Copper Non-Commercial Positions:

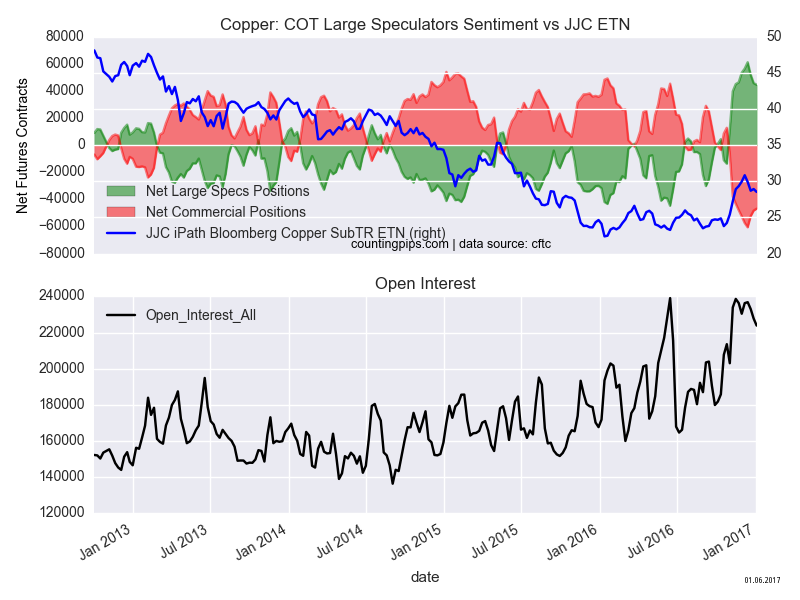

Large speculators and traders decreased their net positions in the copper futures markets last week for a third straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of copper futures, traded by large speculators and hedge funds, totaled a net position of 44,484 contracts in the data reported through January 3rd. This was a weekly change of -1,279 contracts from the previous week which had a total of 45,763 net contracts.

Copper speculative positions have now declined for three straight weeks following a remarkably strong run of seven consecutive weekly gains that brought speculative net positions to +61,115 contracts.

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -46,943 contracts last week. This is a weekly change of 1,439 contracts from the total net of -48,382 contracts reported the previous week.

Copper ETN:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the iPath Bloomberg Copper Subindex Total Return Exp 22 Oct 2037 (NYSE:JJC), which tracks the price of copper, closed at approximately $28.52 which was a decrease of $-0.40 from the previous close of $28.92, according to market data from Yahoo Finance.