22162 | 110800 | -88638 | -19751 |

| 04/08/2014 | 181814 | 13340 | 100802 | -87462 | 1176 |

| 04/15/2014 | 164843 | 14351 | 83067 | -68716 | 18746 |

| 04/22/2014 | 165674 | 16564 | 83807 | -67243 | 1473 |

| 04/29/2014 | 168820 | 13846 | 84198 | -70352 | -3109 |

| 05/06/2014 | 167093 | 20381 | 81109 | -60728 | 9624 |

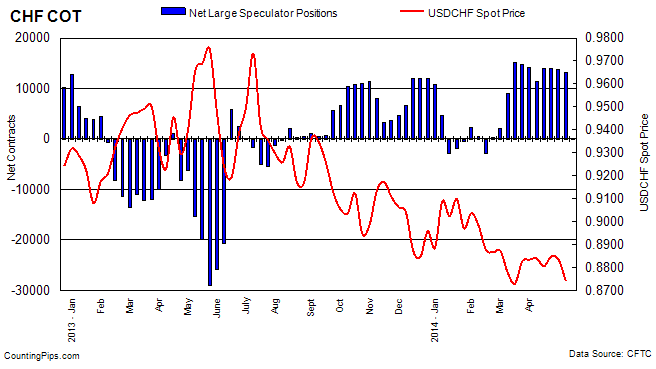

Swiss Franc:

Last Six Weeks data for Franc futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 47228 | 24800 | 10569 | 14231 | -588 |

| 04/08/2014 | 44752 | 19275 | 7940 | 11335 | -2896 |

| 04/15/2014 | 48976 | 23905 | 9839 | 14066 | 2731 |

| 04/22/2014 | 46888 | 21732 | 7709 | 14023 | -43 |

| 04/29/2014 | 47424 | 21960 | 8257 | 13703 | -320 |

| 05/06/2014 | 55538 | 25102 | 11918 | 13184 | -519 |

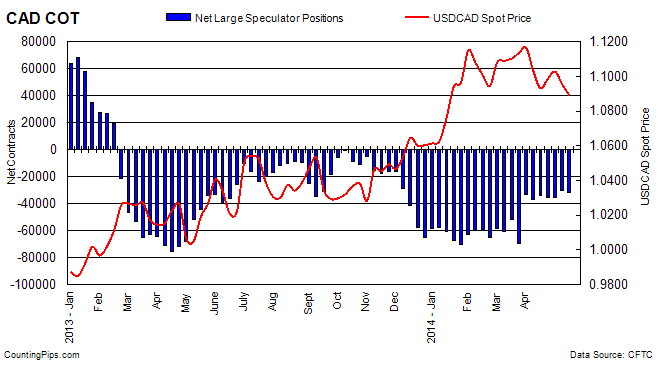

Canadian Dollar:

Last Six Weeks data for Canadian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 117966 | 27549 | 64543 | -36994 | -3779 |

| 04/08/2014 | 120336 | 28704 | 63011 | -34307 | 2687 |

| 04/15/2014 | 119525 | 28288 | 63714 | -35426 | -1119 |

| 04/22/2014 | 118707 | 27529 | 62984 | -35455 | -29 |

| 04/29/2014 | 123589 | 30093 | 60388 | -30295 | 5160 |

| 05/06/2014 | 122287 | 28044 | 59644 | -31600 | -1305 |

Australian Dollar:

Last Six Weeks data for Australian dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 93999 | 35398 | 40278 | -4880 | 15647 |

| 04/08/2014 | 96887 | 37630 | 34320 | 3310 | 8190 |

| 04/15/2014 | 98933 | 40463 | 32366 | 8097 | 4787 |

| 04/22/2014 | 107696 | 49540 | 33170 | 16370 | 8273 |

| 04/29/2014 | 109934 | 50019 | 39313 | 10706 | -5664 |

| 05/06/2014 | 104936 | 44805 | 36168 | 8637 | -2069 |

New Zealand Dollar:

Last Six Weeks data for New Zealand dollar futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 32313 | 25765 | 7285 | 18480 | 267 |

| 04/08/2014 | 32898 | 26521 | 6755 | 19766 | 1286 |

| 04/15/2014 | 33100 | 26671 | 6824 | 19847 | 81 |

| 04/22/2014 | 32579 | 26056 | 5881 | 20175 | 328 |

| 04/29/2014 | 29858 | 22979 | 4499 | 18480 | -1695 |

| 05/06/2014 | 33025 | 25027 | 4334 | 20693 | 2213 |

Mexican Peso:

Last Six Weeks data for Mexican Peso futures

| Date | Open Interest | Long Specs | Short Specs | Large Specs Net | Weekly Change |

| 04/01/2014 | 145270 | 49893 | 28109 | 21784 | 23438 |

| 04/08/2014 | 130331 | 70371 | 13870 | 56501 | 34717 |

| 04/15/2014 | 131412 | 71038 | 16801 | 54237 | -2264 |

| 04/22/2014 | 128932 | 68329 | 14818 | 53511 | -726 |

| 04/29/2014 | 128100 | 68073 | 18455 | 49618 | -3893 |

| 05/06/2014 | 146455 | 67663 | 19779 | 47884 | -1734 |

Disclaimer: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).