BRICS countries are large economies with large reserves of gold and an impressive volume of production and consumption of this precious metal. In China, the gold trade is conducted in Shanghai, in Russia it is in Moscow. Our idea is to create a link between the two cities in order to increase trade between the two markets,” First Deputy Governor of the Russian Central Bank Sergey Shvetsov told TASS – RT.com, April 19

The article in RT.com from which the above quote is sourced surprisingly did not receive a lot of attention from the alternative media. Perhaps it was overshadowed by the highly anticipated move by China to commence fixing the price of gold on the Shanghai Gold Exchange in yuan. I suggested that we would not see an immediate impact on the price of gold, which we have not, but that the move was part of a larger plan by China to “de-dollarize” the world.

Also largely ignored by the alternative media was the fact that Russia added another 500,000 ounces of gold to its Central Bank reserves – data provided by Smaulgld.com. To put this into some context, currently the Comex, which is sporting over 50 million ounces of paper gold open interest, is reporting 643k ounces of gold designated as available for delivery (“registered”). In 2015, Russia added a record amount of gold tonnage to its Central Bank stash.

I would argue, as would many, that China and Russia are strategically and methodically weaning the world off paper gold and fiat currencies and are looking to officially remove the dollar from its reserve status and to re-introduce gold into the global monetary system – without triggering WW3. Of course, this would explain the Obama Government’s recent military belligerence toward both countries…

Dennis Gartman, among many others, has expressed anxiety over the net short position in gold futures by the “commercial trader segment” bullion banks per the Commitment of Traders report. The fear is that the banks are getting ready to attack the price of gold with another hedge fund “long liquidation” operation. This, of course, is a trading pattern in the precious metals that we have become accustomed to enduring since the bull market began in 2000/2001. Obvious manipulation that for some reason seems to be undetectable by the Government regulators (CFTC) who are paid by the Taxpayers to enforce laws.

I looked at some statistics from the COT data that goes back to 2005 (compiled assiduously by one of the partners in the investment fund I co-manage). While the net short position in gold futures held by the bullion banks, 240,121 per the latest COT report, is quite a bit higher than the average net short over the period (-161,781), it’s not even close to the highest net short of -308,231 in December 2009 or -302,740 in September 2010. In 2009, gold sold off for a bit after that -308k reading but in 2010 gold continued higher toward $1900 after the -302k reading.

The point here is that the relative net short position held by the criminal bullion banks is not necessarily the best predictive metric with which to forecast the next move in the price of gold. Furthermore, it’s quite possible that the physical gold market activities being conducted by China and Russia will act as a counter-force to the manipulation efforts exerted by the western Central/bullion banks.

I have argued for years that traditional chart and t/a analysis applied to the precious metals is thoroughly useless because of the high degree of intervention by the Central and bullion banks.

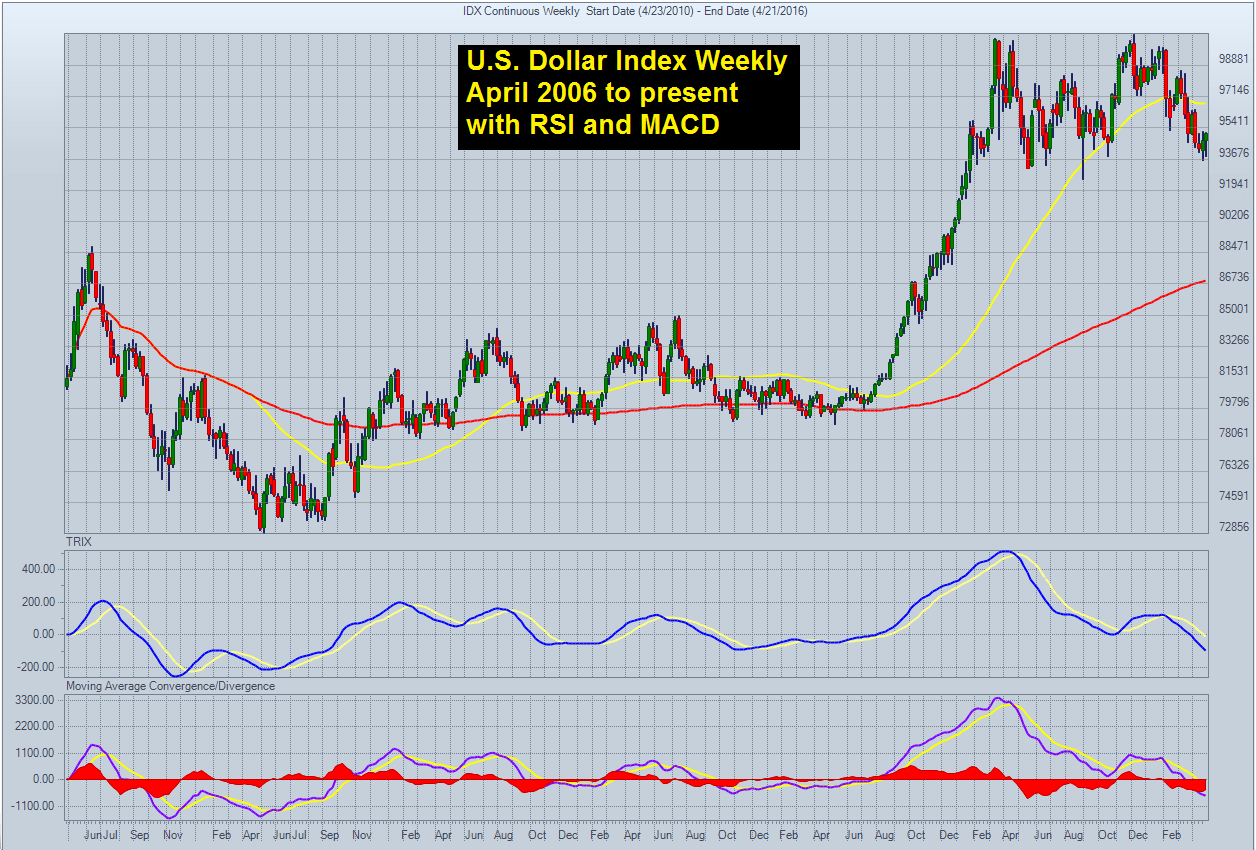

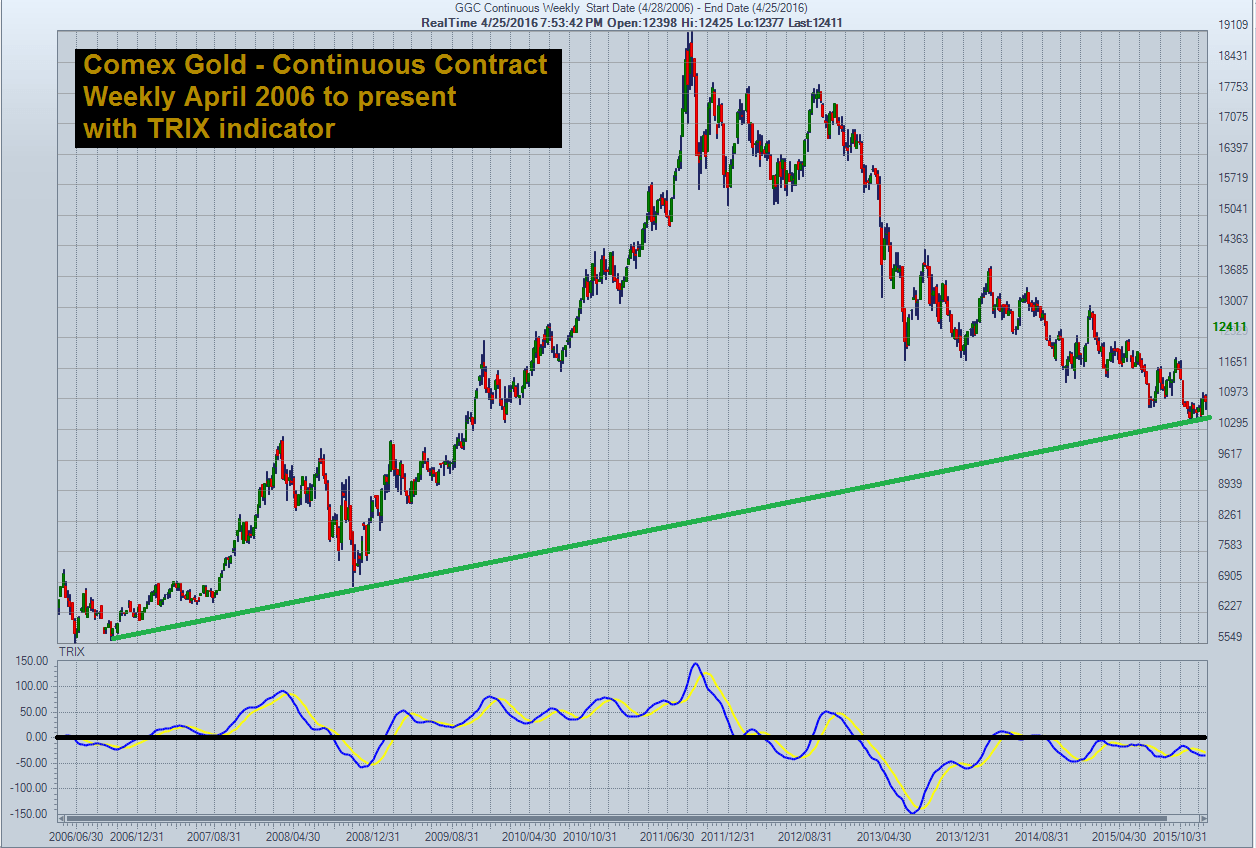

With that reservation about using charts, I wanted to present a couple charts of gold and one of the dollar because, in my view, gold is potentially set up for a monster move higher and the dollar appears to be potentially headed off the proverbial cliff (click on images to enlarge):

The first graph above is a 10-yr weekly of gold. You can see that over this time period, the price of gold is still exceedingly “oversold” per the TRIX indicator. The second graph above is a 1-yr daily which shows that gold has been “oscillating” laterally in a consolidation formation. It’s brushing up against its 50 dma (yellow line). Of course, at this point, the price of gold could “break” either way, higher or lower. Perhaps even a quick trip down to its 200 dma (red line). Having said that, the longer term graph of gold, combined with the massive demand for physical gold from Russia and China, suggests that every manipulated price hit should be aggressively bought. You can see the dollar (lower left graph) is positioned treacherously, as it has traded well below its 50 dma and could be headed lower. Certainly the ongoing economic and political deterioration of the United States is not giving anyone a reason to buy dollars.

There’s been a lot of “chatter” about whether or not the mining shares, which have had a tremendous run since mid-January, are “overbought.” The general consensus is that the mining shares are due for a pullback and I know a lot of my subscribers are hesitant to buy right now. My view is that, in the context of the brutal beating inflicted on the miners since March 2011 by overt manipulative forces – from both official entities and predatory hedge funds – it’s impossible to determine a true measure of “overbought” because the mining shares have been oversold for nearly five years.

I’m in an email group with a very impressive roster of precious metals investment and analytic professionals. One of them who is rather well-known made this comment today, which I thought summed up the situation perfectly: Now everybody is desperately waiting on the sideline to build up a first position in gold, silver and miners, but nobody wants to buy into the rally, but rather buy into a correction… that’s why I am convinced, that every bigger dip will be bought and gold might head to 1,400-1,500 by year end!