Talking Points:

- US Dollar Still Locked in Narrow Consolidation Range

- S&P 500 Trying to Build Upside Momentum Once Again

- Gold Treading Water, Crude Oil Attempting to Recover

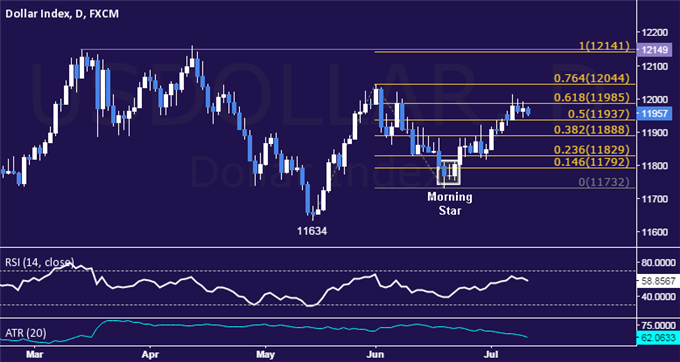

US DOLLAR TECHNICAL ANALYSIS – Prices advanced as expected after putting in a bullish Morning Star candlestick pattern. Near-term resistance is at 11985, the 61.8% Fibonacci expansion, with a break above that on a daily closing basis exposing the 76.4% level at 12044. Alternatively, a move below the 50% Fib at 11937 opens the door for a challenge of the 38.2% level at 11888.

S&P 500 TECHNICAL ANALYSIS – Prices are attempting to launch a recovery once again. A break above the 38.2% Fibonacci retracement at 2075.90 exposes the 50% level at 2086.20. Alternatively, a turn back below the 23.6% Fib at 2063.30 targets the 14.6% retracement at 2055.40.

GOLD TECHNICAL ANALYSIS – Prices are consolidating losses after accelerated downward to hit a four-month low. A daily close below the 76.4% Fibonacci expansion at 1152.47 exposes the 100% level at 1136.03. Alternatively, a move above the 61.8% Fib at 1170.86 targets the 50% expansion at 1170.86.

CRUDE OIL TECHNICAL ANALYSIS – Prices are attempting to recover after finding support above the $55/barrel figure. A daily close above the 14.6% Fibonacci expansion at 58.65 exposes the 60.85-61.37 area (23.6% level, April 22 low). Near-term support is at 55.08, the July 7 low.