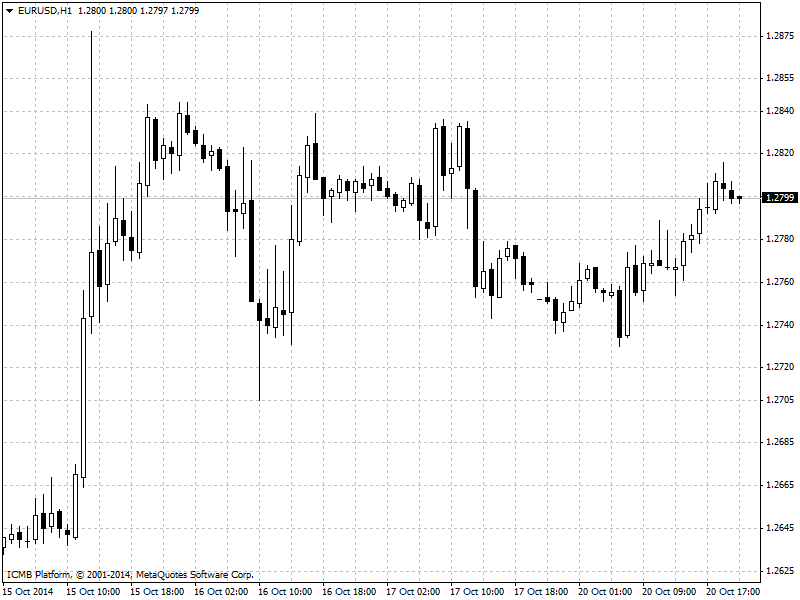

The euro edged higher against the dollar and the yen in quiet trade on Monday, as financial markets remained calm after last week’s selloff. Data on Friday showed that U.S. consumer sentiment rose to the highest level since July 2007 this month and another report showed that U.S. housing starts rose more than expected in September. Meanwhile, concerns over the stagnating euro zone economy continued to weigh on the single currency. Annual inflation in the euro zone was just 0.3% in September, well below the European Central Bank’s target of close to but just under 2%. In recent months the ECB has cut interest rates to record lows, extended new four-year loans to banks and announced a plan to purchase asset-backed securities, a form of quantitative easing, in a bid to spur growth in the euro area.

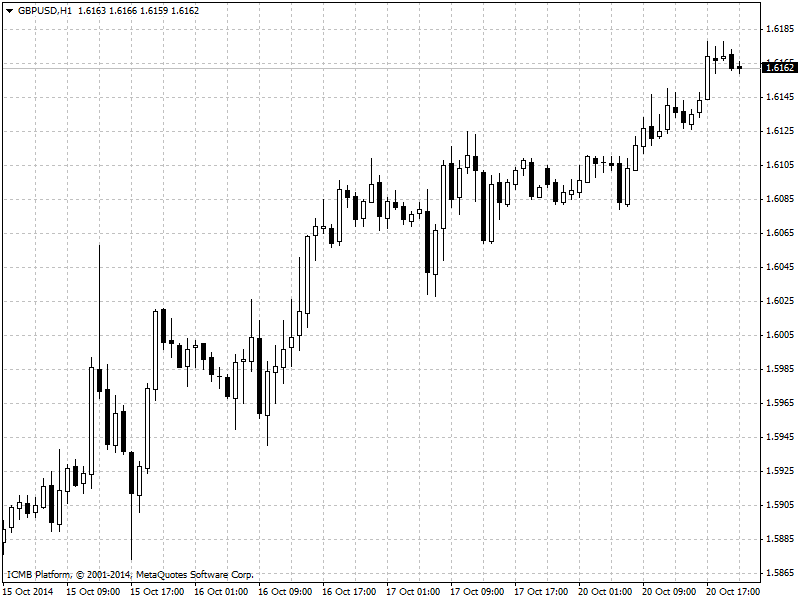

The pound pushed higher against the dollar in quiet trade on Monday, as calm returned to financial markets after concerns over slowing global growth and soft U.K. inflation data triggered volatility last week. The data reinforced expectations that the Federal Reserve will raise interest rates in the second half of 2015 and calmed investor jitters at the end of a volatile week of trading. Sterling slumped to 11-month lows against the dollar mid-week after data showed that the annual rate of U.K. inflation slowed to 1.2% in September, down from 1.5% in August. The data eased pressure on the Bank of England to raise interest rates from a record low 0.5%. On Friday, BoE Chief Economist Andy Haldane said the bank could afford to keep rates lower for longer and indicated that rates may only start to rise in the middle of next year, given the more subdued growth outlook.

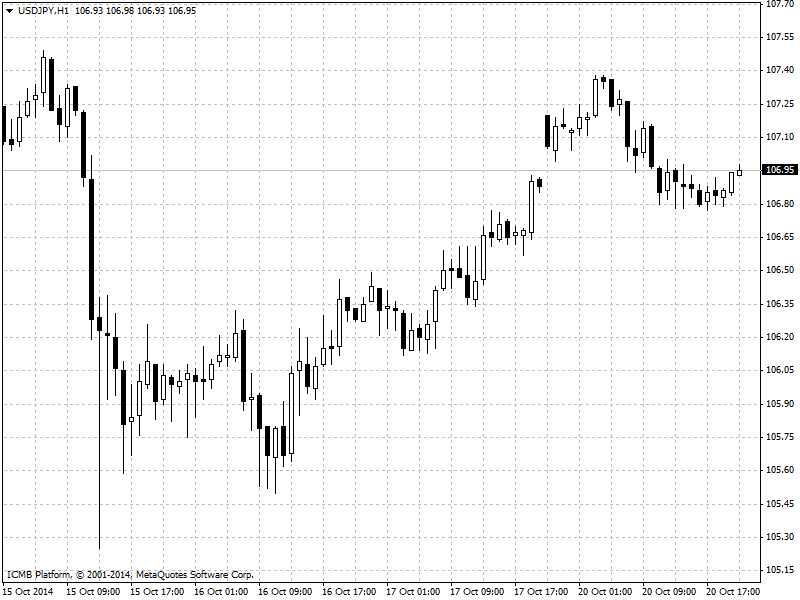

The dollar slid against the yen on Monday though it came off earlier lows as the Japanese currency enjoyed safe-haven demand on concerns a cooling global economy may water down U.S. recovery. The dollar has strengthened against the yen and most of its counterparts in recent weeks on expectations that U.S. monetary policy will grow less accommodative while European and Asian central banks move in the opposite direction. Profit taking sent the greenback into negative territory against the yen, a safe-haven currency amid times of uncertainty, amid concerns that even though the U.S. economy is improving, a slowdown in Europe and Asia could dampen recovery. Germany’s Bundesbank reported earlier the country’s economy barely grew in the third quarter, as industrial output slowed and business sentiment deteriorated.