Iconix Brand Group, Inc. (NASDAQ:ICON) is set to report first-quarter 2018 results on May 4, before the market opens. The company has a mixed record of earnings surprises in the trailing four quarters. While the company has been benefiting from a wide array of retail partnerships and strong international operations, its men’s and home segments have been posing concerns for a while. Bearing these aspects in mind, lets delve into how things are shaping up for the upcoming quarterly release.

Factors Likely to Impact Q1 Performance

Iconix has over 50 direct to retail partnerships and more than 400 licensees worldwide with several retail giants like Kohl’s (NYSE:KSS) and Macy’s (NYSE:M) . Such wide-spread business network provides adequate scope for the company to expand. Moreover, launch of the Starter brand in 2017 and the multi-year agreements with Umbro and Target (NYSE:TGT) , depict the company’s dedication toward developing long-term partnerships.

With a wide array of retail partnerships, Iconix is also well placed for expanding its international footprint. In this respect, the company has been undertaking efforts to strengthen its footprint in Canada. Evidently, it purchased the remaining 50% interest in Iconix Canada from its joint-venture partner in 2017. Besides this, the company has international joint ventures in China, Latin America, Middle East, Europe and Asia. Owing to such efforts, revenues in the international segment grew 10%, 4% and 3% in the fourth, third and second quarters of 2017, respectively. Going ahead, the company is expected to continue expanding the international footprint.

However, Iconix has long been battling softness in Men's and Home segments. In fourth-quarter 2017, sales at the Men’s category declined 30%, while revenues from the Home segment dipped 6%. These factors also marred net revenues by 11% in the last reported quarter. Such headwinds are likely to continue in the first quarter and dent the company’s overall performance. As a result, the Zacks Consensus Estimates for the impending quarter reveals a dismal picture. The consensus mark for earnings for the quarter under review is currently pegged at 9 cents, down almost 57% from the year-ago quarter. This estimate has remained stable over the past 30 days. Also, analysts polled by Zacks expect revenues to decline close to 15% year over year to $50 million.

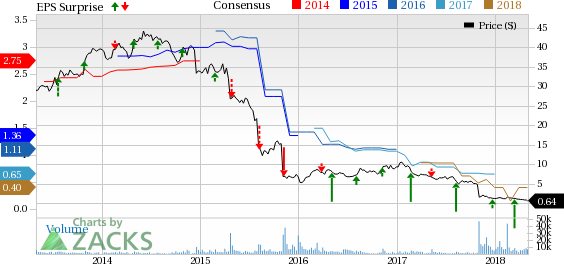

Iconix Brand Group, Inc. Price, Consensus and EPS Surprise

That said, lets take a look at what the Zacks Model reveals regarding Iconix for the upcoming earnings release.

Zacks Model

Our proven model does not show that Iconix is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Iconix currently has an Earnings ESP of 0.00%. Although the company’s Zacks Rank #2 increases the predictive power of ESP, we need a positive Earnings ESP in order to be confident about an earnings surprise. You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Target Corporation (TGT): Free Stock Analysis Report

Macy's, Inc. (M): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Iconix Brand Group, Inc. (ICON): Free Stock Analysis Report

Original post

Zacks Investment Research