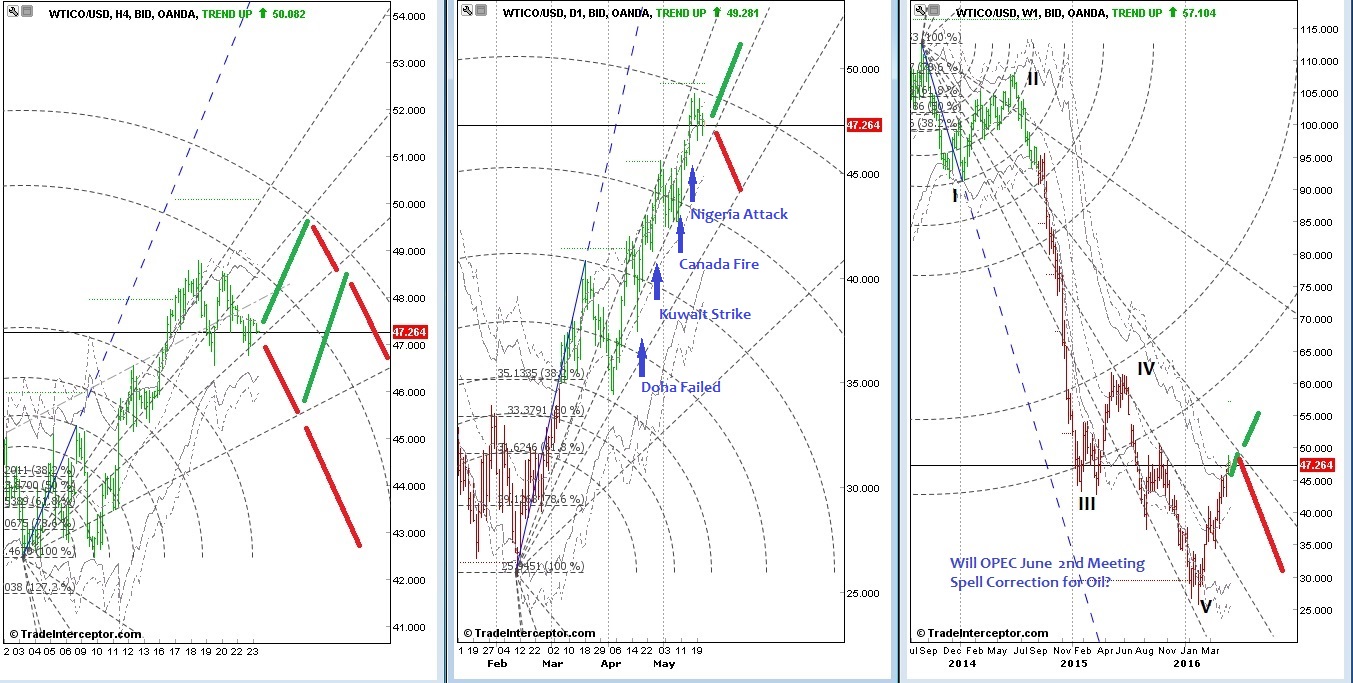

The Federal Open Market Committee (FOMC) released an unexpectedly hawkish minutes last week that fueled the recent dollar rally, though crude isn't behaving as we expected in our April 25th article. Instead, it keeps pushing close to $50/barrel, a level not seen since late October last year, as a series of supply disruption drama unfolds.

Crude made a turnaround from close to $25 a barrel in mid-February before turning up in early March after speculation was high that OPEC would freeze production in an effort to stabilize price. The Doha meeting failed however, and a day after the meeting, there was the Kuwaiti strike that disrupted close to 1/2 a million barrels a day of oil supplies for about a week.

Oil price was further sustained when the wildfire in Fort McMurray in oil-rich Alberta, Canada, broke after the Kuwaiti strike ended. An estimated 1.4 million barrels worth of supplies were disrupted, and oil companies are still clearing the areas before production can resume.

Most recently, there was the Nigerian attack on the largest oil terminal that belongs to EXXON.

The FOMC minutes last week drove price down for a session before bidders picked up again. There is no doubt that all these episodes helped buoy prices, but they are no indication that the rise was due to global economic growth.

Indeed, the IMF's 10-page Spring Global Policy Agenda was opened with the following statement:

"The global economy is expanding moderately but the outlook has weakened further since October, and risks have increased. The global economy has been impaired from growth that has been too slow for too long, and at this rate a sustained recovery—with the expected higher living standards, lower unemployment and declining debt levels—may not be delivered."

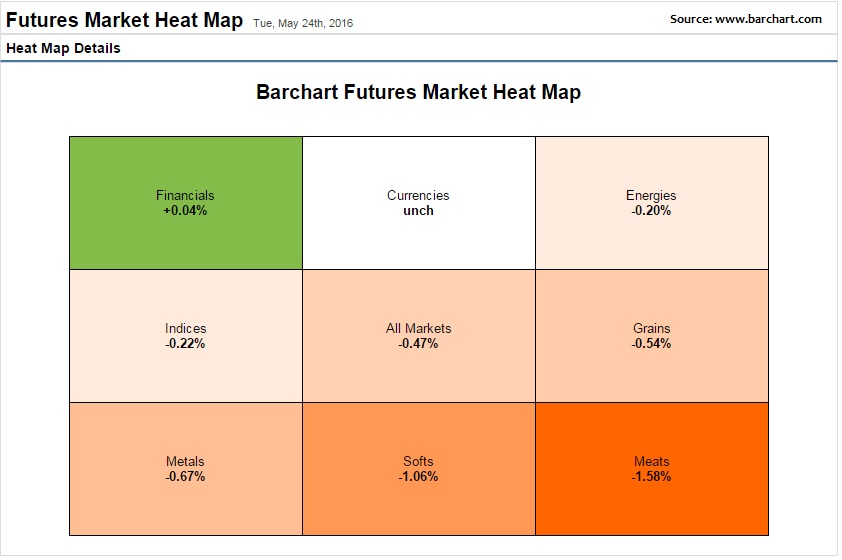

Sentiment from the futures market also shows that participants are more concerned about the global economic risk as they engaged in more bond buying for security. All markets are down -0.47%, with financials (bonds) leading the demand at around 0.05%.

Nevertheless, large speculators continued to increase their net longs by more than 26% (from 291,960 to 368,769 contracts as of last week's CoT report).

How high will oil fly? Looking at technicals, we still have room to push further up to around $50 - $55 sometime this year, though fundamental increases in supplies might cap the rise. The OPEC meeting this June 2nd might give a clue as to where oil is going next.