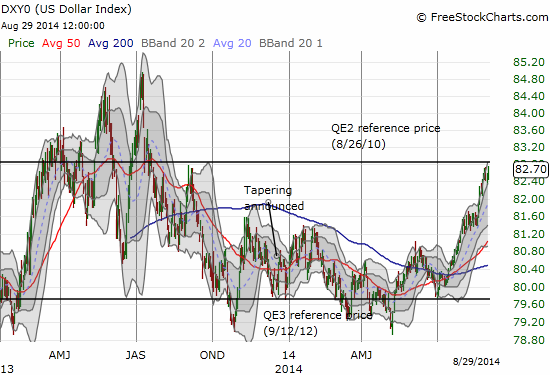

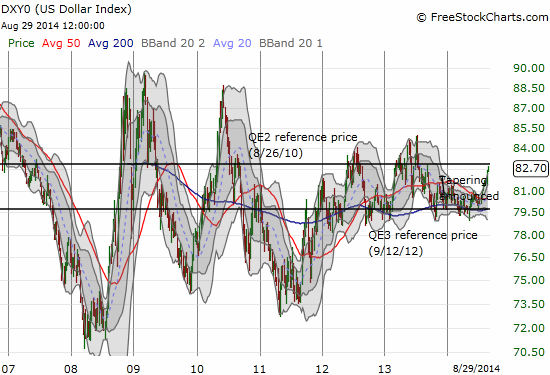

Ten days ago, I thought the U.S. dollar (PowerShares db USD Index Bullish (NYSE:UUP)) was over-extended and due for a correction. A cooling never happened. Instead, the dollar index continued climbing the upward trending channel between the first and second Bollinger Bands® (BBs). Now, the dollar index faces an even more critical test: the presumed ceiling of a trading range that has held firm since last summer. This cap is somewhat stylized as I created by the dollar index’s level when QE2 was pre-announced by Federal Reserve chairman Ben Bernanke on August 26, 2010 at Jackson Hole, Wyoming.

The QE2 reference price has served as a cap that the U.S. dollar index has failed to exceed for long

Source: FreeStockCharts.com

Even though the dollar index managed to break above the QE2 reference price several times, the rallies never lasted long. So, I still like to think of this level as a cap.

This critical test is all the more critical with the European Central Bank (ECB) on-deck for a monetary policy decision featuring pressure from France in the form of Prime Minister Manuel Valls demanding that the ECB do even MORE to get the euro lower. France is fighting against renewed recessionary pressures. Valls made a similar demand back in May ahead of the ECB taking additional extraordinary measures. Given the euro is slightly more than 50% of the dollar index, moves in the euro will most directly influence the dollar’s critical test.

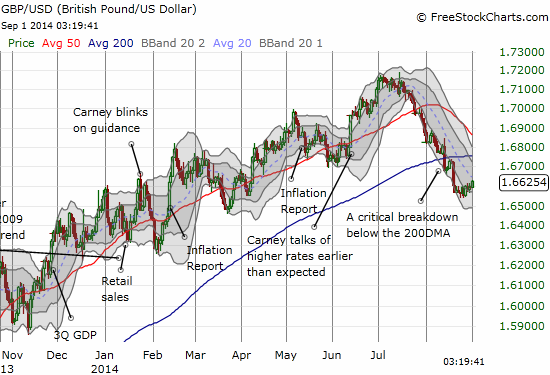

I am most interested in the possibility for the British pound to make a comeback against the U.S. dollar. It has been on a massive slide against the U.S. dollar for almost six weeks. This slide seems well over-done given the strong economic fundamentals in the UK that should not be impacted by the upcoming referendum in Scotland on independence. Note well though that GBP/USD faces major looming overhead resistance from a now declining 50-day moving average (DMA) and a 200DMA which is now flattening…

The British pound’s downward momentum against the U.S. dollar finally seems to be over – just in time for the dollar index’s test of its QE2 reference price

I am sure sometime in September I will be assessing whether or not GBP/USD can resume its previous uptrend.

Be careful out there!

Full disclosure: long and short the U.S. dollar versus various currencies, long GBP/USD