- Signs of de-escalation in the Ukraine crisis spark relief rally

- Stock markets and euro storm back, gold and oil prices retreat

- Fed minutes and US retail sales eyed - is the dollar rally exhausted?

Risk appetite comes back

A sense of optimism has returned to global markets following reports that Russia has withdrawn some forces from the border with Ukraine. Equity markets came back swinging as traders priced out geopolitical risk and loaded up on riskier assets again, betting that the peak of the storm had passed.

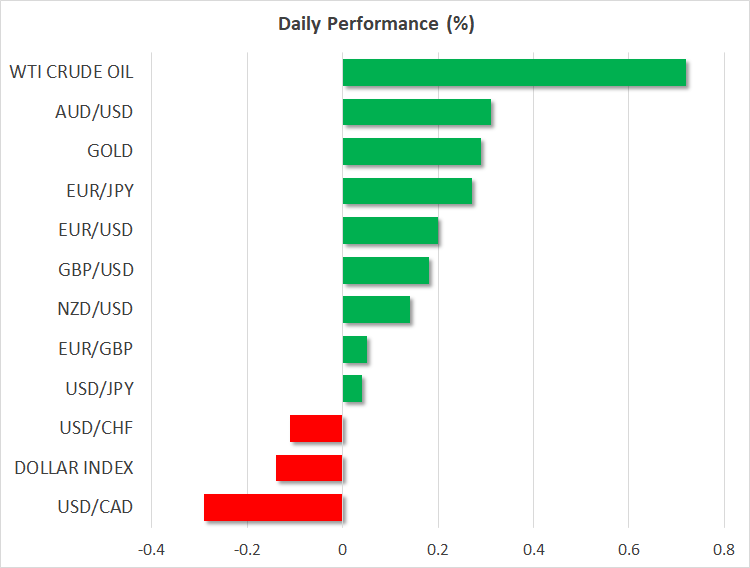

In the FX space, the signs of de-escalation translated into a stronger euro amid hopes that Europe won’t be forced to impose sanctions on Russia and cut off its own energy supply in the process. The euro advanced the most against the defensive Japanese yen, which suffered a double whammy as safe haven demand faded and global bond yields edged higher.

The situation remains fluid and sentiment can turn on a dime, but for now, financial markets are trading like we are out of the danger zone. Judging by the size of the relief rally, some geopolitical premium is still baked into riskier assets, which suggests there’s scope for the recovery to continue in case the wind continues to blow in the direction of peace.

Commodities cool off

In the commodity sphere, gold prices came off the boil as the perceived risk of an invasion declined. Real Treasury yields have started to grind back higher, reducing the appeal of non-interest-bearing assets like bullion. This is where the real battle begins for gold.

The precious metal absorbed the spike in real yields without even a scratch in recent weeks amid rising demand for portfolio protection, but now that geopolitical fears are starting to subside, we’ll find out what the fallout from tighter monetary policy is. If bullion can slice above the $1880 region in this environment, it would be a strong sign that the path of least resistance is higher.

Crude oil prices came under pressure too after Putin said some troops were being withdrawn. There were also some encouraging signs in the Iran talks after the EU’s foreign policy chief said that “we are in the last steps of the negotiation”. The supply side of the equation is therefore looking more bearish as US shale producers are also ramping up production.

That said, markets are very hungry for oil right now. Futures contracts are still in extreme backwardation, a pattern that indicates traders are willing to pay more for near-term supply. As such, some modest increase in production might not break the uptrend entirely, but rather slow it down.

US events coming up

The US dollar will be in the spotlight today when the latest retail sales numbers and the minutes of the most recent Fed meeting hit the markets. Traders are betting the Fed will take a sledgehammer to crush inflation with six and a half rate increases already priced in for the year, so every release is crucial.

The worrisome part is that the dollar hasn’t been able to capitalize properly on positive data surprises recently. Take last week’s inflation numbers. One extra rate hike was priced into bond markets in the aftermath but the dollar barely rose, until fears of armed conflict in Ukraine sent investors into the reserve currency’s safety.

When a currency cannot rally on good news, that’s usually a sign of exhaustion in the trend. Hence, today’s releases will be especially important. If retail sales exceed expectations for instance and the dollar cannot stage a lasting rally in response, it would be another sign that the uptrend is losing power.

Finally, the earnings season will enter the final stretch with Nvidia (NASDAQ:NVDA), Applied Materials (NASDAQ:AMAT), Rio Tinto (NYSE:RIO), Shopify (NYSE:SHOP), and many others releasing their quarterly results today.