There was an interesting article out yesterday morning from Reuters stating:

"From the companies' point of view, it makes perfect sense these days to hoard cash. First, Congress lets overseas profits accumulate untaxed, so long as offshore subsidiaries own the cash. Second, companies have a hard time putting cash to work because fewer jobs and lower wages mean less demand for products and services. Third, a thick pile of cash gives risk-averse CEOs a nice cushion if the economy worsens.

Given the enduring hard times, you might think that corporations have used up their cash since 2009. But real pretax corporate profits have soared, from less than $1.5 trillion in 2009 to $1.9 trillion in 2010 and almost $2 trillion in 2011, data from the federal Bureau of Economic Analysis shows."

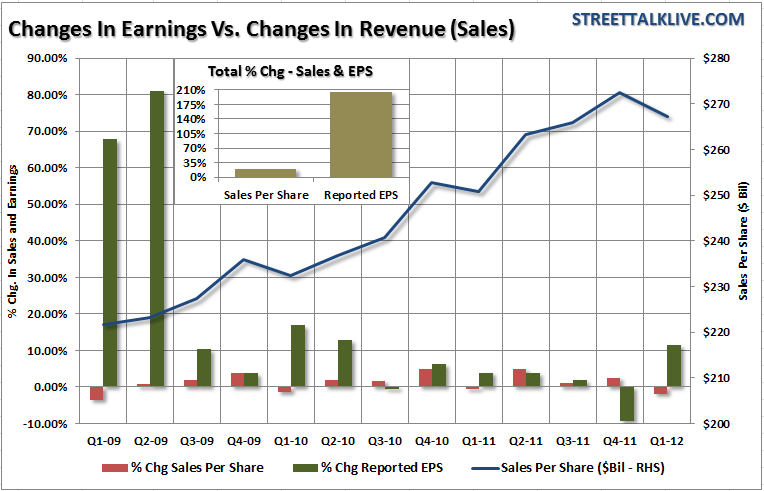

There is a very interesting, albeit disturbing, contradiction in the statement above. The initial assumption would be that if companies are having a hard time putting cash to work, because there is less demand for products and services, this would infer lower revenues. The chart shows the change in reporting earnings and sales (top line revenue) for the S&P 500. Since the beginning of 2009 the total growth in sales per share has been 21% as compared to a 206% increase in reported earnings. This confirms our assumption that lower revenues and demand is behind the historically high levels of corporate "cash hoarding." However, if revenue growth is weak then how are real pretax corporate profits soaring? The answer comes down cost controls and productivity.

The single biggest expense to any company is full-time employees due to payroll, taxes and benefits. While the economy has grown since the depths of the last recession - demand has remained weak in terms of sales growth. The lack of demand has kept businesses on the defensive with a focus on maximizing profitability of each dollar of revenue.

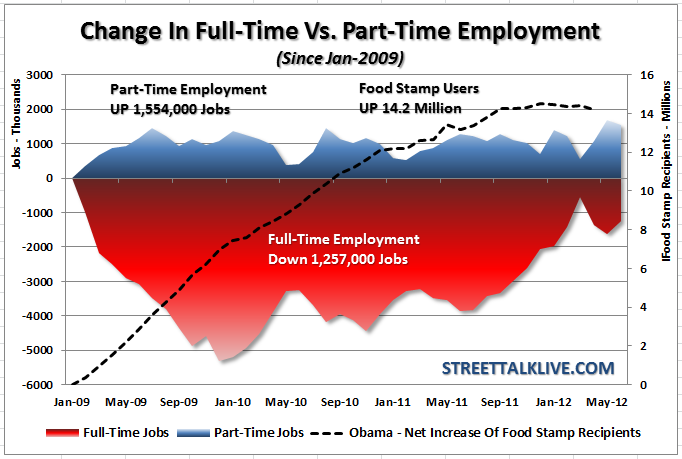

During the recession, and recovery, businesses have kept very tight controls on costs by reducing inventory levels, cutting budgets and maximizing productivity per employee. This has also led to massive changes in hiring and employment. Temporary hires (which have lower wages and no benefit costs) have substantially outpaced permanent employment since the end of the last recession. Since the first quarter of 2009 part-time employment has increased by more than 1.5 million while full-time employment is still lower by 1.25 million.

The analysts and media have been quick to jump to the idea that temporary jobs will ultimately turn into full-time employment. However, in an economy that is growing at a sub-par rate with a large and available labor pool - the use of temporary versus full-time employment may well be the "new normal". This also explains why dependence on "food stamps" have surged by over 14 million participants during the same period.

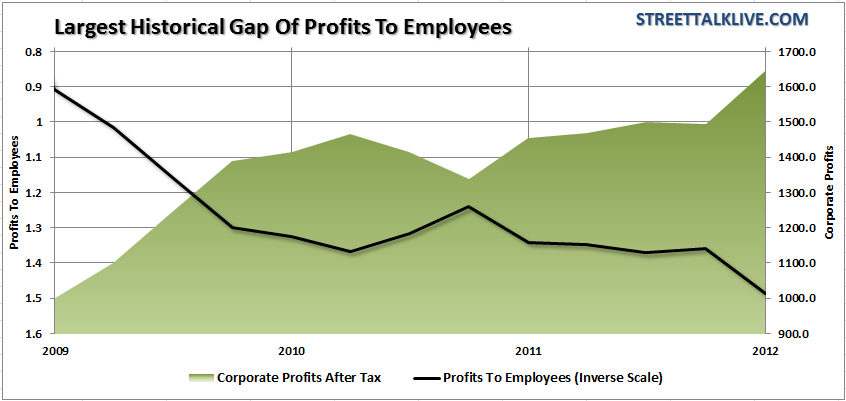

In order to see the impact more clearly we need only to look at the levels of corporate after-tax profits to employees. In 2009, coming out of the recession, the ratio of corporate profits to employees was 0.90. Today, that ratio has soared to 1.50. The reason for this is twofold. First, while employment has recovered, real unemployment still remains very high. In the most recent employment report while 84k new jobs were created - 85k people went on disability. Out of the 84k new jobs more than 1/3 were temporary with the bulk of the remainder in lower paying service related jobs. This is not the kind of employment picture that leads to long term increases in end demand.

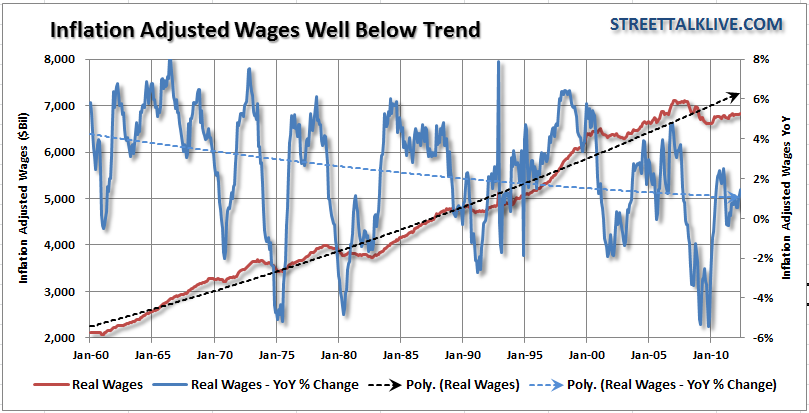

Furthermore, over the past decade the demand on businesses to increase profits, from shareholders and Wall Street, has driven productivity higher and wages lower. Real wages are well below the long term trend due to the large, and available, labor pool which keeps wages and salary levels suppressed. Lower wages are double edged sword for businesses. In the short run lower wages increase profitability. In the longer term, as wages fail to keep pace with inflation, consumers struggle to maintain their standard living which forces them to cut back on consumption eroding end demand on businesses. The cycle, which is deflationary in nature, is very difficult to break.

While it is enticing to want to force corporations to deploy the cash and create jobs - the unfortunate situation is that it is the very demands to maintain profitability that keeps them on the defensive. Secondarily, let's not forget that we live in a free market economy and businesses are in the "business" of making profits.

As Bernanke stated, in his recent testimony to Congress, it is imperative that Congress acts with fiscal policy changes that promotes real, organic, economic growth. Corporations will not increase hiring, and ultimately wages, until end demand substantially increases. Consumers can not increase demand until they have more money to spend. This "chicken and egg" syndrome is indicative of the problem that faces an economy trapped in a deflationary cycle. Fiscal policy that leads to productive investment, removes uncertainty about future regulatory and tax implications, and provides an environment that allows cash to be invested at profitable rates of return will ultimately break the blockade the economy currently faces. However, until then, businesses have no incentive to release their "cash hoards" as long as "poor sales", as shown in the recent NFIB report, remain their primary concern.

For investors, the continued increases in profitability, at the expense of wages, is very finite. It is revenue that matters in the long term - without subsequent increases at the top line; bottom line profitability is severely at risk. The stock market is not cheap, especially in an environment where interest rates are artificially suppressed and earnings are inflated due to "accounting magic." This increases the risk of a significant market correction particularly with a market driven by "hopes" of further central bank interventions. This reeks of a risky environment, which can remain irrational longer than expected, that will eventually revert when expectations and reality collide.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Corporate Profits Surge At The Expense Of Workers

Published 07/19/2012, 01:16 AM

Updated 02/15/2024, 03:10 AM

Corporate Profits Surge At The Expense Of Workers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.