In earlier postings, I have examined global power from both “empire” and “fragmentation” perspectives. Empire implies concentrated power, usually for economic gain – not just for the acquisition of power per se.

In my “empire” posting, I speculated that in the 21st Century, China would replace the US as the global power. In 1989, the world had just witnessed an intense country-to-country confrontation – during the Cold War, the question was whether the US or the Soviet Union would destroy the world with hydrogen bombs. It was a definite “empire” focus.

But even as we watched the US-USSR “empire” confrontation, things were happening to reduce the power of nation-states. Three new players had come on the scene:

- International organizations, most of which had been created by the US at the end of WWII; but with the ending of U.S. dominance, these entities took on lives of their own;

- Multinational corporations which were shedding their national identities and becoming global;

- Special interest/cause groups which have been with us at least since the beginning of recorded time; they re-emerged with the name “non-governmental organizations” (NGOs).

By 1989, nation-states had not disappeared but they had to share power: they had to compete and collaborate with the three new players[1]. So in my “fragmentation” piece, I suggested that global power in the future will not be controlled by nations but by some form of organized groupings that might include multinationals, NGOs, international organizations, and nation-states. A good example of a “fragmented power” group is Germany, working with the IMF, to force austerity measures on Greece and other Eurozone countries. But I have rethought my position, and several things stand out:

- Nation-states remain very important, and

- It is not clear that China will ever become the “#1” superpower.

Americans might say that the greatest threat to world peace is not a nation but an NGO – Al Qaeda. But where did Al Qaeda come from? It came from hatred in the Middle East resulting from US support for Israel in its aggressive acts throughout the region. In short, it resulted from an interaction among nations. Consider two other NGOs: Hamas and Hezbollah. However, they would have little power if not aligned with and supported by nations. And finally, consider what has been happening in Syria and what is holding up a resolution. The vast majority of nations want Assad removed, but Russia is blocking it.

Questions About China’s Future

China is a resource poor country. Iron ore is good example. Unlike the US that makes all the new steel it needs from scrap, China needs to import iron ore to make steel. Energy is a special problem for China. I quote from a recent paper: “53% of China’s oil is imported. Coal is its primary energy source. China consumes more coal than any country in the world. And there is another problem: China is running out of coal. China only has 35 years of coal left at current production rates. In contrast, the US has 270 years left. The Chinese authorities are very aware of their coal predicament and are doing all they can to find new energy sources and cut down on coal consumption. But it will be a slow process. In the meantime, US exports of coal to China are growing.

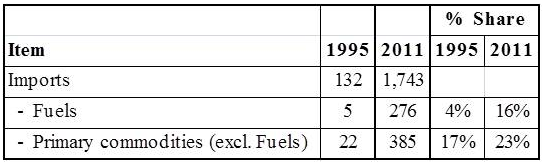

Table 1 shows how Chinese energy and primary commodity imports have grown since 1995. Fuel imports are up 13 times to 16% of total imports. Commodities have increased 17 times to 23% of total imports. And remember that China’s middle class is growing rapidly and will want more energy and other import intensive consumer goods.

Table 1. – China, Import Growth. 1995-2011 (bil. US$)

Consider the case of motor vehicles, a product that the Chinese middle class will want. In the US, there are 802 motor vehicles per thousand people. It is interesting to ask what will happen to oil consumption when there are 400 motor vehicles per thousand people in China. That would mean more than an eightfold increase in Chinese vehicles. Assume they drive the same distances as the current vehicles and are powered by and get the same miles-per-gallon as the current vehicles. This would cause Chinese auto fuel demands to increase by almost 9 times. That growth would increase global oil demand by 77% over its current production level. This will not happen. Something has to give.

Japan

You might say all of this is preposterous. You say China is “on track” to be the next great superpower. Consider Japan. Japan used its Marshal Plan aid very effectively. So by the late 1960’s, Japan had made tremendous economic strides. In fact, many predicted it would be the next great superpower. Herman Kahn, the founder of the Hudson Institute predicted in 1971 that Japan’s GDP could become the largest in the world by 2000. It did not work out that way. Japan’s GDP never came close; in 2011, the US GDP was three times the GDP of Japan. So when it comes to China, might the soothsayers be wrong again?

If Not China?

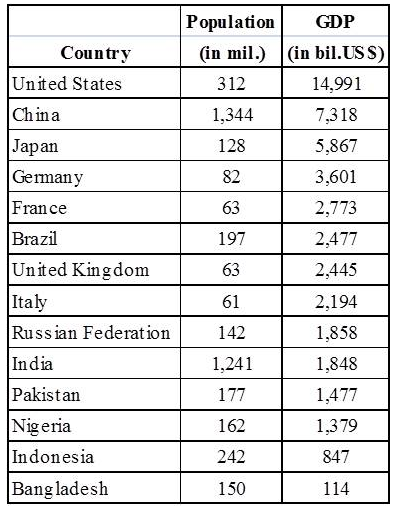

It is worth considering other candidates as the next great superpower. Table 2 lists the largest countries in the world, measured either by population or GDP.

Table 2. – Largest 10 Countries, By Population or GDP

Japan, for reasons no one has explained adequately, has not grown for decades. As I have noted, all countries have corruption. But India is a democracy with the form of corruption that means nothing can get done. Germany, France, and Italy are locked in the Eurozone and the Eurozone problems have not been resolved. The UK had its empire and is too small to repeat. Brazil is a great country with tremendous natural resources, and the same can be said for Indonesia. They should be watched. Pakistan and Nigeria have serious internal problems, and Bangladesh is only on the list because of its population size. Russia has a well-educated populace with great natural resources. But it is limited having gone straight from Tsardom into central planning with no free market experience. It is notable the US GDP is twice that of China, the second largest country.

How About Regions?

It is also worth examining this question by region: what regions are likely to be the dominant economic power in future years. Perhaps the most meaningful regions to consider are Emerging Asian (Asia without Australia and Japan), the European Union., and the Western Hemisphere.

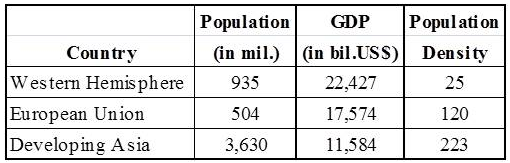

Data on these countries appear in Table 3.

Table 3. – Regional GDPs, Populations, and Densities

Perhaps the most telling statistics in Table 3 are the low population densities in the Western Hemisphere. This region also has remarkable farmlands, abundant natural resources, and the best system for commercializing new technologies in the world. It is hard to bet against the Western Hemisphere.

However, there will be some desperate times as the resource poor countries of Asia become aggressive in their search for needed resources. But I quote from an earlier piece: “…the Chinese defense budget is 2% of its GDP, or $146 billion. The US defense budget is 4.7% of US GDP, or $705 billion. And yes, the US has been waging two wars and China’s GDP is growing more rapidly than the US. But given the differences in the size of the two budgets, US military superiority should continue for some time.”

Conclusions and Investment Implications

China, with 1.3 million hard working people, is already a major power. But as I have pointed out, its period of amazing export growth is coming to an end as its labor costs rise and labor becomes a smaller share of product costs. Increasingly, China will have to draw down its reserves to buy energy, food, and other natural resources to satisfy its growing middle class.

The collapse of US banks pitched the entire world into a global recession. But the US recovery now has momentum, even real estate. And the competitive position of the US is improving inasmuch as the global recession accelerated the downturn in US labor costs.

It is a good time to invest in the US and its Latin American neighbors. How? Buy a broad-based US ETF like SPDR S&P 500 ETF Trust (SPY) and the same for Latin America like

SPDR S&P Emerging Latin America ETF (GML). Give them both a couple of years.