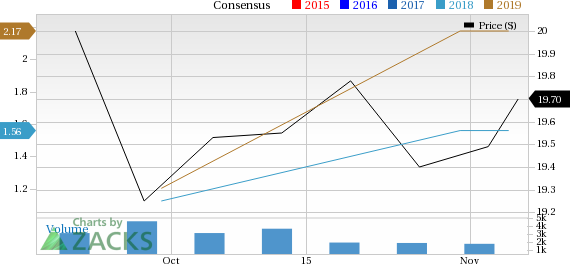

Clearway Energy (NYSE:CWEN) delivered third-quarter 2018 earnings of 20 cents per share, missing the Zacks Consensus Estimate of 53 cents by 62.3% and also decreasing from the year-ago figure of 27 cents.

Total Revenues

In the reported quarter, Clearway Energy’s revenues came in at $292 million, which lagged the Zacks Consensus Estimate of $295 million by 1%. However, the top line was up 8.6% year over year. This improved performance was primarily boosted by growth in the renewable business.

Highlights of the release

The company's total operating expenses in the third quarter were $192 million compared with $185 million in the year-ago quarter.

Interest expenses came in at $74 million, in line with the year-ago level.

Net income in the reported quarter was $49 million compared with $31 million in the year-ago period.

Clearway Energy is poised to benefit from acquisitions and strategic partnership to expand its operations.

The company’s management approved a 3.4% increase in the quarterly dividend rate, resulting in 15% year-over-year dividend per share growth in 2018.

Segment Details

Conventional segment contributed $39 million compared with $36 million in the year-ago quarter.

Renewables segment contributed $55 million compared with $18 million in the prior-year quarter.

Thermal segment contributed $10 million, in line with the year-ago quarter.

Corporate segment reported a loss of $55 million, higher than the year-ago figure of $33 million.

Financial Condition

Clearway Energy had cash and cash equivalents of $232 million as of Sep 30, 2018, up from $148 million on Dec 31, 2017.

Long-term debt as of the same date was $4,928 million, reflecting a decline from $5,659 million on Dec 31, 2017.

The company's net cash flow from operating activities during the first nine months of 2018 was $396 million compared with $373 million recorded in the prior-year period.

Guidance

Clearway Energy reiterated its full-year Adjusted EBITDA guidance of $985 million and Cash Available for Distribution at $285 million. For 2019, the company issued Cash Available for Distribution guidance of $295 million.

Zacks Rank

Clearway Energy currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here .

Upcoming Releases

CenterPoint Energy, Inc. (NYSE:CNP) will report third-quarter 2018 results on Nov 8. The Zacks Consensus Estimate for the to-be-reported quarter is pegged at 41 cents per share.

Chaparral Energy Inc. (NYSE:CHAP) is scheduled to report third-quarter 2018 results on Nov 13. The Zacks Consensus Estimate for the quarter to be reported is pegged at 7 cents per share.

North Oil & Gas, Inc. (NYSE:NOG) will report third-quarter 2018 results on Nov 8. The Zacks Consensus Estimate for the quarter is pegged at 12 cents per share.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG): Free Stock Analysis Report

NRG Yield, Inc. (CWEN): Free Stock Analysis Report

Chaparral Energy, Inc. (CHAP): Free Stock Analysis Report

Original post

Zacks Investment Research