Copper, along with several of the other principal base metals fell sharply this week as a resurgent US dollar drove many commodities lower, with both gold and silver also selling off strongly. For the base metals market it was nickel, which saw the most dramatic price moves, falling over 5.5% with copper and zinc both falling over 2 %, with tin one of the few commodities closing higher.

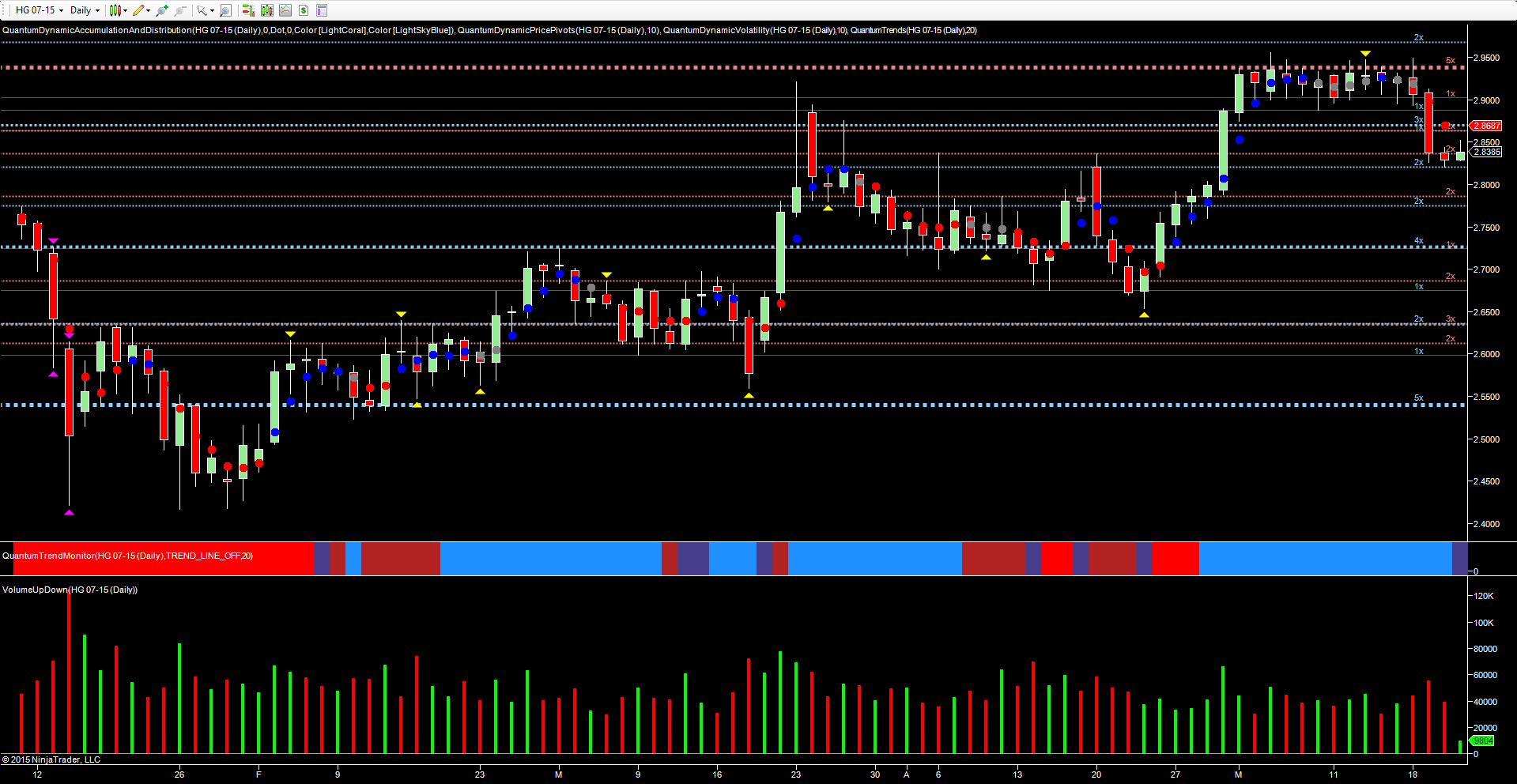

For copper, and indeed the other metals, the weakness this week was no great surprise given the technical picture of the last 2 weeks, with the metal trading in a tight range, and failing to break through the well defined ceiling of resistance in the 2.94000 per lb region. This is a level that has seen strong distribution in the past and is denoted with the red dotted line. It is also a region that has been repeatedly tested since early May. The most recent was on Monday, with the daily candle closing with a deep wick to the top and on rising volume, suggesting further selling at this level. This was duly confirmed on Tuesday with the commodity falling sharply as the US dollar soared higher, and closing below the potential platform of support in the 2.8687 per lb area, defined with the blue dotted line on the accumulation and distribution indicator. Yesterday’s price action found some support in the 2.8205 area, but is trading in a narrow range on Globex at time of writing, with this morning’s price action struggling to move higher and looking weak.

For copper, and indeed other base metals, much will now depend on two primary factors, namely China and the US dollar. The recent weak manufacturing data from China has suggested a slowdown in the world’s second largest economy thereby adding further pressure on Bejing for additional stimulus to maintain growth, whilst for the US dollar it will be the tone of Friday’s speech from FED chair Janet Yellen which may well set the trend for next week.

Yesterday’s FOMC minutes suggested that a rate rise in June is now off the table, and with the earliest now likely in Q4, if not into 2016, it will be interesting to note the extent of any pullback from the hawkish tone of earlier in the year. The caveat to this view is the extent to which the FED does not wish to lose face, having prepared the market since the middle of last year for an interest rise sooner rather than later, and may simply go ahead will despite the recent run of poor data. One method may be to revise the data until it is bent into to shape to support a rise.

Returning to the US dollar, from a technical standpoint the US dollar is now retesting deep levels of resistance on the daily chart in the 95 to 95.50 region and for any continuation of the bullish sentiment of the last few days, this level will need to be breached.