Comerica (NYSE:CMA) reported third-quarter 2019 earnings per share of $1.96 that surpassed the Zacks Consensus Estimate of $1.91. Also, the bottom line was up from the prior-year quarter figure of $1.86.

Higher revenues on the back of non-interest income growth, and lower expenses were recorded. Moreover, rise in deposits was another tailwind. However, lower loans and rise in provisions were undermining factors. Also, contraction of margins posed a headwind.

Net income for the quarter totaled $292 million, down 8.2% year over year.

Furthermore, segment wise, on a year-over-year basis, net income decreased 6.1% at Business Bank. However, it increased 31% both for Retail Bank and Wealth Management unit. The Finance segment incurred net loss, similar to the prior-year quarter.

Revenues Improve, Expenses Fall

Comerica’s third-quarter net revenues were $842 million, up 1.1% year over year. Also, the figure surpassed the Zacks Consensus Estimate of $831.3 million.

Net interest income decreased 2.2% on a year-over-year basis to $586 million. In addition, net interest margin contracted 8 basis points (bps) to 3.52%.

Total non-interest income came in at $256 million, up 9.4% on a year-over-year basis. Higher card fees and commercial lending fees were mostly offset by decrease in mainly service charges on deposit accounts and other non-interest income.

Further, non-interest expenses totaled $435 million, down 3.8%. The decline resulted from lower salaries and benefits expense, restructuring expenses, software expense and FDIC insurance expenses.

Efficiency ratio was 51.54% compared with 52.93% in the prior-year quarter. A fall in ratio indicates a rise in profitability.

Solid Balance Sheet

As of Sep 30, 2019, total assets and common shareholders' equity were $72.8 billion and $7.2 billion, respectively, compared with $72.5 billion and $7.3 billion as of Jun 30, 2019.

Total loans were down slightly on a sequential basis to $51.5 billion. However, total deposits increased 2.3% from the prior quarter to $56.8 billion.

Credit Quality: A Mixed Bag

Total non-performing assets fell 4.6% year over year to $229 million. Also, allowance for credit losses was $681 million, down 2.3%. Additionally, allowance for loan losses to total loans ratio was 1.27% as of Sep 30, 2019, down from 1.35% as of Sep 30, 2018.

However, net loan charge-offs came in at $42 million, up significantly from the year-ago quarter. In addition, provision for credit losses was $35 million against nil provisions in the prior-year quarter.

Strong Capital Position

As of Sep 30, 2019, the company's tangible common equity ratio was 9.09% compared with 10.09% in prior-year quarter. Common equity Tier 1 capital ratio was 9.92%, down from 11.68%. Total risk-based capital ratio was 11.91%, down from 13.76%.

Capital Deployment Update

Comerica’s capital deployment initiatives highlight its capital strength. During the third quarter, the company repurchased 5.7 million shares for a total cost of $370 million under its existing equity repurchase program. This, combined with dividends, resulted in a total payout of $467 million to shareholders.

Impressive Outlook for 2019

Comerica has guided for full-year 2019, taking into consideration the current economic and rate environment.

It expects average loans to be up 4%. However, deposits are likely to decline 1-2%.

The company anticipates net interest income to remain stable or decline 1%. The expectation includes a decline of 25 basis points (bps) in the federal funds rates in December 2019.

Non-interest income is estimated to be more than 2%.

Non-interest expenses are predicted to remain stable, excluding restructuring charges of $53 million incurred in 2018.

Provision for credit losses is likely to be 15-20 bps of total loans.

Our Viewpoint

Consistent loan growth and strong fee income base is likely to drive Comerica’s revenues to some extent. Also, prudent expense management will aid bottom-line expansion. Its robust capital position supports steady capital deployment activities through share repurchases and dividend hikes, which seem impressive.

However, higher provisions remain a concern. Also, contraction of margin on account of lower interest rates might continue to impede interest income growth.

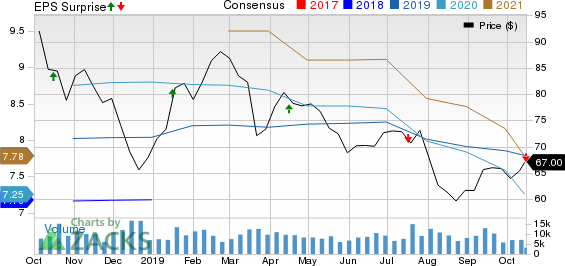

Comerica Incorporated Price, Consensus and EPS Surprise

Currently, Comerica carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Citigroup (NYSE:C) delivered a positive earnings surprise of 1% in third-quarter 2019, backed by improved investment banking performance. Adjusted earnings per share of $1.98 outpaced the Zacks Consensus Estimate of $1.96. Also, bottom line climbed 20% year over year.

First Republic Bank’s (NYSE:C) third-quarter 2019 earnings per share of $1.31 surpassed the Zacks Consensus Estimate of $1.21. Also, the bottom line jumped 10.1% from the year-ago quarter.

Wells Fargo’s (NYSE:WFC) third-quarter 2019 earnings of 92 cents per share lagged the Zacks Consensus Estimate of $1.15 on lower net interest income. The figure also comes in lower than the prior-year quarter earnings of $1.13 per share.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >

Comerica Incorporated (CMA): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

First Republic Bank (FRC): Free Stock Analysis Report

Original post

Zacks Investment Research